Tesla (NASDAQ:TSLA) bulls don’t dwell on the challenges facing its auto business. Instead, they see the company’s real value in its ambitious bets on the future – autonomous fleets like Cybercab/Robotaxi and humanoid robots like Optimus. For them, these are the driving force behind a bullish outlook on Tesla’s long-term potential.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

While Tesla’s self-driving vision already faces stiff competition from Alphabet’s Waymo and GM’s Cruise, a new rival is making headway in the humanoid sphere.

According to a Bloomberg report, Figure AI, a U.S.-based humanoid robotics startup, is in discussions to secure $1.5 billion in funding. If finalized, the deal would value the company at $39.5 billion.

While none of the parties involved has officially confirmed the report yet, if it turns out to be accurate, the valuation would represent a more than 15-fold increase from Figure’s estimated worth of $2.6 billion just a year ago. That valuation came off the back of a Series B funding round last February, which included participation from OpenAI, Nvidia, Microsoft, and Jeff Bezos. Per PitchBook, this new valuation would position Figure among the ten highest-valued private startups. It would also place Figure’s worth above Ford’s, which stands at approximately $37.9 billion, and nearly on par with Stellantis at $42 billion.

Founded in 2022, Figure AI specializes in the development of AI-powered general-purpose humanoid robots, with its latest iteration, ‘Figure 02,’ designed to handle a variety of human tasks, from warehouse operations to household chores. The humanoid robots are being tested in BMW’s auto assembly operations. Additionally, the company recently announced that it has secured its second commercial customer, reportedly one of the largest companies in the United States. Looking ahead, over the next four years, Figure AI anticipates shipping 100,000 robots.

How is all this going to affect Tesla? Morgan Stanley analyst Adam Jonas thinks that competition is a good thing for the nascent space, and that does not necessarily spell bad news for Tesla.

“We continue to view Tesla as one of the leading enablers of humanoid robotics in the Western world and anticipate growing investor interest in TSLA’s role in this potential multi-trillion TAM end-market,” Jonas said. “A successful Figure would create competition for Tesla, but we continue to believe this is not a ‘winner take-all’ market similar to other industrial end-markets such as autos, machinery, etc.”

Jonas thinks the news of Figure AI’s fundraising will boost the humanoid robotics market’s standing amongst investors, thereby offering “another reason to consider humanoids as they contemplate the upside for TSLA shares.”

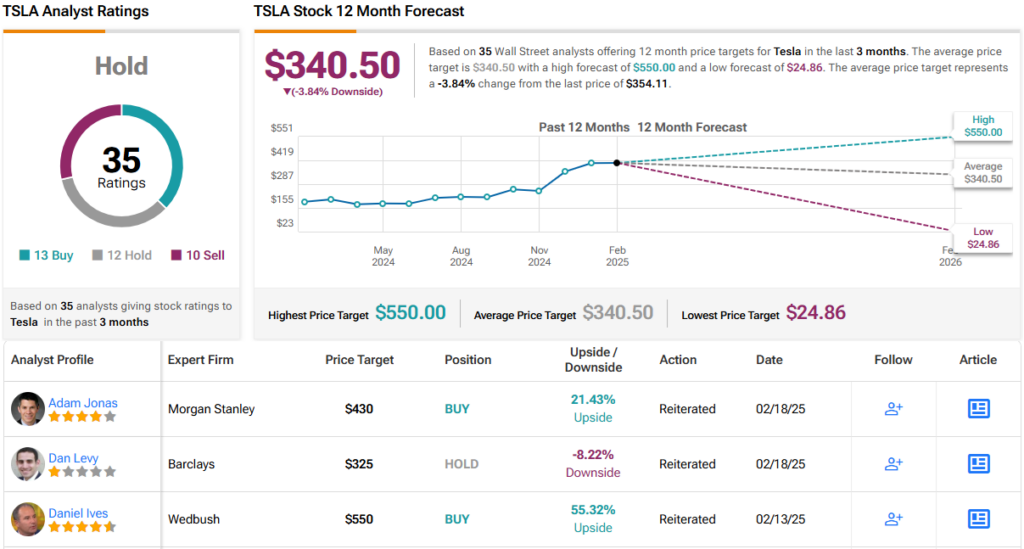

All told, Jonas rates TSLA shares as an Overweight (i.e., Buy), while his $430 price target suggests the stock will climb 21% higher over the coming months. (To watch Jonas’ track record, click here)

That’s more optimistic than the Street’s overall take, where the $340.5 average target points to downside of 4% over the coming months. On the rating front, based on a mix of 13 Buys, 12 Holds and 10 Sells, the analyst consensus rates the stock a Hold (i.e., Neutral). (See Tesla stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.