Typically, once you’ve had enough (fun or frustration) with a speculative enterprise like troubled semiconductor giant Intel (INTC), it’s usually best to part ways. However, the market still seems optimistic about INTC stock. If you still believe in the upside narrative, switching strategy may be more appropriate rather than outright abandoning any exposure at all.

Last month, I presented my Hold recommendation on the beleaguered chipmaker and nothing has fundamentally changed that opinion. When Intel disclosed its earnings report for the second quarter, investors rushed for the exits. Despite some positives, INTC stock crumbed under the weight of various headwinds, including fading revenue and profitability. Nevertheless, I believed that a risk-controlled bull call options spread could be profitable and that turned out to be accurate.

INTC stock has gained nearly 20% in the trailing month up to October 11. With management set to report Q3 earnings results in a few weeks’ time, it’s an interesting challenge to develop a trading approach on Intel at this stage. For investors comfortable with options, I believe that it’s time to consider switching from a debit-based options trade to a credit-focused approach.

Getting Some Extra Credit

Typically, retail investors are most familiar with the debit-based methodology of options. By paying a premium, you secure the right (but not the obligation) to buy the underlying security at the listed strike price in the case of a call option, or the right to sell at the strike price in the case of a put option. However, there are always two sides in derivatives market trading; if you’re buying an option, someone else is selling it.

Now, one of the beautiful aspects of options trading is that retail traders can participate in the credit side of the deal. Rather than paying a premium for the rights to secure a directional wager, you will instead receive the credit. Essentially you are being paid for underwriting the risk of potential future stock movements above the exercise price (for calls) or below the exercise price (for puts).

Of course, selling options (whether they be calls or puts) carries the risk of assignment. If the option goes into the money, the option holder can exercise the contract. That means the option seller (writer) must cough up either money or shares to the owner of the option that was sold. However, with an options spread — buying and selling the same-expiration option at different strike prices — you can still sell derivatives while simultaneously limiting your risk.

Examining the Bull Put Spread for INTC Stock

In my last article about INTC stock, I presented the benefits of the bull call spread. Here, we paid a debit on the wager that shares will steadily rise to reach a predefined price threshold by expiration. Specifically, INTC needed to hit $21 or higher by September 27 for the trade to achieve its maximum reward. The security ended the period at $23.91 so I was actually more conservative than I needed to be.

Moving forward, I’m not entirely sure that INTC stock has enough gas remaining for another robust move. At the same time, technical indicators give the impression that the market is still optimistic about the chipmaker’s chances. Therefore, a bull put spread may be appealing. With this strategy, we sell a put for income and simultaneously buy a put at a lower strike to cap off potential assignment risk.

Contextually, a bull put spread may be the best of both worlds. We’re not necessarily expecting INTC stock to soar, but rather for it not to collapse. And so long as it doesn’t collapse, we can collect a yield over a short time period.

Narrowing Our Intel Credit Spread

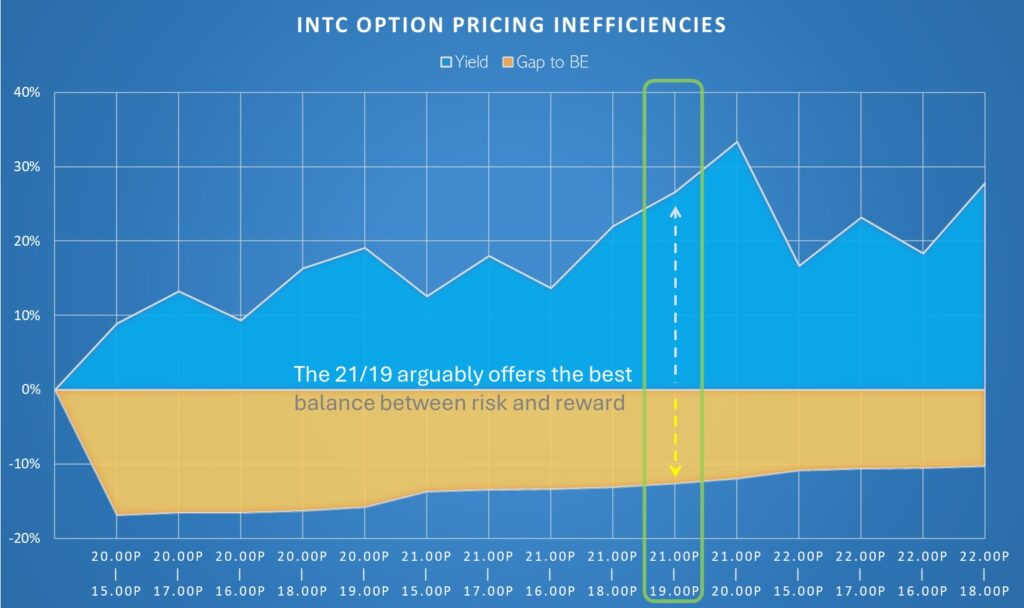

After deciding to go with a bull put spread, my next challenge is determining what specific options to select. For example, the options chain expiring November 15 features about 123 different contracts. That’s a lot of credit spreads to sift through. How can we decide which ones to choose? Fortunately, we can leverage option pricing inefficiencies in our favor.

