With major indices hovering near all-time highs and robust growth across the board, investing in struggling industries requires a particularly strong fortitude. For Electric Vehicle (EV) makers, the expectation is that future profits will outweigh the poor returns seen today.

Rivian (NASDAQ:RIVN) is no exception, with its shares plummeting nearly 40% in 2024 alone. The most pressing issue is the company’s alarming cash burn rate, losing over $30,000 on every vehicle it delivers.

However, the company has been clawing its way back from a historic low point in April, with bulls pointing to several reasons for optimism. These include the announcement of a joint venture with Volkswagen that could be worth up to $5 billion, a marked improvement in operating and production efficiencies, and the expected launch of the R2 midsize SUV in 2026. Moreover, the company’s management has re-affirmed its commitment to reaching positive margins per car by the end of the current year.

But are these developments enough to attract new investors? JR Research remains skeptical.

“RIVN is still rated ‘F’ for profitability, underscoring its fundamentally weak proposition,” writes the 5-star investor, who is in the top 1% of TipRanks’ stock pros.

While enhanced efficiencies and increased production could change the outlook for Rivian, JR Research has yet to see sufficient evidence that the company is up to the challenge.

The investor is especially dubious about the company’s ability to deliver profits, pointing out that “Wall Street’s projections suggest negative FCF margins through the FY2028 forecast period.”

This is especially concerning given the growing competition from both legacy manufacturers and newer players, notes JR Research.

“A more competitive environment could impede Rivian’s growth prospects, hindering its ability to accelerate its FCF profitability,” writes the investor.

JR Research is therefore adopting a wait-and-see approach, and will be looking at the firm’s upcoming execution and ability to deliver profits. For now, though, the investor urges caution.

“I assess Rivian’s FCF unprofitability as a critical impediment to a more robust re-rating,” concludes the investor. As a result, JR Research rates RIVN shares a Hold (i.e. Neutral). (To watch JR Research’s track record, click here)

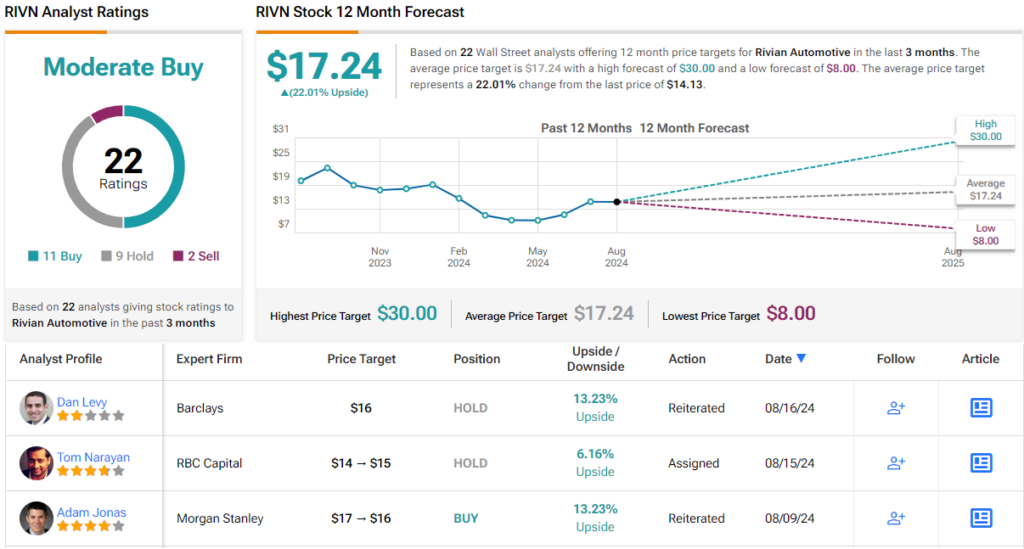

On the whole, Wall Street seems a bit more upbeat about Rivian. Out of 22 analyst recommendations in the last 3 months, 11 are Buys, 9 are Holds, and 2 are Sells, giving Rivian a Moderate Buy consensus rating. The average 12-month price target of $18 suggests a 22% upside for the next 12 months. (See RIVN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.