Biotechnology company Stoke Therapeutics (STOK) is grabbing investors’ attention with its Zorevunersen (STK-001) treatment for Dravet syndrome, a severe form of genetic epilepsy. Furthermore, progress continues in the pursuit of treatment for a second protein-insufficiency disease, autosomal dominant optic atrophy (ADOA). Stoke has made substantial strides recently, with the FDA lifting the clinical hold on Zorevunersen and the promising data to be given at the upcoming European Epilepsy Congress.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

These developments have helped propel the stock up over 179% year-to-date. Stoke is a compelling opportunity for investors interested in a biotech with substantial potential upside.

Stoke Therapeutics Promising Pipeline

Stoke Therapeutics is a biotechnology firm specializing in RNA-based medicines to treat severe diseases. The company uses a unique method known as TANGO (Targeted Augmentation of Nuclear Gene Output) to develop antisense oligonucleotides (ASOs) to selectively restore protein levels.

Stoke is currently conducting clinical trials of its lead pipeline candidate, Zorevunersen (STK-001), to treat Dravet syndrome. The firm is also researching a treatment for another haploinsufficiency disease, autosomal dominant optic atrophy (ADOA), the most inherited optic nerve disorder.

Recently, the company announced the U.S. Food and Drug Administration (FDA) had lifted the partial clinical hold on Zorevunersen. Stoke plans to share previously disclosed positive data from Phase 1/2a and open-label extension (OLE) studies of Zorevunersen in children and adolescents with Dravet syndrome at the upcoming 15th European Epilepsy Congress (EEC).

The company is engaged in discussions with global regulatory agencies and will provide a regulatory update on Zorevunersen’s Phase 3 registration plans in the second half of 2024.

Analysis of Stoke’s Recent Financial Results

The company recently reported results for the second quarter of 2024. Revenue of $4.83 million marked a significant improvement compared to a loss of $2.5 million during the same period in 2023. The increase was driven by upfront license fees and services provided per an agreement with Acadia Pharmaceuticals (ACAD).

Expenditures also rose, with Research & Development expenses slightly increasing to $21.1 million and General & Administrative expenses rising more notably to $13.0 million from the previous year’s $10.2 million. These increases led to the company reporting a net loss of $25.7 million or $0.46 earnings per share, a reduction from the net loss of $30.7 million or $0.69 per share experienced during the corresponding period in 2023.

As of the quarter end, the company reported $282.0 million in cash, cash equivalents, and marketable securities.

What Is the Price Target for STOK Stock?

The stock has been volatile, sporting a beta of 1.95 as it has climbed 176% over the past year. It trades near the upper end of its 52-week price range of $3.35 – $17.58 and demonstrates positive price momentum by trading above its 20-day (13.87) and 50-day (13.54) moving averages.

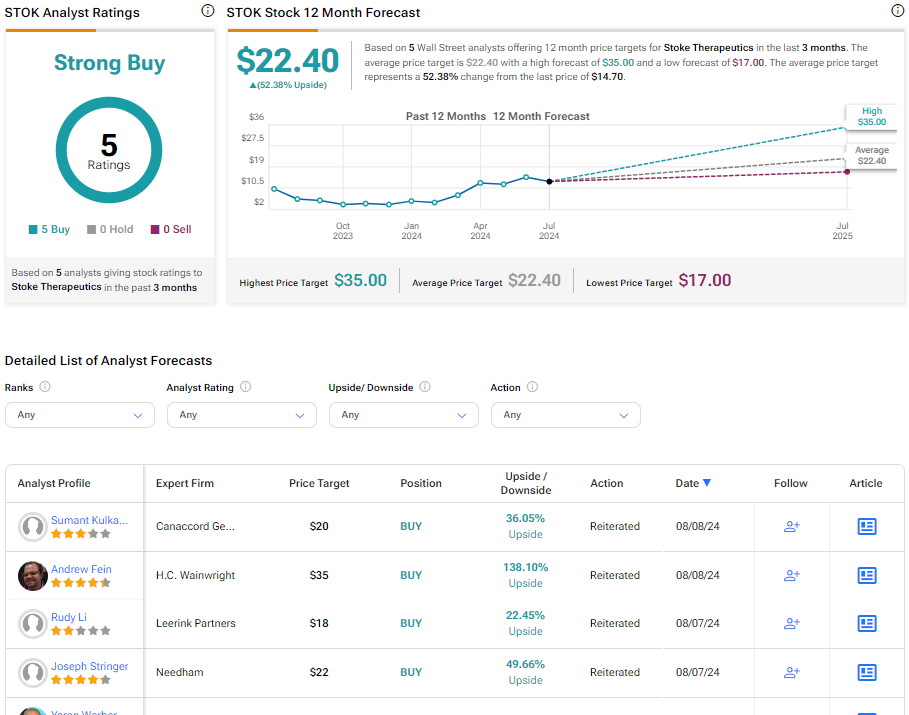

Analysts following the company have been bullish on the stock. For instance, Leerink Partners analyst Rudy Li reiterated a Buy rating on the shares with an $18 price target, noting that all pipeline programs are on track, with expected pivotal clinical trial updates in the second half of the year.

Stoke Therapeutics is rated a Strong Buy based on the recommendations and price targets recently assigned by five analysts. The average price target for STOK stock is $22.40, representing a potential upside of 52.38% from current levels.

STOK in Summary

Stoke Therapeutics is making notable strides with several promising candidates in clinical trials, with pivotal updates expected in the second half of the year. The stock’s positive momentum makes STOK an attractive choice for investors looking for significant growth opportunities in the biotech sector.