The world’s leading chipmaker, Taiwan Semiconductor Manufacturing Company (TSM), or simply TSMC, reported another strong performance for the June quarter. The company delivered solid results across the board, raised guidance for Q3, and is well-positioned to continue benefiting from the AI boom. This strengthens my bullish outlook on TSMC, though with some caution due to ongoing geopolitical risks.

These risks help explain why TSMC’s valuation multiples aren’t sky-high. While TSMC remains a fundamentally strong long-term investment, its significant political exposure means an extra dose of caution is warranted.

TSMC’s Q2 Earnings Review

In the June quarter, TSMC delivered another outstanding performance, beating both top- and bottom-line expectations. This marks the 12th consecutive quarter of the company exceeding EPS forecasts. For Q2, TSMC reported EPS of $1.47, surpassing the consensus of $1.41 and coming in nearly 30% higher than Q2 last year.

While TSMC’s track record for beating revenue expectations has been more erratic compared to earnings, the company reported $20.82 billion in Q2, against an expected $20.33 billion. This marks the second consecutive quarter of revenue exceeding expectations.

The strong performance is further highlighted by a 36.3% increase in net income and a 40% rise in revenues compared to the same quarter last year. With operating margins at an impressive 42.5%, TSMC stands out as one of the top performers among Big Tech giants in the Technology sector.

But the most exciting news from the quarter might be the guidance from the company’s management. Management is expecting strong results in Q3, fueled by high demand for smartphones and AI-related products, which should increase the need for TSMC’s technologies. For Q3, revenues are projected to be between $22.4 billion and $23.2 billion, with an operating profit margin expected to range from 42.5% to 44.5%.

Breaking it down by technology and platform segments, TSMC’s latest-generation 3nm (nanometer) technology has progressively increased its revenue share, representing 15% of total wafer revenue, up from non-existent in the same quarter last year. Similarly, 5nm technology has maintained its share above 35% for the second consecutive quarter. It’s worth noting that the smaller the nanometer, the more advanced the technology. The next generation, 2nm, is expected to arrive by 2025.

Looking at revenue by platform, the High-Performance Computing (HPC) segment accounted for more than half of revenues at 52%, driven by data centers supporting AI, with a 28% quarter-over-quarter increase. Smartphones were the second largest, accounting for 33% of total revenues, while other segments were in the single digits.

Cyclical Tailwinds on the Horizon

In addition to the growing demand driven by AI data centers for HPC, management’s expectations for a more solid Q3 and Fiscal 2024 are driven by a potential refresh in PCs and smartphones.

Take Apple’s (AAPL) iPhone, for example. Demand has been weaker than usual in recent quarters. Since TSMC is the primary supplier of Apple’s custom-designed chips, such as the A-series processors used in iPhones, it’s no surprise that TSMC’s Smartphone platform segment revenue fell 1% quarter-over-quarter.

However, at Apple’s developers conference (WWDC) in July, the tech giant announced that it would incorporate AI capabilities into its iOS 18, built around a new AI feature set. Some of these features will only be available on newer devices, which could drive a wave of upgrades from older iPhones to newer models. Out of the 1.5 billion iPhones in use worldwide, 270 million haven’t been upgraded in four years. Additionally, Apple announced AI-enhanced Macs and iPads earlier this year.

Given these developments, Apple expects to increase iPhone shipments by 10% this year compared to 2024. This potential increase in shipments could provide a significant boost to TSMC’s revenues.

Capital Spending Guidance Reviewed

The strong demand for AI highlights TSMC’s ongoing growth opportunities. This has made TSMC’s investment plans more predictable. In Q2, the company revised its CapEx guidance to $30 billion–$32 billion, up from the previous range of $28 billion–$32 billion.

This is great news for investors, as it suggests that TSMC has seen solid demand for its products and greater clarity on pricing. Lower CapEx can lead to improved cash flow, which can be used for other purposes, such as reinvesting in growth opportunities, strengthening the balance sheet, and increasing profit margins.

Therefore, this CapEx reduction should bring more confidence to investors regarding operating performance as the company targets gross profit margins of 53.5-55.5%.

