Shares of TaskUs, Inc. (TASK) jumped over 4% in pre-market trading on Wednesday after the company reported robust debut second-quarter earnings results since its IPO in June this year.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

TaskUs is an outsourcing service provider to the fastest-growing companies globally. Currently, the company has a market capitalization of about $3.1 billion.

The company reported adjusted earnings of $0.32 per share that almost doubled year-over-year compared to earnings of $0.18 per share in the prior-year period. Results were in line with the consensus estimate. (See TaskUs stock charts on TipRanks)

Additionally, revenues jumped 57.4% year-over-year to $180 million compared to $114.4 million in the prior-year quarter.

In other positive news, the adjusted EBITDA margin grew 140 bps year-over-year to 24.5% during the quarter.

TaskUs CEO Bryce Maddock commented, “We welcome our public shareholders as we build on this momentum and continue to support the most innovative technology companies to protect and grow their brands.”

Based on strong Q2 results, the company provided guidance for the third quarter and full-year 2021. Full-year revenues are forecast to be in the range of $705 to $709 million in 2021, representing year-over-year growth of 47.9%. Furthermore, the company expects an adjusted EBITDA margin range of 23.7% to 24.1%.

For Q3, revenues are expected to be in the range of $182 – $186 million. Additionally, the company forecasts adjusted EBITDA margin to be in the range of 23.1% – 23.5%.

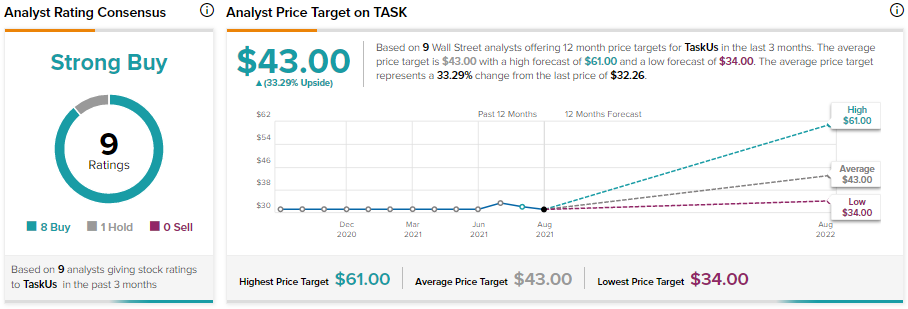

Robert W. Baird analyst David Koning recently reiterated a Buy rating on the stock with a price target of $40 (24% upside potential).

Koning forecasts the company to report earnings of $0.17 per share for the third quarter of 2021.

Overall, the stock has a Strong Buy consensus rating based on 8 Buys and 1 Hold. The average TaskUs price target of $43 implies 33.3% upside potential from current levels.

Related News:

Bentley Systems Posts Q2 Beat and Raises Guidance; Shares Pop 5%

Senseonics Holdings Misses Q2 Earnings, Shares Down 8%

SmileDirectClub Posts Q2 Miss; Shares Fall 13% After-Hours