Shares of the world’s biggest coffee chain, Starbucks Corporation (NASDAQ: SBUX) rose 5.16% to close at $87.41 on Wednesday. The price action followed the revelation from the company that former CEO Howard Schultz will return as an interim CEO on the departure of the current boss, Kevin Johnson. The acting CEO plans to step down from his position on April 4.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Starbucks was already working on CEO succession plans as Johnson disclosed last year that he planned to retire. Consequently, the company said that the new CEO will be announced by the fall.

Schultz, who resigned from the position of CEO in 2008, but acted as an executive chairman until 2018, will return on an interim basis and rejoin the board as well. Schultz will receive $1 of compensation. `

Meanwhile, Johnson, who was appointed as the President and CEO in 2017, will serve as a special consultant to the firm and its board through September for the smooth transition.

CEO’s Achievements

Johnson served on the Starbucks Board of Directors since 2009 and thereafter joined the leadership team in 2015 as President and chief operating officer. Later on, in 2017, he was appointed as the President and CEO, following the founder of Starbucks, Schultz.

Under Johnson’s tenure, the company expanded through the Global Coffee Alliance with Nestle, covering about 80 markets at present.

Commenting on Johnson’s achievements, Mellody Hobson, Independent Starbucks Board of Directors chair, said, “Kevin and the entire executive team stepped up to the challenge of the pandemic and navigated one of the most difficult periods in modern history…During Kevin’s tenure, Starbucks scaled an industry leading digital offering spanning nearly 45 million Starbucks Rewards members in the U.S. and China.”

Conclusion

Leadership transitions are the need of the hour to plan post-pandemic strategies with fresh leaders. Therefore, organized transitions and tactical leader selection could pave a smoother path for companies, otherwise protracted decisions might lead to critically lost time.

Wall Street’s Take

Following the CEO’s resignation, Stephens analyst James Rutherford maintained a Buy rating on the stock and a price target of $125, which represents a possible 12-month upside potential of 43% from current levels.

Rutherford believes that Schultz “will be a steady hand to guide the company.”

The rest of the Street is cautiously optimistic about the stock and has a Moderate Buy consensus rating based on 14 Buys and 10 Holds. The average Starbucks price target of $116.22 implies a 32.96% upside potential from current levels. Shares have lost 19.5% over the past year.

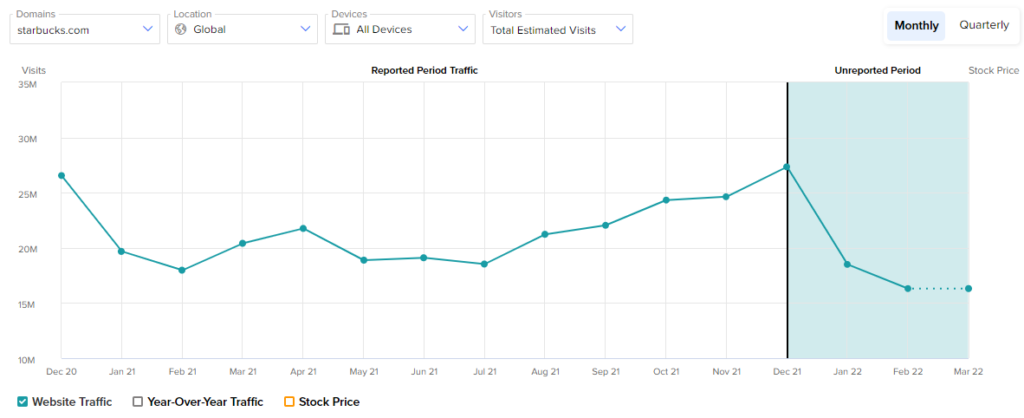

Estimated Monthly Visits

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (NYSE: SEMR), offers insight into Starbucks’ performance.

According to the tool, the Starbucks website recorded a 32.34% and 11.83% decrease in global estimated visits in January and February, respectively, on a sequential basis. Also, year-to-date website growth, compared to year-to-date website growth in the previous year, came in at a decline of 7.56%. This, in turn, indicates that the company’s revenues and profitability might disappoint going forward.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Ford to Expand EV Footprint in Europe

ExxonMobil Fails to Rescind Appeal to Terminate Climate Change Investigations

Intel to Invest €80B to Expand Footprint in European Union