State Street (NYSE: STT) shares sank 8.5% on April 14 despite the company reporting better-than-expected Q1 results, topping both earnings and revenue estimates.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Based in the U.S., State Street is an American financial services and bank holding company. Through its subsidiaries, it offers a range of financial products and services to institutional investors.

Q1 Beat

Adjusted earnings of $1.59 per share beat analysts’ expectations of $1.47 per share. The company reported earnings of $1.37 per share in the prior-year period.

Total revenues jumped 4% year-over-year to $3.08 billion, and exceeded consensus estimates of $3.04 billion.

The top line benefited from higher fee revenue that increased 4% driven by solid growth in management fees, front office software and data, and foreign exchange trading services.

Net interest income rose 9%, driven by growth in investment portfolio and loan balances and higher interest rates.

CEO Comments

CEO Ron O’Hanley commented, “Our distinctive product innovation and solutions continue to make contributions across the franchise as evidenced by another quarter of solid new business wins in our Investment Services business and strong inflows at Global Advisors”.

Wall Street’s Take

Consensus among analysts is a Moderate Buy based on six Buys, and five Holds. The average State Street price target of $106.55 implies 40.6% upside potential to current levels.

Bloggers Weigh In

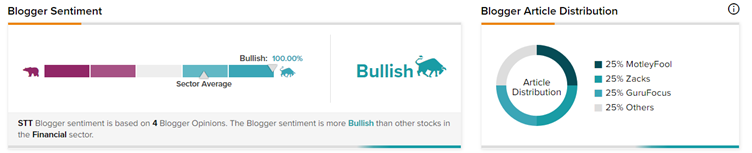

TipRanks data shows that financial blogger opinions are 100% Bullish on STT stock, compared to a sector average of 70%.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure