There’s a new name looking to stake its claim to the GLP-1 goldmine, and analysts say the stock has upside potential of almost 130%. The stock is Structure Therapeutics (NASDAQ:GPCR). I’m bullish on GPCR because the stock has significant potential if the company can eventually capture even a small piece of the massive GLP-1 weight loss drug market (GLP-1s are the drugs used to treat type 2 diabetes and obesity).

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Furthermore, as already mentioned, Wall Street analysts collectively believe the stock has plenty of upside potential from current levels, making it an enticing high-risk, high-reward investment opportunity.

What’s the Big Deal?

According to TipRanks, GPCR is a “clinical stage global biopharmaceutical company aiming to develop and deliver novel oral therapeutics to treat a wide range of chronic diseases with unmet medical need.” The most interesting thing about GPCR is its GLP-1 drug candidate, GSBR-1290.

As you’re probably well aware, shares of GLP-1 stocks like Eli Lilly (NYSE:LLY) and Novo Nordisk (NYSE:NVO) have soared after their drugs became major hits.

It’s hard to understate how massive the obesity market is. The World Health Organization forecasts that roughly 50% of U.S. adults will be considered obese by 2030, up from 42% in 2020 and just 31% in 1999. Therefore, it’s no surprise that this is an extremely lucrative market. JPMorgan (NYSE:JPM) believes that the market for GLP-1 drugs will surpass $100 billion in sales annually by 2030 (driven by both obesity and type 2 diabetes).

While Eli Lilly and Novo Nordisk are already entrenched in this market, GPCR is a relative minnow compared to these healthcare mega-caps, with a market cap of just $1.57 billion. Thus, if GPCR can capture even a small sliver of this lucrative market, shares could be worth significantly more than they are today.

Plus, GPCR offers a differentiated option because it is working to develop an oral solution rather than the injections that Eli Lilly and Novo Nordisk currently provide, which could be a preferable option for many patients. JPMorgan forecasts that the market for oral GLP-1 drugs alone will be worth $30 billion per year by 2035.

Mind the Risks

To be clear, while GPCR’s upside is exciting, this is still a high-risk, high-reward investment, as this is an early-stage biotech stock, and we do not yet know if this drug will be approved. Even if approved, there is the risk that the drug doesn’t become commercially viable or gain enough market share.

In December, shares of Structure Therapeutics tanked when interim phase 2 results for GSBR-1290 underwhelmed investors. Results showed that Structure’s candidate led to weight loss of 3.3% to 3.5% after 12 weeks of treatment, but results for Eli Lilly’s own oral candidate looked more impressive. Nevertheless, the drug appeared safe, and was effective, so there is still reason for optimism.

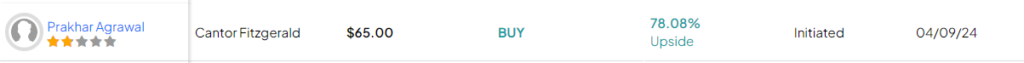

Plus, the full data set of results should be reported during the second quarter, and it’s possible that they could be more compelling. Prakhar Agrawal of financial services firm Cantor Fitzgerald recently initiated coverage of the stock with an Overweight rating and a $65 price target. This was based on the upcoming results. Cantor Fitzgerald explained that while Eli Lilly’s candidate has shown the strongest profile among oral GLP-1s, it has “high conviction” that GSBR-1290 will stack up well against LLY’s drug.

Another risk is that there will also likely be plenty of competition. Global Data says that over a dozen new obesity drugs could come to market by 2029. However, Global Data analyst Jasper Morley is still bullish on the space and believes there will be multiple winners, explaining that because of surging demand and a growing patient population, “It is highly likely that a number of companies manufacturing these later entrants will receive great returns for their efforts.”

Analysts are Bullish on GPCR Stock

The stock is making waves with additional Wall Street analysts. JPMorgan analyst Hardik Parikh also recently initiated coverage on the stock with an Overweight rating and a $65 price target, which is well north of the stock’s current price of just $33.76. Parikh believes that Structure’s oral GLP-1 drugs could generate $30 billion in sales by 2035 and wrote, “GPCR’s lead asset… is a pure-play option for this opportunity, and even a small share would support substantial upside to the stock.”

While JPMorgan is coming in with a bullish recommendation and a high price target, it’s not nearly the highest on the Street. Piper Sandler’s Yasmeen Rahimi has a significantly higher price target of $93, which implies upside potential of over 175% from current levels.

What Is the Price Target for GPCR Stock?

Overall, GPCR earns a Strong Buy consensus rating based on eight Buys, zero Holds, and zero Sell ratings assigned in the past three months. The average GPCR stock price target of $77.13 implies 128.5% upside potential.

Investor Takeaway

The weight loss drug market is a lucrative one, and incumbents like Eli Lilly and Novo Nordisk have seen their valuations shares surge, thanks to the success of their GLP-1 drugs. I’m bullish on Structure because if its candidate is successful and can capture even a small part of this lucrative market, the stock has massive potential. Analysts rate the stock a Strong Buy, and the fact that the average analyst price target implies an upside of over 128% is further reason to be bullish.

Another thing I like about Structure is that, given its small size, it could theoretically be an attractive acquisition candidate for a larger healthcare company looking to enter the GLP-1 space. There is certainly risk here, but the potential rewards look compelling for risk-tolerant investors.