EV giant Tesla (TSLA) rallied 14.8% yesterday, outperforming the S&P 500’s (SPX) 2.5% gain. The upside came after Donald Trump, who received substantial support from TSLA CEO Elon Musk, won the U.S. elections. Investors believe a Trump win could be beneficial for the electric vehicle maker, as his policies may provide a boost to the company’s growth and outlook. Also, Tesla released mixed Q3 results last month and provided a positive outlook. Tesla forecasted modest growth in vehicle deliveries for 2024. Given this context, it’s a good time to examine who owns Tesla.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

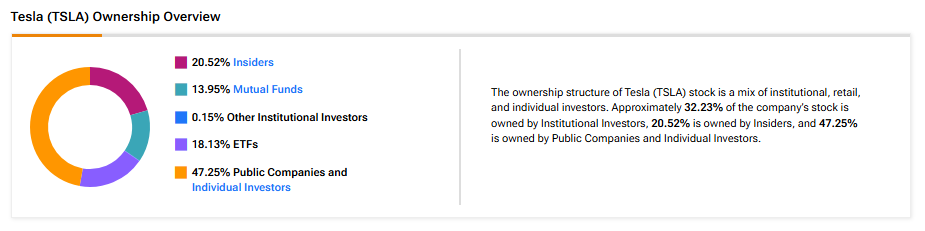

Now, according to TipRanks’ ownership page, public companies and individual investors own 47.25% of TSLA. They are followed by insiders, ETFs, mutual funds, and other institutional investors, at 20.52%, 18.13%, 13.95%, and 0.15% respectively.

Digging Deeper into TSLA’s Ownership Structure

Looking closely at top shareholders, Musk owns the highest stake in Tesla at 20.5%. Next up is Vanguard, which holds a 6.64% stake in the company.

Among the top ETF holders, Vanguard Total Stock Market ETF (VTI) owns a 2.69% stake in TSLA stock, followed by Vanguard S&P 500 ETF (VOO) with a 2.27% stake.

Moving to Mutual Funds, Vanguard Index Funds holds about 5.85% of Tesla, whereas Fidelity Concord Street Trust owns 1.45% of the stock.

Is TSLA a Buy Now?

Turning to Wall Street, TSLA has a Hold consensus rating based on 11 Buys, 16 Holds, and eight Sells assigned in the last three months. At $207.83, the average Tesla price target implies a 27.97% downside potential. Shares of the company have gained about 62.27% in the past six months.

Conclusion

TipRanks’ Ownership tool provides TSLA ownership structure by category, enabling investors to make well-informed investing decisions.