Block (SQ) reported mixed results for the second quarter. However, shares of the company gained over 5% in after-hours trading yesterday after the company raised its full-year guidance. SQ’s performance is benefiting from strong revenue growth and disciplined cost management.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

SQ operates as a financial services and digital payments company.

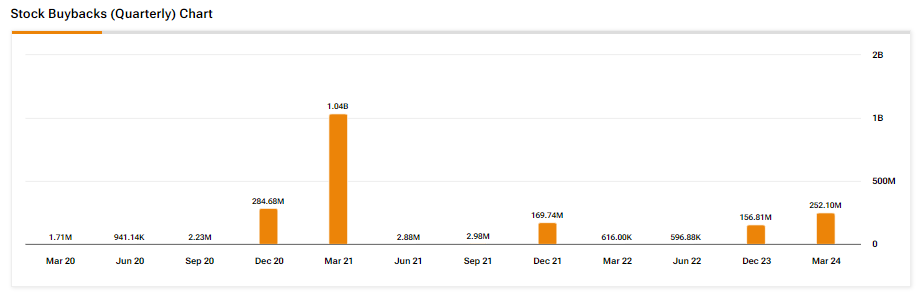

Interestingly, the company announced a $3 billion share buyback program. In Q2, SQ returned over $390 million to shareholders through buybacks. The company has recently increased its share repurchase activity, as seen in the image below.

For a thorough assessment of Block stock, go to TipRanks’ Stock Analysis page.

SQ: Key Q2 Highlights

Block posted adjusted earnings of $0.93 per share, up by 138.5% year-over-year and above the analysts’ expectations of $0.84. The bottom line was supported by a 4% decline in operating expenses.

Meanwhile, the company delivered revenue of $6.16 billion in Q2, up 11% year-over-year. However, this came in lower than the Street’s estimate of $6.26 billion.

In Q2, Cash App, Block’s popular mobile payment platform, saw significant growth, generating $4.13 billion in revenues, marking a 12.4% year-over-year increase. Importantly, Cash App accounted for 67% of Block’s total revenues in Q2. Further, the platform’s monthly active users (MAUs) increased 13% year-over-year and crossed over 24 million.

Q3 and FY24 Outlook

In the third quarter, the company expects to report adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) of $695 million, with an operating margin likely to be 14%.

It is worth highlighting that Block revised its FY24 outlook upward. It now anticipates adjusted EBITDA of $2.90 billion, up from its previous forecast of $2.76 billion. Additionally, adjusted operating income is expected to reach $1.44 billion, compared to its prior outlook of $1.3 billion.

Is Block a Buy or Sell?

The company’s focus on cutting expenses, improving sales efficiency, and capitalizing on the Cash App’s potential are key drivers. However, intense competition in the fintech space, especially from PayPal (PYPL), remains a key concern.

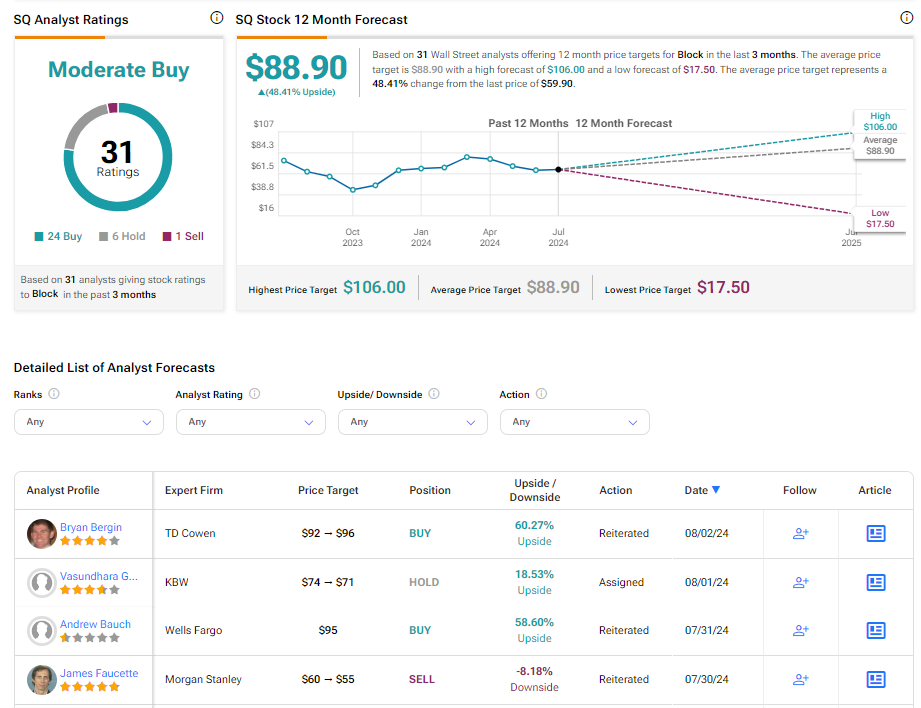

With 24 Buy, six Hold, and one Sell ratings, Block stock commands a Moderate Buy consensus rating. On TipRanks, the analysts’ average price target on SQ stock of $88.90 implies 48.41% upside potential from current levels. Over the past six months, shares of the company have declined by about 18%.

However, it’s worth noting that estimates will likely change following today’s earnings report.