With the arrival of new CEO Brian Niccol at coffee chain giant Starbucks (SBUX) came a lot of hope that the chain could turn around some of its earlier troubles and become the powerhouse of coffee it once was. Even analysts are starting to come out in support. And with a second day of rallies going—Starbucks shares are up over 4% in Wednesday afternoon’s trading—those hopes may have a solid foundation after all.

TD Cowen analyst Andrew Charles led the charge on this one, offering up an open letter that lit a spark under investors. Charles noted that Niccol was looking in the right direction to help improve store traffic and is moving with a sufficient sense of urgency to make it much more likely that Starbucks could win going forward.

Charles further noted that speeding up the rollout of the “Siren System” will likely prove helpful and he looks forward to finding out just what exactly will happen to the app-based and mobile order processes. These are great concepts by themselves, but they need to be appropriately fleshed out in order to have much real value.

It’s worth noting that, so far, Charles has enjoyed a 57% success rate on his stock ratings, with an average return of 11.6% per rating.

Reprioritizing Sitting and Relaxing

Coffee house buffs—which I happen to be from a long way back—can tell you that one of the great values of a coffee shop is that you can sit, relax, and converse for the simple price of actually ordering something. Parisian cafe rules once worked this way, reports suggest, and it may be that Starbucks is trying to bring that back.

For Starbucks, of course, there is the retail element of this to consider. The longer people stay in a Starbucks, the better the chance they will make a second order. Or a third. Increasing time in store tends to increase order size, as well as fundamentally shake up the image of the store itself. And Niccol is out to do just that by “elevating the in-store experience,” he noted in an open letter.

Is Starbucks Stock a Buy, Sell, or Hold?

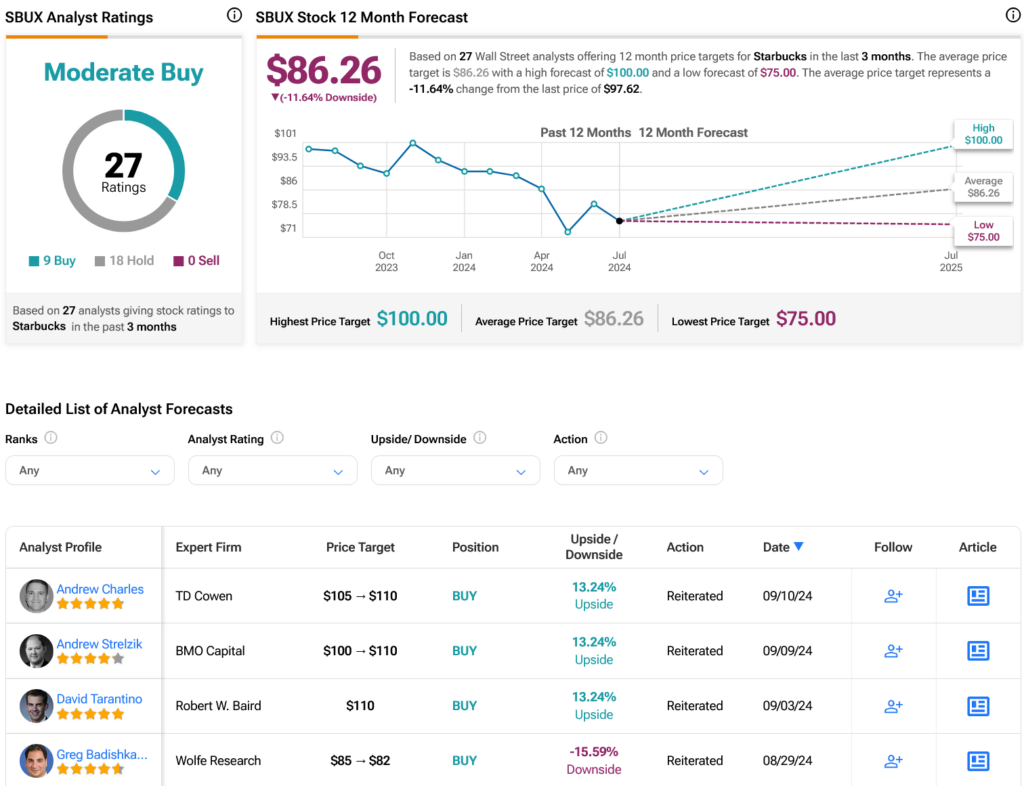

Turning to Wall Street, analysts have a Moderate Buy consensus rating on SBUX stock based on nine Buys and 18 Holds assigned in the past three months, as indicated by the graphic below. After a 2.88% rally in its share price over the past year, the average SBUX price target of $86.26 per share implies 11.64% downside risk.