Elon Musk’s net worth has fallen below $400 billion as Tesla (TSLA) stock tumbles in 2025 amid growing concerns over the EV giant’s future. As of February 12, the Bloomberg Billionaires Index reported Elon Musk’s net worth at $379 billion, marking a decline of $53.7 billion since the start of the year. Musk’s wealth reached an all-time high in December when he became the first person to surpass a $400 billion net worth. This figure peaked at $486.4 billion on December 17, fueled by the $350 billion valuation of SpaceX.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

TSLA stock has dropped 27% from a high point of $480 in December 2024 and is down 12% year-to-date to $356 as of writing. Interestingly, 60% of Musk’s net worth comes from his Tesla stock holdings and options.

Here are some factors contributing to Tesla’s stock decline.

Musk’s Political Stance Fails to Inspire Investor Confidence

The majority of TSLA stock’s decline in 2025 is linked to Musk’s political involvement, including his financial backing of U.S. President Donald Trump and his increasing influence in European politics. Meanwhile, his outspoken support for far-right causes on his platform X has often sparked significant controversies.

Additionally, Musk’s new role leading the DOGE department in the Trump administration has raised concerns about his shifting focus away from Tesla. Notably, the DOGE (Department of Government Efficiency), led by Musk, was established through one of Trump’s executive orders to enhance government efficiency.

Tesla’s Sales Slump Hits Hard

In addition to political turmoil, Tesla’s stock faced pressure from declining sales in Europe and China. Sales in Europe dropped 13% in 2024, driven mainly by sharp declines in Germany (59%) and France (63%). The situation in China was equally challenging, with Tesla’s sales of locally made EVs falling 11.5% in January amid growing local competition.

Not to forget, Tesla’s Q4 earnings report fell short of expectations, with an 8% year-over-year decline in automotive sales.

Wedbush Analyst Stays Confident in Tesla

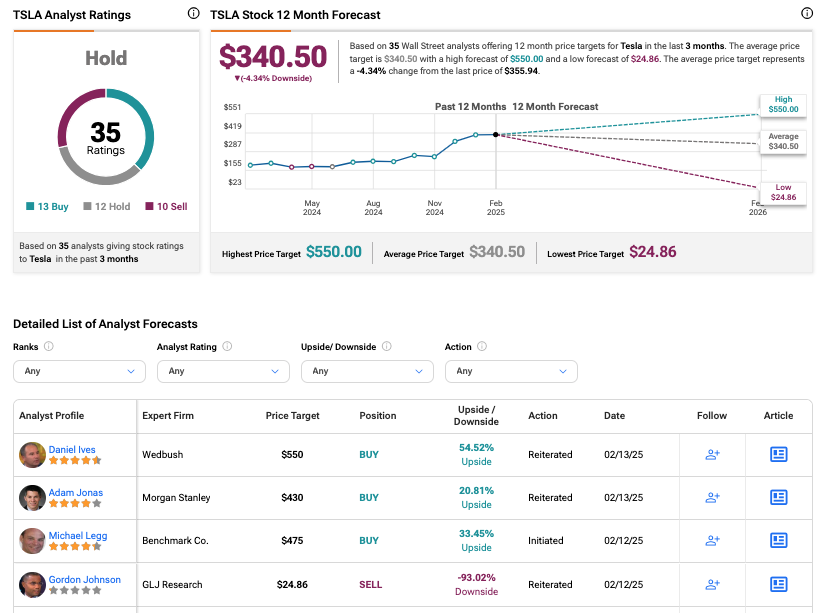

Turning to the positives, Wedbush analyst Daniel Ives reiterated his Buy rating on TSLA recently, predicting a 63.4% upside. A long-time supporter of Tesla, Ives believes Musk’s focus on the DOGE initiative won’t deter the company’s growth. He points to Tesla’s affordable EVs, autonomous vehicle development, and the potential of humanoid robots as key catalysts for future success.

Is Tesla Stock a Buy, Sell, or Hold?

On Wall Street, TSLA stock carries a Hold consensus rating based on 13 Buy, 12 Hold, and 10 Sell ratings assigned in the past three months. TSLA’s average share price target of $340.5 implies a 4.34% downside from the current levels.