I was bullish on NIO (NIO) stock some years ago, but I never anticipated its path to profitability would be so challenging. The firm’s delivery figures have improved notably over the past 12 months, but this is becoming an incredibly competitive industry. Even the dominant manufacturers are experiencing sales or margin pressures, which is core to my bearishness. NIO would need to massively outperform to become sustainable. Moreover, NIO’s cash burn has forced heavy reliance on external financing, with billions raised in share dilutive convertible notes and equity offerings.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

NIO’s Deliveries Catch Up With Peers

NIO’s recent delivery growth shows signs of catching up to industry peers. The company reported 13,863 vehicle deliveries in January 2025 – a 38% year-over-year increase – split between its premium NIO brand and mass-market Onvo line. This dual-brand strategy appears pivotal, with Onvo accounting for 43% of January deliveries. The upcoming Firefly subcompact brand, launching in April 2025 with a $21,300 entry price, has exceeded order expectations and could add 50,000 annual deliveries.

Cumulative deliveries reached 685,427 vehicles through January 2025, demonstrating some scaling progress. However, NIO continues to trail market leaders BYD (BYDDF) and Tesla (TSLA), each delivering over 1.5 million vehicles annually—partly due to pandemic-era hangovers.

January’s results suggest improved execution. The company must maintain momentum through Firefly’s launch and Onvo’s production stabilization to close the gap with competitors, which may prove very difficult.

NIO’s Fundamental Issue

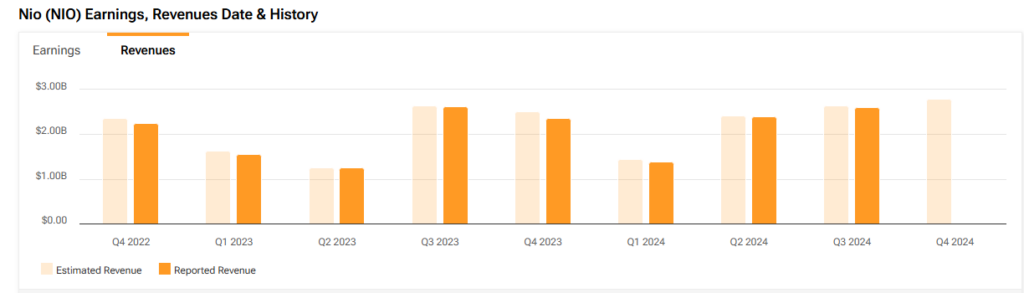

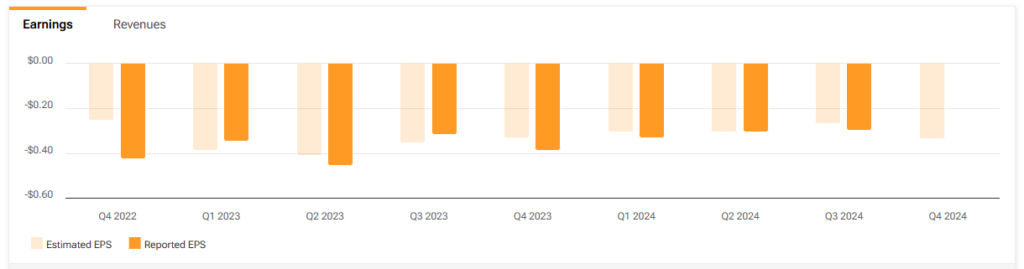

Despite the improving deliveries, NIO’s financial position remains precarious, with no clear path to profitability. This is a core part of my bear case. The company reported a $710 million net loss in Q3 2024, up marginally year over year, while revenue actually fell. Full-year 2023 losses hit $2.9 billion despite 47% revenue growth.

While gross margins improved from 8% to 10.7% between Q3 2023 and 2024, this trailed Tesla’s 17.6% and BYD’s 18.1%. The capital-intensive battery-swap network—now exceeding 2,300 stations—continues draining resources without demonstrating a clear competitive advantage over Tesla’s Supercharger network.

NIO’s cash burn forced heavy reliance on external financing, with $2.6 billion raised in 2023 through convertible notes and equity offerings. Management’s 2025 target of 440,000 deliveries would require doubling the 2024 volume, demanding perfect execution of Firefly’s European expansion while navigating protectionist tariffs.

With R&D and SG&A expenses consuming 34% of revenue and aggressive brand expansion tripling addressable markets, NIO risks spreading resources too thin. Until the production scale matches Tesla/BYD levels or premium pricing power materializes, losses appear structural rather than transitional.

A Closer Look at NIO’s Cash Burn

NIO’s cash burn persists despite modest margin improvements, with Q3 2024 showing a sizable net loss despite 13.1% vehicle margins. The company’s $5.29 billion cash reserve provides approximately eight quarters of operational time at current burn rates.

However, this assumes no further capital raises and doesn’t consider the impact of servicing its existing debt. Analysts have noted reduced uncertainty as NIO met loss estimates for the first time in three years, potentially easing investor concerns about financial predictability.

NIO’s Valuation Screams Wait

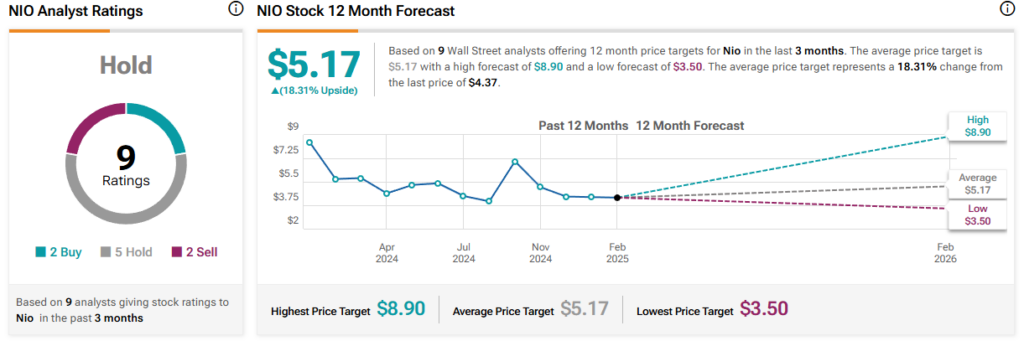

Central to my bearishness is the valuation. NIO trades with speculative valuations, with a ~$9 billion market cap against $5 billion debt and no meaningful P/E ratio until 2027’s projected 33.1x. While analysts project 20-38% annual EPS growth through 2026, profitability remains contingent on executing 2027 targets, requiring flawless scaling of Firefly/Onvo brands and European expansion.

Earnings expectations for March 11, 2025, include a $0.33 per-share loss and $2.76 billion revenue, with three recent EPS estimates and downgrades signaling palpable skepticism.

Is NIO a Buy, Sell, or Hold?

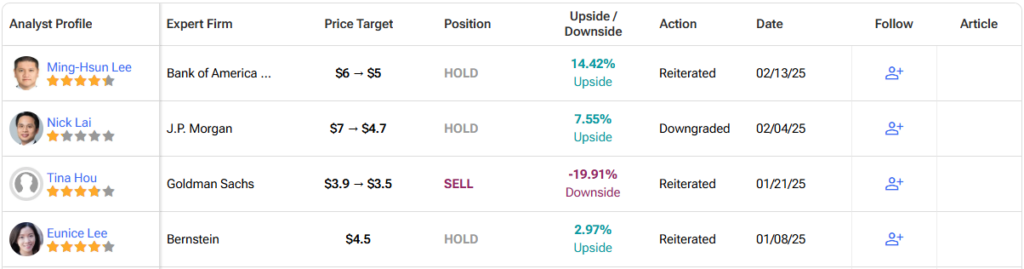

On Wall Street, NIO stock has a consensus rating of Hold based on two Buy, five Hold, and two Sell ratings over the past three months. NIO’s average price target of $5.17 per share implies approximately 18% upside potential over the next twelve months.

NIO’s Delivery Growth Issues Unmasked

I’m bearish on NIO despite strong delivery growth because profitability remains elusive. Heavy cash burn, persistent losses, and costly expansions strain finances, while valuation depends on the flawless execution of Firefly and Onvo launches. NIO’s dual-brand strategy shows promise, but scaling issues, weak margins, and significant competition from Tesla and BYD create formidable obstacles. With limited runway and mounting debt, NIO must deliver extraordinary results to justify its speculative valuation. For now, the risks far outweigh the potential rewards.