Stock splits are often seen as a sign of confidence in a company’s growth, as they typically occur after significant increases in the stock price. When a stock split occurs, it does not dilute the ownership of shareholders. Instead, each shareholder receives additional shares in proportion to their current holdings, and the price of each share is adjusted accordingly. For instance, in a 2-for-1 split, shareholders will have twice as many shares, but each share will be worth half as much. The total value of their holdings remains unchanged.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

These transactions tend to have the desired result. The fact of the split attracts attention and generates headlines, while the lower stock price attracts new investors. The result is a positive spin for the company combined with a flow of new capital. And better yet, for investors, the historical data shows that, in the first 12 months post-split, the shares will outperform the S&P index by a wide margin.

The Street’s analysts keep a close watch on stock splits, and they are not shy about which ones they’ll recommend investors buy to reap the maximum rewards. Using the TipRanks database, we’ve taken a look at two major tech stocks with high prices and upcoming splits, Super Micro Computer (NASDAQ:SMCI) and Lam Research (NASDAQ:LRCX), and a dip into the analyst commentaries will tell us which one the Street picks out as the superior stock-split buy ahead of this week’s upcoming split activity.

Super Micro Computer

First on the list is Super Micro Computer, a Silicon Valley tech company specializing in designing, developing, and producing advanced computer hardware, including high-performance computing systems and AI-capable server stacks. In addition, Super Micro offers enterprise-scale management software and memory storage solutions, which are crucial for 5G networking, AI, cloud computing, data centers, and edge computing applications.

Super Micro has over 30 years of experience in the tech field, and its current expertise makes it a one-stop shop for customers with high-end computer needs. The company can design and build complex server stacks and high-performance computers in-house, and can install them at any scale to meet a wide variety of end uses. Super Micro meets these needs with a combination of off-the-shelf parts and custom builds, both based on the company’s existing product lines, and can adapt final products to meet unique, one-off design requests. The firm has a large-scale manufacturing footprint, and at current capacities can produce approximately 5,000 AI, HPC, and liquid cooling rack solutions monthly.

The expansion of AI – particularly generative AI – has been a boon to Super Micro. The company’s high-performance computer products are well-suited to the AI field, offering the combination of high speed and advanced memory capacity required by AI applications. This surge in demand drove its stock price to nearly $1,200 earlier this year. While the stock has since pulled back, it remains above $400, marking a 46% increase year-to-date.

That helps to explain the 10-to-1 stock split which is coming up for Super Micro on October 1. The split will multiply every shareholder’s stock holding by 10, and bring the price down below $42.

Looking at the recent financial results, Super Micro reported $5.3 billion in revenue for fiscal 4Q24, marking a 143% year-over-year increase and beating expectations by $10 million. However, despite posting a solid non-GAAP EPS of $6.25, this was still $1.56 below the forecast, which management attributed to higher operating expenses and slimmer gross margins.

The company’s narrative recently took a dramatic twist. A report from short-seller Hindenburg Research made serious accusations of “accounting manipulation, sibling self-dealing, and sanction evasion.” Adding to investor anxiety, Super Micro delayed the filing of its annual 10-K report.

JPMorgan’s Samik Chatterjee, a 5-star analyst rated in the top 4% of the Street’s stock pros, has taken note of these developments and foresees regulatory challenges ahead.

“While the latest filings from the company indicate that the company is working diligently to be in compliance with regulatory requirements from a filing perspective and business is continuing as usual otherwise, at the same time it is tough to get more visibility into the timing over which the company will be back in compliance with its filing requirements. We continue to still view the Hidenburg report and the delay in the 10-K filing as separate events in themselves, but expect lack of visibility in relation to the timing of the company returning to compliance will create challenges to near-term sentiment in relation to comparison to the 2017-2020 time period for outcomes as well as severity of impact to financials,” Chatterjee opined.

Chatterjee comes down on the side of caution, adding, “As a result of our expectations for a near-term overhang for the shares from the uncertainty, we prefer to recommend new investors to remain on the sidelines till the company is back in compliance.”

