Jeep maker Stellantis’ (STLA) top management is crumpling with the ousting of the CFO and the retirement of the CEO on the cards. Yesterday, the board removed CFO Natalie Knight amid the weakening financial performance of the automaker. The move is meant to rekindle investor confidence and stabilize the flailing business. Additionally, Stellantis confirmed that CEO Carlos Tavares will retire in 2026 and that a search for a suitable replacement was underway.

Here’s More About Stellantis’ Reorganization Plans

Doug Ostermann, who was the COO for China, will take up the CFO position. Knight was the first to point out the deteriorating profits and ballooning expectations at Stellantis earlier this year. STLA stock price has been on a downward spiral this year, and the downtrend was exacerbated by Knight’s cautious stance on expectations during the April 30 analyst call. The company cut its profit forecast last month, citing weak U.S. business and stiff competition from China’s automakers. Year-to-date, STLA stock has lost 39.1%.

Bloomberg first reported the sweeping management shakeup at Stellantis yesterday, which could affect a wide range of departments from finance teams and regional heads to brand executives. Stellantis’ North American operations remain at the core of the automaker’s struggling performance. The company has appointed Antonio Filosa as its North America COO alongside his role as Jeep brand CEO. Filosa will be assigned the task of turning around Stellantis’ North American performance.

Bernstein Analyst Reacts to the Reshuffle

Following the management reshuffle, Bernstein analyst Daniel Roeska noted that the latest reshuffle, one among the 21 made in the last 12 months, might not calm investors. Roeska added that Stellantis lost all trust when it cut guidance in September after falsely dismissing concerns regarding inventory and discounts in the U.S.

Roeska has a Hold rating on STLA stock with a price target of $12.04, implying 9.5% downside potential from current levels.

Is STLA a Good Stock to Buy?

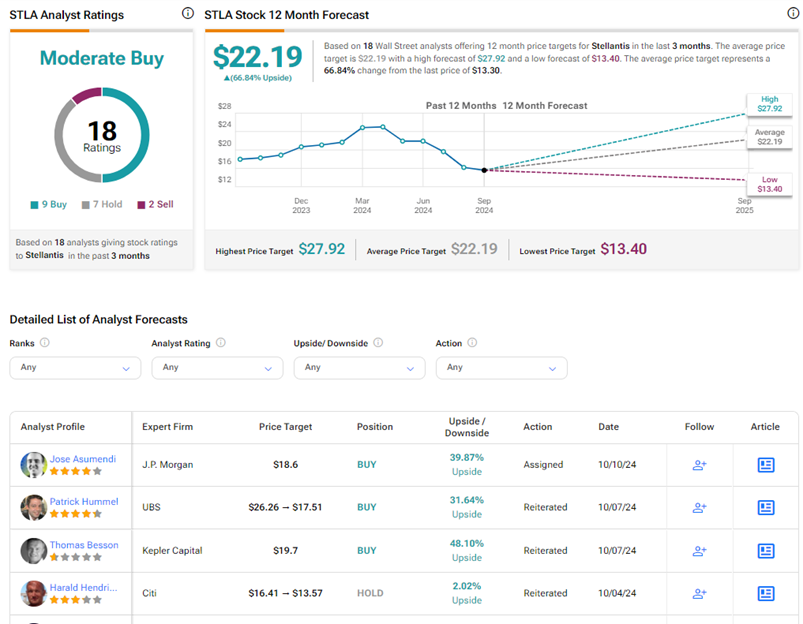

Analysts remain divided on Stellantis stock amid several company-specific and macro headwinds. On TipRanks, STLA stock has a Moderate Buy consensus rating based on nine Buys, seven Holds, and two Sell ratings. The average Stellantis price target of $22.19 implies 66.8% upside potential from current levels.