Tesla (TSLA) has opened a new manufacturing plant in Texas and has big plans for it. The opening of the Texas factory, in which the company invested more than $1 billion, follows the recent inauguration of the company’s European manufacturing hub, dubbed the Giga Berlin in Germany.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

According to a Reuters report, Tesla will initially produce the Model Y SUV at the Texas facility, and aims to manufacture as many as 500,000 units annually. The company also plans to start producing the Cybertruck pickup and Roadster sports sedan at the factory next year. Beyond cars, Tesla also plans to use the facility to build its Optimus humanoid robot.

Tesla is working to expand its production capacity as demand for electric vehicles continues to grow. With the Texas and Berlin facilities now open, Tesla next plans to expand its existing production plants in California and Shanghai, China. The company targets to increase its annual deliveries by 50% over the coming years.

Tesla’s Self-Driving Software Test Expands

Tesla CEO Elon Musk said at the Texas factory inauguration that the company would later this year open its full self-driving (FSD) software testing to all subscribers in North America, Reuters reported. The FSD feature costs $12,000. Musk also said Tesla would launch robotaxis.

Wall Street’s Take

Wedbush analyst Daniel Ives recently reiterated a Buy rating on Tesla with a price target of $1,400, which indicates 32.4% upside potential.

The rest of the Street is cautiously optimistic about the stock, with a Moderate Buy consensus rating. That’s based on 15 Buys, five Holds, and six Sells. The average Tesla price target of $1,005.64 implies 4.9% downside potential from current levels. Shares have increased 55% over the past year.

News Sentiment

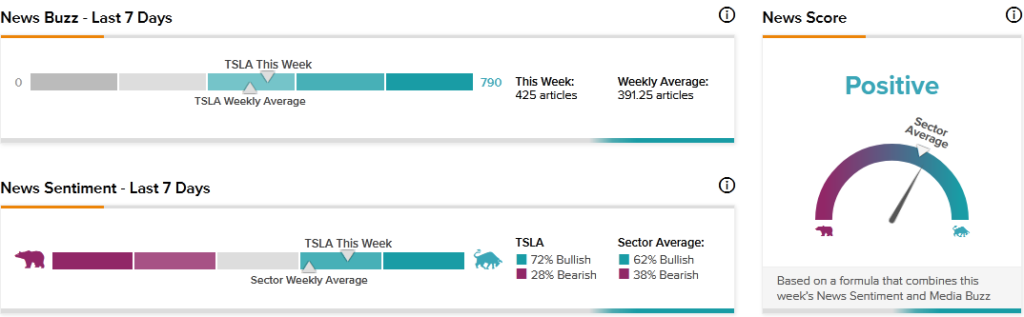

TipRanks data shows that the News Score for Tesla is currently Positive based on 425 articles published over the past seven days. Notably, 72% of the articles have a Bullish Sentiment compared to a sector average of 62%, while 28% of the articles have a Bearish Sentiment compared to a sector average of 38%.

Key Takeaway for Investors

The manufacturing capacity expansion is important for Tesla to grow and defend its share of the electric vehicle market. The expanded capacity could unlock economies of scale that would enable Tesla to sell more affordable cars, which could help it stop the GM-Honda alliance that seeks to dethrone it as the global electric vehicle market leader.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Murphy Oil Corporation Bumps up Quarterly Dividend by 17%

Uber to Expand Scope in the UK After License Win

Should Investors Seeking Upside Dive in DigitalOcean?