To this end, the analyst rates SMCI a Neutral, although his price target of $500 still points toward a 21% upside on the one-year horizon. (To watch Chatterjee’s track record, click here)

So, that’s JPMorgan’s view, what does the rest of the Street have in mind? The broader sentiment presents a bit of a puzzle. On one hand, with 3 Buys, 10 Holds, and 1 Sell, the consensus lands at Hold. Yet, following the stock’s sharp recent decline, analysts project a strong recovery, expecting a 54.5% upside in the coming months. (See SMCI stock forecast)

Lam Research

The second stock we’ll look at, Lam Research, holds an essential niche in the semiconductor industry, providing the sophisticated machine tools and fabrication equipment used in the manufacture of silicon microchips. Specifically, Lam provides the high-tech tools and devices that are used in the preparation of silicon wafers, the precursor to chips. These wafers are the raw material of all microprocessors, and Lam is known as an innovative supplier of the equipment used in their production, as well as in quality control.

Semiconductors are absolutely essential in our digital world, and that fact provides support for Lam’s overall success. Despite a sharp drop in the shares in July, when the company felt pressure from reduced industry spending on memory chips, especially NAND chips, Lam still boasts a share price above $800. Industry analysts are expecting the memory sector to see a resumption of spending next year, a development that will likely benefit Lam as chip makers boost production.

With that in mind, the company’s quarterly results are worth a look. Lam brought in revenues of $3.87 billion during fiscal 4Q24, a total that was up more than 20% year-over-year and was $40 million better than had been anticipated. The company’s bottom line, the non-GAAP EPS of $8.14, beat the forecast by 55 cents per share. And in a sign that the company is healthy enough to weather most headwinds, Lam reported $862.4 million in cash generated from operating activities in the fourth fiscal quarter, with a cash and liquid asset balance of $5.9 billion.

We’ll see Lam’s next set of quarterly results on October 16, two weeks after the company’s upcoming stock split. The split, which will be effective on October 2, was authorized at 10 to 1 and will bring the company’s share price down to between $82 and $83 based on current valuation.

Brian Chin, 5-star analyst with Stifel Nicolaus, sums all of this up in his review of LRCX shares, writing of the company, “Following a down June quarter for NAND and memory, Lam sees NAND spending gradually improving, while remaining upbeat on its position and the outlook for advanced foundry/GAA and DRAM/TSV investment. Management highlighted several areas of technology/product focus for the company, including cryo-etch, and teased an upcoming Analyst Day in Feb ’25. While acknowledging there are a few debates around the company/sector, we expect Lam to perform well against the broader WFE environment this year and next, especially once NAND spending inflects.”

Chin sees this stock as a solid Buy, setting a price target of $1,050, which indicates a potential 27% upside over the next year. (To watch Chin’s track record, click here)

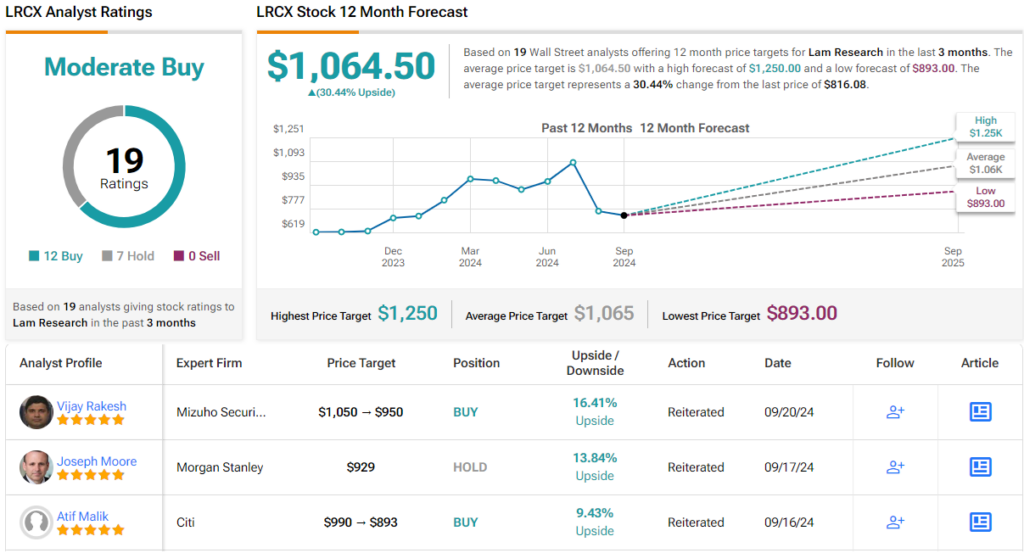

From the Street as a whole, LCRX stock gets a Moderate Buy consensus rating, based on 19 reviews that include 12 to Buy against 7 to Hold. The stock’s trading price stands at $816.08, while the average target price of $1,064.50 implies that the shares will appreciate by 30% in the year ahead. (See LCRX stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.