Apple’s (NASDAQ:AAPL) new iPhone 16 appears to be off to a good start with early days indicating there’s healthy demand for the new Pro models.

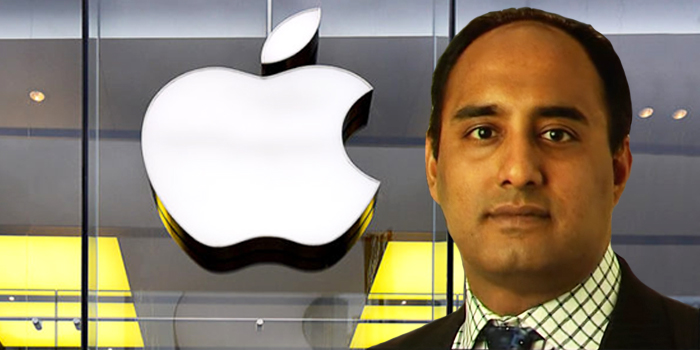

This is the view shared by Evercore’s 5-star analyst, Amit Daryanani, based on insights from his firm’s iPhone delivery tracker.

The iPhone 16 presale, which started last Friday, reveals longer delivery times for the Pro models compared to last year, across all key regions tracked by Evercore, including the US, China, Japan, the UK, and Germany.

“In aggregate,” says Daryanani, “given the staggered launch of both Apple Intelligence across geographies and AI features we think the mix data set is logical – Pro Max is modestly weaker vs. iPhone 15, Pro models are doing fairly well notably in China where they are competing with Huawei’s new Mate X product.”

In the US, delivery times for the iPhone 16 Pro have risen to 17 days, compared to 7 days last year, and in China, they have extended to 24 days, up from 18 days last year.

Daryanani thinks that the longer delivery times in China are “particularly encouraging,” still believing that any market pressure in the region is concentrated at the lineup’s lower end, while the flagship Pro model continues to perform strongly.

That said, Daryanani also points out that the Pro Max is seeing shorter delivery times across all regions, though still elevated at over 20 days. Meanwhile, the more budget-friendly iPhone 16 and 16 Plus models are available in 4-5 days, slightly faster than last year’s 6-7 day window.

A key point, according to Daryanani, is that demand for the iPhone 16 Pro seems to be strongest in the US and UK, where Apple Intelligence is expected to be available sooner. “We continue to expect a ‘stronger for longer’ iPhone cycle given the staggered nature of the Apple Intelligence rollout,” the analyst summed up.

All things considered, Daryanani gives Apple shares an Outperform (i.e., Buy) rating, with a $250 price target, suggesting potential 15% gains in the coming months. (To watch Daryanani’s track record, click here)

The Street’s average price target is in line with Daryanani’s objective. Rating-wise, 22 other analysts are also bullish, with 8 additional Hold ratings and a single Sell, resulting in a Moderate Buy consensus rating. (See Apple stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.