TSMC Remains a High-Risk Stock

The biggest yellow flag for investing in TSMC is undoubtedly the geopolitical risk surrounding the company. Tensions between China and Taiwan, as well as U.S.-China relations, pose potential risks that could disrupt production and supply chains and lead to export restrictions, sanctions, and other barriers affecting TSMC.

Political comments, such as former President Trump suggesting that he might not defend Taiwan from a Chinese attack if re-elected, have recently impacted TSMC’s share price.

Because of these risks, TSMC’s relatively discounted valuation compared to other large-cap tech giants makes sense. The company trades at a forward P/E ratio of 24.4x, about 11% above its historical average over the past five years, but this is still cheaper than stocks like Nvidia (NVDA) at 42x forward earnings. Valuing geopolitical risk is always tricky, and this uncertainty complicates the bullish thesis for TSMC.

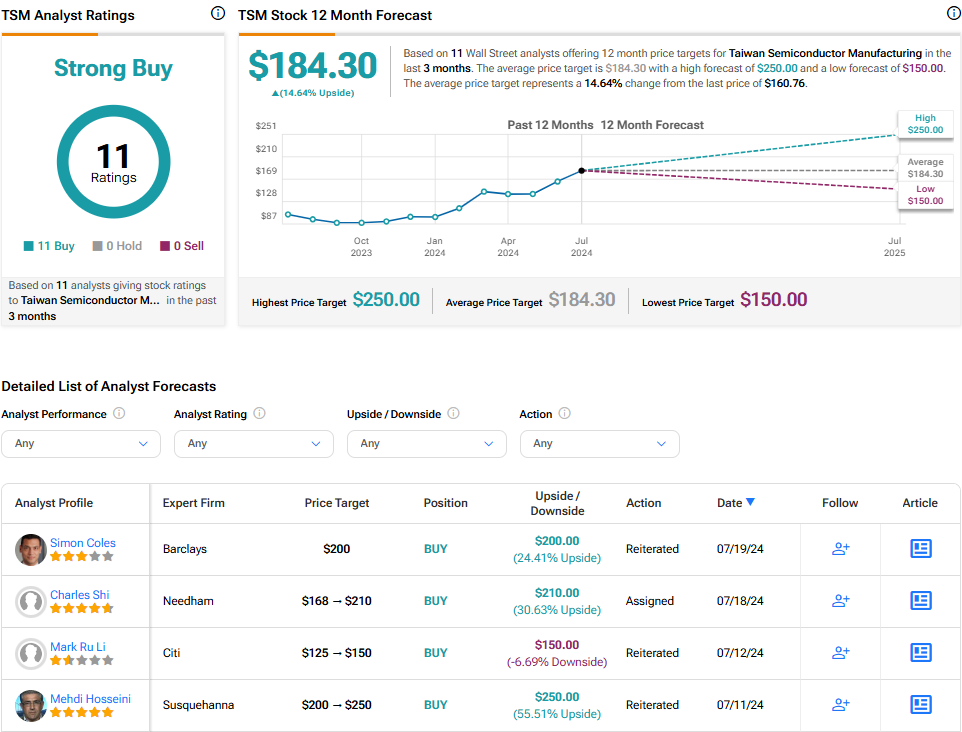

Is TSM Stock a Buy, According to Analysts?

Political risks and other potential concerns don’t seem to dampen the bullish outlook of Wall Street analysts covering TSMC stock. Every analyst is bullish on the stock, giving it a Strong Buy rating. Wall Street’s average price target for TSM stock is $184.30, which implies upside potential of 14.6% from the current share price.

The Takeaway

TSMC showcased impressive Q2 results, with strong revenue growth, excellent profit margins, improved guidance, and reduced CapEx projections. As a leading player in a booming industry, particularly with AI’s rising impact, the stock seems reasonably priced, making the investment case appealing.

However, geopolitical risk adds complexity to this bullish outlook. While this risk is significant and challenging to quantify, I remain cautiously bullish. The company’s solid fundamentals and favorable trends make its potential hard to ignore.