Shares of automaker Stellantis (STLA) are down in today’s trading despite revealing details for its new STLA Frame platform, which is designed for full-size trucks and SUVs with electrified powertrains. Unlike its unibody EV platforms for smaller vehicles, the body-on-frame design supports multiple power options, including battery electric (BEV), range-extender electric (REEV), hybrids, and even hydrogen.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The Ram 1500 REV EV pickup and Ramcharger range-extender models will be the first to use the STLA Frame and will offer up to 500 miles of all-electric range and 690 miles for REEV models, with 2,700-pound payloads and 14,000-pound towing capacity. Jeep models are also expected to adopt the platform. Stellantis hopes to have these vehicles available for sale by mid-2025.

Stellantis Is Facing Challenges

Stellantis’ launch of this new platform comes as the company faces challenges. Indeed, the firm is struggling in the U.S. and China, which has led to bloated inventories. In addition, Trump’s reported plan to cut EV tax credits poses additional risks for Stellantis’ electric vehicle ambitions. As a matter of fact, Elon Musk is actually in favor of cutting EV tax credits because he believes it would significantly impact legacy automakers’ abilities to compete.

Despite this, CEO Carlos Tavares is confident in Stellantis’ multi-energy platform, which he sees as a flexible strategy to adapt to shifting market and regulatory conditions. In addition, the automaker recently announced that it will be laying off 1,100 workers in an effort to improve efficiency, which should help offset some losses should EV tax credits get removed.

Is STLA a Good Stock to Buy Now?

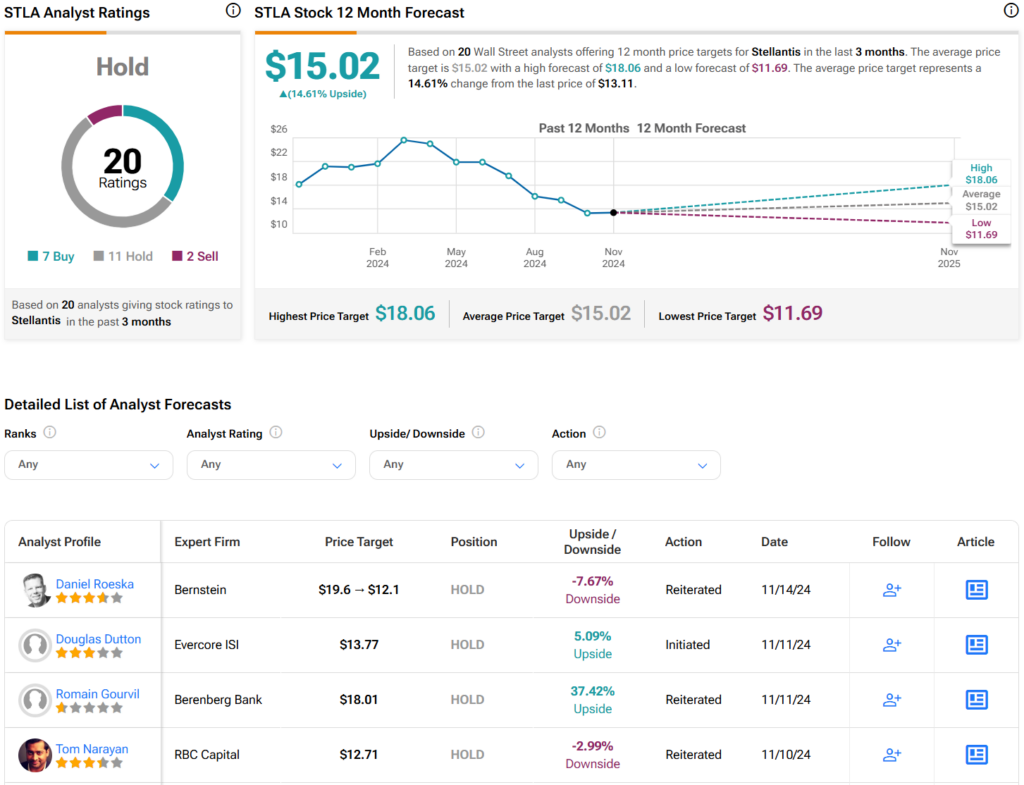

Turning to Wall Street, STLA stock has a Hold consensus rating based on seven Buys, 11 Holds, and two Sells assigned in the last three months. At $15.02 per share, the average Stellantis price target implies an upside potential of 14.6%. It is also worth noting that shares of the company have declined 40% year-to-date.