Chinese tech conglomerate Tencent Holdings Limited (HK:0700) reported an 82% year-over-year increase in the Q2 profit attributable to shareholders to ¥47.63 billion, driven by its thriving Gaming unit. The company continued its growth trajectory of higher quarterly revenue for the sixth time in a row. In the second quarter, revenue grew by 8% to ¥161.1 billion, beating the consensus of ¥160.7 billion.

Tencent shares have lost 1.27% in today’s trading session. Year-to-date, the stock has grown by 26.03%.

Tencent Holdings is a technology company offering digital entertainment and internet services to over 1 billion customers.

Gaming and Ads Fuel Tencent’s Earnings

Among Tencent’s segments, revenue from domestic games rebounded, rising 9% to ¥34.6 billion. Meanwhile, international games revenue also climbed 9% to ¥13.9 billion. Tencent saw a boost in sales from its popular game Valorant and the release of new titles.

The company highlighted that its newly launched Dungeon & Fighter Mobile (DnF) has reconnected with millions of IP (intellectual property) fans. The game engaged players effectively, setting it up to become Tencent’s next long-term successful title.

Additionally, Online Advertising revenue increased by 19% year-over-year to ¥29.9 billion, driven by WeChat Channels, which is a space for short-form videos. In comparison, Fintech revenue registered a modest growth of 4% to ¥50.4 billion due to sluggish consumer spending and a drop in revenue from consumer loan services.

Meanwhile, Tencent has completed 60% of its share buyback target of HK$100 billion for 2024.

Is Tencent Stock a Buy?

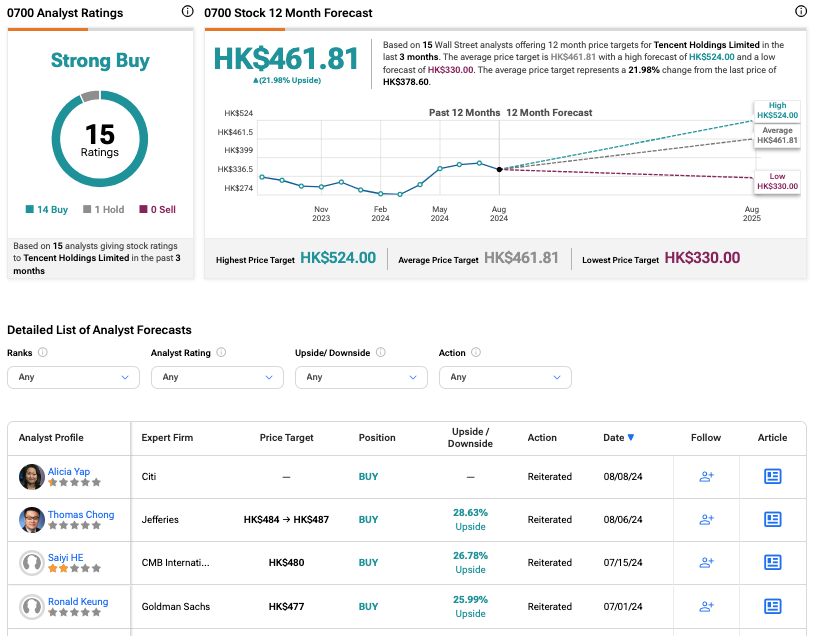

According to TipRanks, 0700 stock has received a Strong Buy consensus rating, backed by 14 Buys and one Hold recommendation. The Tencent share price forecast is HK$461.81, which implies an upside of 22% on the current trading level.