Energy powers the world, and the ongoing rise in global demand solidifies a strong, long-term foundation for energy stocks.

So, let’s focus on energy – particularly clean energy. As the cornerstone of the green economy, clean energy offers two distinct benefits: it’s renewable and produces fewer pollutants compared to traditional fossil fuels. On top of this, green and renewable energy stocks have an additional advantage – governmental commitments that ensure long-term support for the sector.

The bottom line is, we’re in the midst of a transition that will affect the whole of the global economy, towards a greater reliance on clean energy that will open up a wide range of investment opportunities. Those opportunities have caught the eye of William Blair analyst Jed Dorsheimer, who has taken a deep dive into the clean energy sector.

Dorsheimer, who is rated by TipRanks among the top 2% of Wall Street’s analysts, brings our attention two major names in the clean energy sector, Tesla (NASDAQ:TSLA) and Enphase (NASDAQ:ENPH), and recommends one as the superior stock in current conditions, while advising caution on the other. We’ve opened up the TipRanks platform to see how Dorsheimer’s calls compare to broader Wall Street views on both. Let’s take a closer look.

Tesla

Tesla, Elon Musk’s pioneering electric vehicle company, stands as one of the 21st century’s most great success stories. It’s the only pure-play EV manufacturer, founded in the 2000s, to achieve sustained profitability and mass-scale production in the American market. After launching its first vehicles into regular production in 2008, Tesla has been consistently profitable since 2020. Despite recent dips in its stock price, the company boasts a market cap of $683 billion, making it not only the world’s largest EV maker by a significant margin but also the largest automaker overall.

While the cars may have made Tesla famous, and are bringing in most of the bacon, the fastest growing segment of the company’s business is its energy operations. Tesla’s Energy segment was started in 2015, when Musk had another of his brainwaves – that the battery technology his company had developed for the cars could be adapted to the home energy storage market. Tesla Energy produces the Powerwall battery system, designed for the residential market, to store energy produced by home solar installations or even just taken from the grid. The Powerwall will provide power to the home in the event of an outage or supplement if grid power is insufficient. Tesla also produces photovoltaic panels for home installations, putting it in a position to provide residential power alternatives in both generation and storage.

In its last quarter, 2Q24, Tesla deployed approximately 9.4 GWh of its energy storage products, marking a company record for such quarterly deployments. Also, in the second quarter, Tesla’s energy generation and storage revenue exceeded $3 billion, registering 100% year-over-year top-line growth for the business segment – and making energy generation and storage the fastest-growing component of Tesla’s overall business.

Overall, Tesla brought in $25.5 billion in Q2, for a modest 2.3% year-over-year increase. The top line also beat the forecasts by $760 million. At the bottom line, the non-GAAP EPS came to 52 cents; while profitable, this missed the estimates by ten cents per share.

For top analyst Dorsheimer, the energy business is the ‘underappreciated’ gem in Tesla’s operations portfolio.

“We view Tesla Energy as the most underappreciated component of the Tesla story and expect the narrative will shift toward the energy storage business in light of tempered EV expectations in the near term. The three key drivers for energy storage are grid stabilization, the data center buildout, and renewables integration. Tesla’s Megapack and Powerwall are industry-leading products and serve as our coverage focus. Combined with the auto business and longer-term opportunities like AI, robotaxi, and robotics, we see Tesla as a technology leader with an Apple-esque ecosystem for the future of energy,” Dorsheimer opined

“We believe the halo effect created by Musk, the company’s culture of first principles, and the technology advantages it has established warrant its significant valuation premium,” Dorsheimer summed up.

These comments support Dorsheimer’s Outperform (i.e. Buy) rating on Tesla stock, although he has not set a price target yet. (To watch Dorsheimer’s track record, click here)

Overall, Dorsheimer’s prospects don’t appear too favorable amongst Wall Street’s analyst corps right now. Based on 14 Holds, 10 Buys, and 7 Sells the stock has a Hold (i.e. Neutral) consensus rating. Priced at $212, the shares are expected to stay rangebound for the time being, given the average price target of $211.46. (See TSLA stock forecast)

Enphase Energy

Next up is Enphase, one of the leaders in the US residential and commercial solar installation market. The company can build out solar installations at small and medium scales, customized to match the size and design features of the customer’s building. Enphase offers everything needed for these installations, including solar panels, vital power inverter units, storage battery systems, and even smart home power management systems.

