Nvidia (NASDAQ:NVDA) isn’t just any company – it’s a powerhouse that drives the market. As a leader in AI chips and the most valuable company on Wall Street, Nvidia has solidified its dominance in the lucrative data center market, making it a go-to name for investors.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

As Nvidia prepares to release its third-quarter earnings on Wednesday after the market closes, investors are eager for clues about the company’s outlook, the direction of the AI industry, and potential shifts across the broader market.

However, given the sky-high expectations surrounding Nvidia’s performance, one might wonder whether the company’s massive scale could eventually weigh on its impressive streak of growth.

In fact, even the company’s projected Q3 revenue of $32.5 billion – a strong 80% year-over-year increase – marks a slowdown from the triple-digit growth rates the market has come to expect. Should this be a signal to consider new opportunities?

Not just yet, says top investor Yiannis Zourmpanos, who remains confident that Nvidia’s extraordinary growth story is far from over.

“This high-growth trajectory is underpinned by increasing AI and data-intensive applications, affirming Nvidia’s leadership and potential for long-term value appreciation,” argues the 5-star investor, who sits in the top 1% of TipRanks’ stock pros.

Zourmpanos points to NVDA’s Blackwell GPU production, which is ramping up this quarter and next. With a thirsty market eager for Nvidia’s latest and greatest, the investor believes that Nvidia is well-placed to profit from the high demand for Blackwell.

“With Blackwell chips alone, Nvidia may hit a potential revenue of over $30 billion in just two quarters,” Zourmpanos projects.

Beyond the increase in revenues, the investor points out that Nvidia has succeeded in making market improvements in its operating margins, growing from 34% in FY2020 to 68% in FY2024.

“This trend of revenue and margin growth supports long-term valuation for the stock,” Zourmpanos opines, adding that “this allows Nvidia to maximize profitability as revenue scales up.”

Zourmpanos is therefore bullish on this “appealing investment opportunity,” rating NVDA a Strong Buy. (To watch Zourmpanos’ track record, click here)

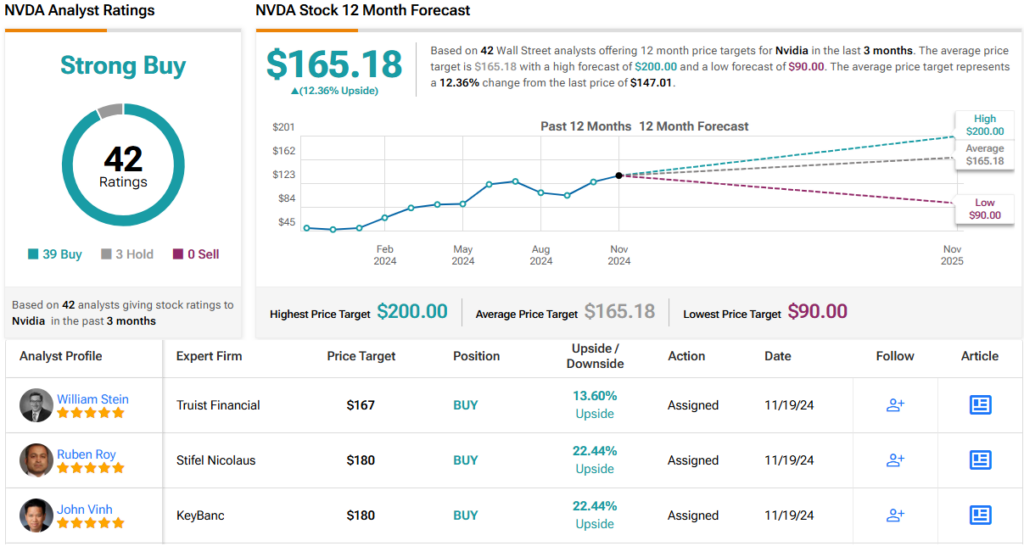

Wall Street is equally optimistic regarding NVDA’s prospects. With 39 Buy and 3 Hold recommendations, NVDA boasts a Strong Buy consensus rating. (See NVDA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.