MicroStrategy (NASDAQ:MSTR) shares faced heavy selling pressure today, plunging nearly 16%, after Citron Research revealed on X that it had taken a short position on the Bitcoin-holding company. Citron justified the move by pointing to more attractive investment opportunities directly in Bitcoin.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

As the Bitcoin price has gone through the roof this year, so have MicroStrategy shares, albeit in a more turbocharged manner. Despite today’s steep decline, the stock’s year-to-date gains still stand at 529%.

Meanwhile, MicroStrategy continues to ramp up its efforts to expand its Bitcoin holdings. The company has set a goal of raising $42 billion to purchase additional Bitcoin. Between October 31 and November 17, it secured $6.6 billion through equity issuance, acquiring 78,980 Bitcoin. This brought its total holdings to 331,200 Bitcoin, boosting its Bitcoin-per-share ratio (or what the company calls the BTC Yield) by 20.4%.

But that’s not all. On November 20, MSTR priced a $2.6 billion convertible debt offering, an increase from the $1.75 billion originally announced on November 18. The offering features a 0% coupon and a 55% conversion premium, with the proceeds designated for, what else, further bitcoin acquisitions to enhance shareholder value.

Watching this all unfold, BTIG’s top analyst, Andrew Harte, thinks the Michael Saylor-led company is making all the right moves.

“The volatility in MSTR’s stock is presenting the company with attractive capital raising opportunities as seen with the proposed $2.6bn 0% convertible offering, and we think management has done an exceptional job using the volatility to raise additional fiat capital to acquire bitcoin,” said Harte, who ranks in the top 2% of Wall Street stock pros.

As the price of bitcoin has surged to over $98,000, MSTR’s total bitcoin holdings are now worth more than $32 billion. As of November 17, the BTC yield ytd stood at 41.8%, well ahead of the company’s target of an annual BTC Yield of 6% to 10% between FY25 and FY27.

“We think MSTR’s YTD Bitcoin Yield demonstrates the company’s ability to generate shareholder value from its bitcoin treasury reserve operations,” the analyst further stated.

So, what is needed now, says Harte, is a reassessment of MSTR’s prospects based on several key factors. These include the recent bitcoin surge, which boosts the value of MSTR’s holdings, and the company’s impressive 20.4% BTC Yield month-to-date since launching the 21/21 plan. There’s also growing confidence from both Harte and investors that the company’s implied Bitcoin premium should exceed 3x. Additionally, Harte expects MSTR will keep on raising capital to acquire more bitcoin, further supporting the BTC price.

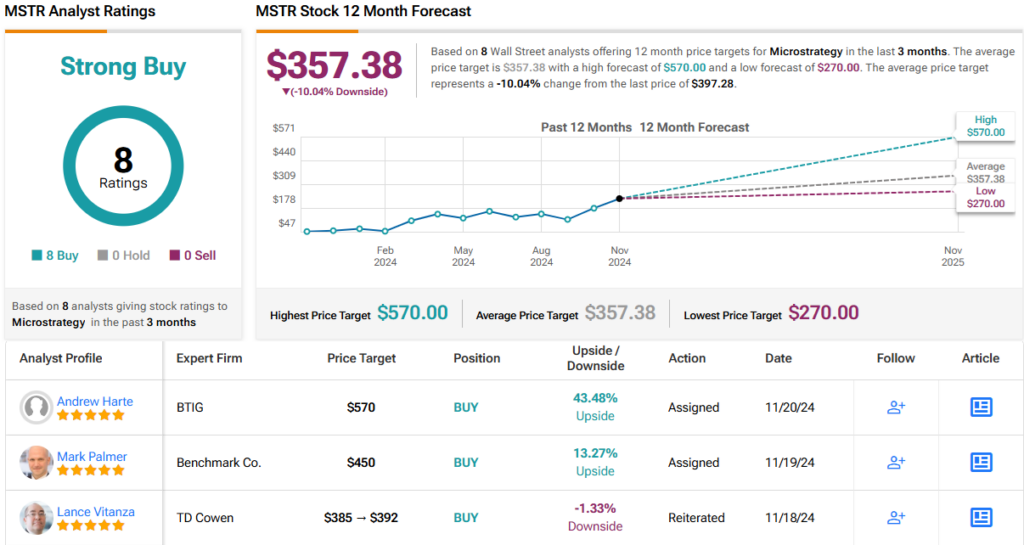

As such, Harte has raised his price target on MSTR from $290 to a Street-high of $570, suggesting the stock can climb 20% higher from here. Hardly needs adding, but Harte’s rating stays a Buy. (To watch Harte’s track record, click here)

Overall, the Street consists of MSTR bulls only, with the stock’s Strong Buy consensus rating based on 8 unanimous Buys. However, the $357.38 average price target sits 10% below the current share price. It will be interesting to see whether other analysts downgrade their ratings or update their price targets shortly. (See MSTR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.