Shares of ASX-listed insurance company Suncorp Group (AU:SUN) surged after the company reported higher profits and a dividend boost for the full year of FY24. The company’s NPAT (net profit after tax) grew 11.8% to AU$1.2 billion, while gross written premium (GWP) increased nearly 14% to A$14.1 billion. Driven by favourable numbers, Suncorp declared a final dividend of AU$0.44 per share, bringing the total dividend for FY24 to AU$0.78 per share. The FY24 total dividend represents a 30% increase compared to the previous year.

Following the results, Suncorp shares gained 1.34% in today’s session. Year-to-date, SUN stock shares have rallied 27%.

Suncorp Group is a leading financial services firm that offers a wide range of insurance and banking solutions across Australia and New Zealand.

Suncorp Navigates Challenges in FY24

In FY24, Suncorp reported a 16.6% year-over-year growth in its cash earnings of AU$1.4 billion. This was largely due to better margins, favourable investment returns, and natural hazard costs coming in under allowances. The company’s net investment returns increased 46.6% to AU$661 million.

Additionally, Suncorp stated that the past three years have been tough for all insurance companies due to inflation, natural hazards, and significant shifts in global reinsurance markets. Nonetheless, the company has successfully survived these challenges, with its earnings now returning to previous levels.

Among the company’s segments, Suncorp Insurance and Suncorp New Zealand divisions were the star performers, posting annual profit growth of 112% and 160%, respectively. On the other hand, Commercial & Personal Injury’s profits fell by 14%, while Suncorp Bank saw a 19.4% decline in its bottom line. Suncorp Bank is now a part of ANZ Group Holding (AU:ANZ).

What Is the Price Target for Suncorp?

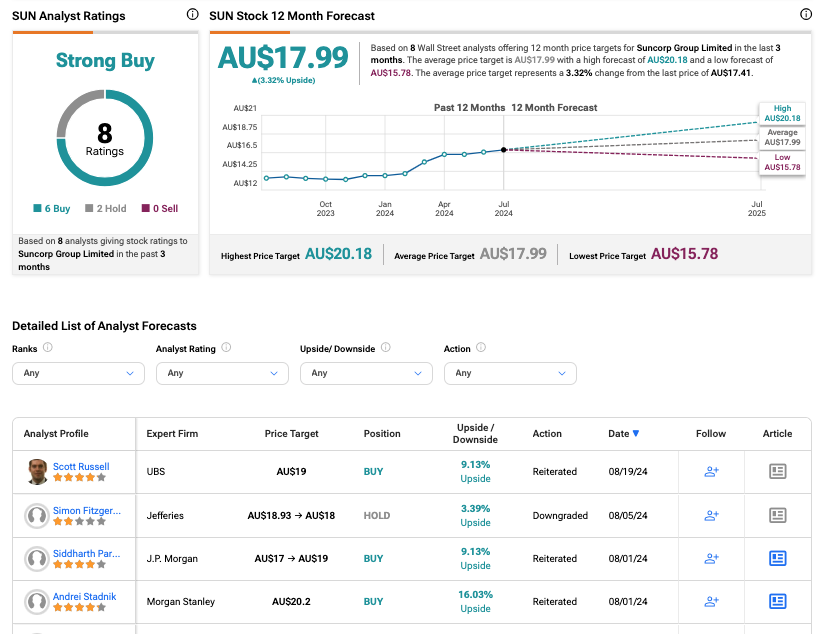

Following the results, UBS analyst Scott Russell reiterated a Buy rating on Suncorp stock, predicting an upside of 9.13%.

As per the consensus among analysts on TipRanks, SUN stock has been assigned a Strong Buy rating based on six Buys and two Hold recommendations. The Suncorp share price target is AU$17.99, which is 3.3% above the current trading levels.