Starbucks (SBUX) is reportedly exploring a strategic partnership for its operations in China, according to an exclusive Bloomberg report. The coffeehouse giant confirmed the report, stating that it is considering various options, including selling a stake in its business to a local partner in China.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

What’s Driving SBUX to Consider This Move?

The coffeehouse chain is facing a slowdown in demand for its beverages in both the U.S. and China—two of its major markets. In fact, the company’s CEO Brian Niccol stated on its Q3 earnings call that “All indications show me the competitive environment is extreme (in China)… and we need to figure out how we grow in the market.”

Specifically in China, the company faces weak consumer spending and intense competition from local players like Luckin Coffee (OTC:LKNCY). To add to SBUX’s woes, sales in the region have declined for three consecutive quarters, with a 14% drop in the latest quarter.

SBUX Reduces Its Workforce

In another development, according to an SBUX regulatory filing, the company reduced its U.S. retail workforce by around 8% in its most recent Fiscal year, even as it added over 500 new stores. The company’s total U.S. headcount fell to 211,000 as of September 29, down from 228,000 a year earlier.

This marks the second consecutive year of workforce declines in the U.S., despite Starbucks expanding its total store count to 10,158 locations.

Is SBUX a Buy or Sell?

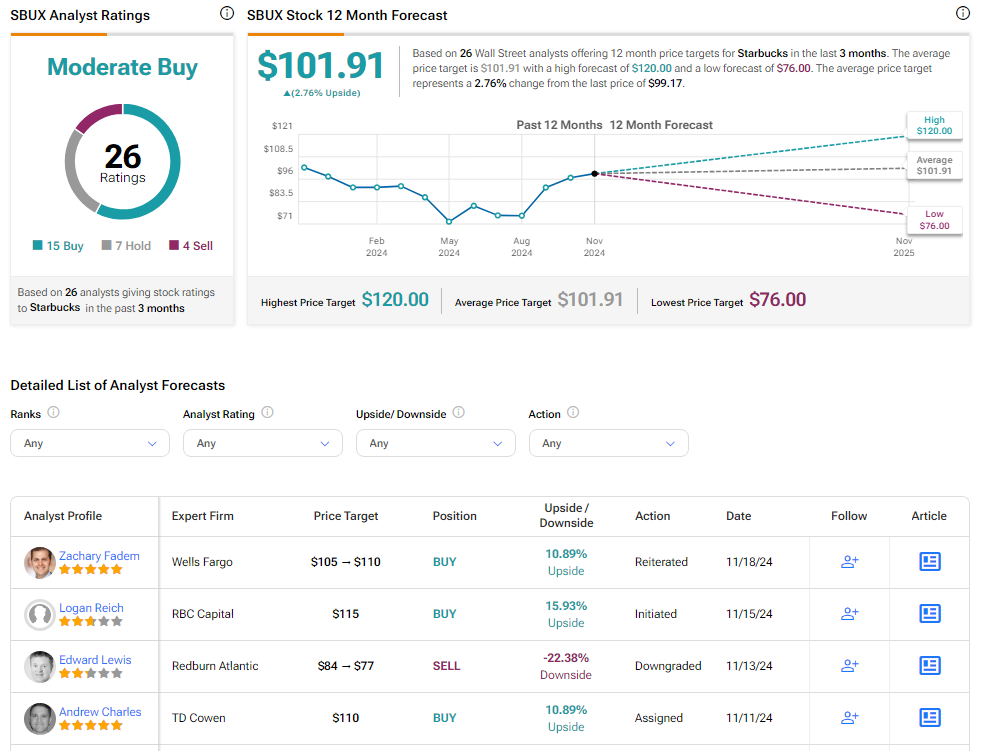

Analysts remain cautiously optimistic about SBUX stock, with a Moderate Buy consensus rating based on 16 Buys, seven Holds, and four Sells. Year-to-date, SBUX has increased by more than 5%, and the average SBUX price target of $101.91 implies an upside potential of 2.8% from current levels.