Enphase is a remarkable company, and has demonstrated solid long-term growth over the last decade or more. The company was founded in 2006, and in 2009 returned a modest revenue total of just over $20 million – and by 2023, that revenue total had grown to an impressive $2.29 billion. From that top-line number, Enphase generated a solid free cash flow of $586.4 million, an indication of the company’s overall efficiency in operations.

The home solar industry is highly cyclical, however, and Enphase is currently facing a period of headwinds. Revenues have been declining in recent quarters, and this was clearly visible in the last report, covering 2Q24. Enphase showed a top line of $303.5 million, missing the forecast by almost $6.2 million and falling more than 57% year-over-year. The company’s earnings also missed; at 43 cents per share in non-GAAP measures, the EPS was 5 cents per share less than had been anticipated.

In coverage of Enphase, William Blair’s Dorsheimer takes a cautious approach, noting: “Enphase shares have been buoyed from a low of $75 to current levels of $122 largely on a call of the bottom by Enphase management. This has come in the form of inventory drawdown in its distribution channel, which the company has now said is at normal levels. However, the question is, will a recovery be V-shaped recovery, which would be measured in less than a year, or more of a muted U shape, measured longer than a year? With the shares trading at 30x our adjusted 2025 EPS estimate of $4.08, we believe a V-shaped recovery is baked into the stock. Therefore, any signs that a recovery is U-shaped add downside risk to the shares, in our opinion.”

Bottom-line, Dorsheimer rates ENPH shares a Market Perform (i.e. Neutral) without providing a fixed price target.

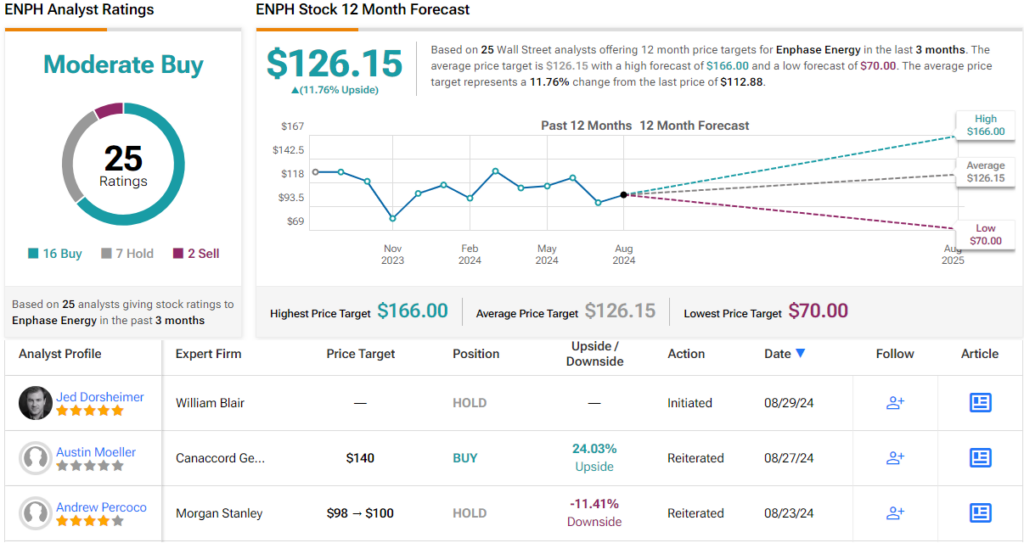

The rest of the Street does have an idea of where ENPH’s share price is heading. The average target currently stands at $126.15, indicating a ~12% upside from current levels. On the rating side, ENPH’s Moderate Buy consensus rating is based on a mix of 16 Buy recommendations, 7 Holds, and 2 Sells. (See ENPH stock forecast)

And there you have it – for Blair’s top analyst Jed Dorsheimer, Tesla is clearly the better clean energy stock for investors to buy right now. However, the rest of Wall Street might beg to differ.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.