Under a purely rational and efficient market, for each measure of risk we accept, we should receive a proportionately greater amount of potential reward. However, options market pricing is rarely perfectly efficient. In fact, for the November 15 bull put spreads, there’s only a 78.8% correlation between the underlying yield and the trade’s gap to the breakeven price. That leaves 21.2% of transactions that deviate from the expected risk-reward relationship.

With TipRanks options algorithm warning us about a 13.28% (plus or minus) anticipated move in INTC stock following Intel’s upcoming earnings disclosure, our bull put spread merits a large margin of safety. In my opinion, investors should consider the 21/19 put spread; that is, sell the $21 put and simultaneously buy the $19 put, both for November 15 expiry.

Dissecting the Income Play

Following Friday’s close, the bid on the short put stood at 75 cents while the ask on the long put landed at 33 cents. The difference between the two of 42 cents ($42 per contract) represents the maximum reward of this trade. INTC stock must be at or above $21 to collect the full credit. Should the trade go awry, the maximum loss would be $1.58 ($158 per contract). Significantly, the breakeven price is $20.58, leaving a safety margin of 12.65%.

To be sure, you can fully cover the potential 13.37% downside risk with the 21/16 put spread. Based on Friday’s pricing, the breakeven price would fall to $20.40, leaving a margin of safety of 13.41%. However, the yield for this trade would slip precipitously to 13.64%. The aforementioned 21/19 put spread would give you almost double the yield at 26.58%.

Frankly, a 27% yield at almost 13% margin to breakeven is about as good as it’s going to get for INTC stock.

Wall Street’s Take on Intel

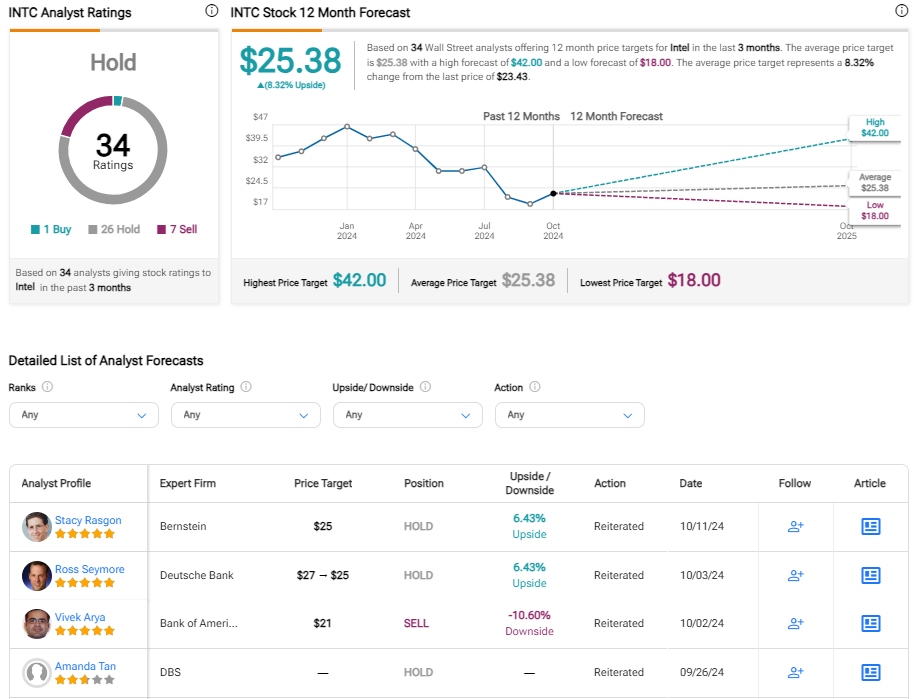

Turning to Wall Street, TipRanks classifies INTC stock as a Hold consensus rating based on one Buy, 26 Holds, and seven Sell ratings. The average INTC price target is $25.38, implying about 8% upside potential.

The Takeaway: Extract Big Yield Using INTC Stock

While Intel is struggling for credibility, INTC stock has been a surprisingly strong performer, advancing almost 20% in the trailing month. Though the overall trajectory might remain bullish, the intensity of the move could fade. Such a framework incentivizes a bull put spread, where traders can earn income so long as shares stay above predetermined levels. Thanks to options pricing inefficiencies, the 21/19 put spread arguably appears the most attractive.