Streaming has undoubtedly changed music’s business model, as it did the film and television industries. The biggest company in terms of subscribers is Spotify (SPOT), with 246 million monthly premium subscribers and more than 600 million active users. It caters to music fans, podcast followers, and audiobook listeners. Its most known podcast on the platform is “The Joe Rogan Experience,” with the latest deal between the two sides worth about $250 million. Unlike Julie Andrews’ hills, the company is alive not only with the sound of music.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

To put Spotify’s success into perspective, its market cap exceeds $76 billion, much beyond that of Sony Music (SONY), the ruler of the old guard in the music industry, with a market cap of $10 billion.

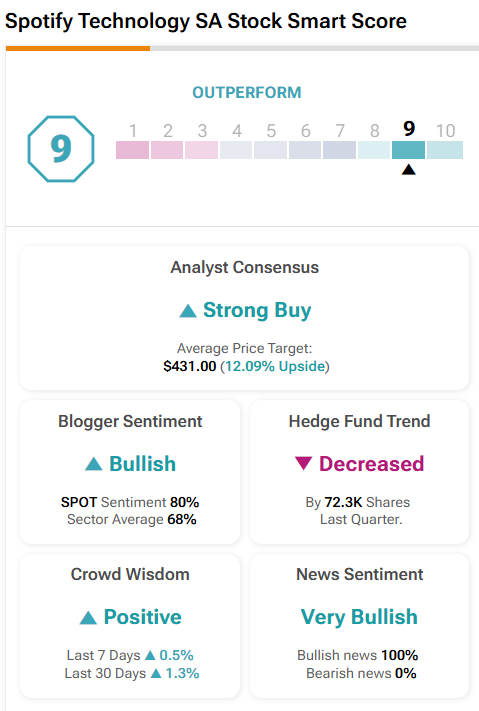

As Spotify prepares to release its Q3 earnings report scheduled for Nov. 12, investors and musicians are tuning in to see how the streaming company continues to play the right chords. According to Tipranks’ Smart Score, there’s no doubt it will, with the stock considered to Outperform with a 9 out of 10 rating.

The last four quarters have been successful, with increased revenue and EPS growth. However, one thing is still hanging above the company’s shoulders – its lofty valuation. With ever-growing competition from Apple Music (AAPL) and YouTube Music, owned by Alphabet (GOOGL), it leaves hardly any margin for error.

If you wish to read more about Spotify, you can see what our writer at Tipranks, Marc Guberti, says about SPOT stock right here.

Now, let’s briefly examine what Spotify has achieved in the last quarter and what to expect in the coming earnings call.

- Spotify’s Growth and Valuation: This year was marked by significant subscriber growth in Spotify’s books. Monthly growth in active users and paid subscribers is encouraging, with Spotify reaching 246 million premium subscribers, a 12% year-over-year increase, and 626 million monthly active users, a 14% increase. However, the company’s high price-to-earnings ratio (P/E) of 149.5x leaves no margin of error. As mentioned above, increased competition could present challenges impacting its future trajectory.

- Innovations and User Engagement: Spotify is experimenting with AI-driven playlists that allow users to create song lists by typing prompts. This feature could enhance user engagement and retention. Again, Spotify doesn’t purely move to the sound of music; it’s becoming a platform for podcasts and audiobooks, featuring over 250,000 podcasts, the most known of which is “The Joe Rogan Experience.”

- Future Outlook: SPOT’s share price has seen impressive revenue, doubling year-to-date, and we go even further; we see it tripling over the past five years, driven by a steady increase in subscribers. The greatest challenge is continuity. Nevertheless, Spotify’s Q3 2024 outlook is promising, with projections of 639 million monthly active users and 251 million premium subscribers, reflecting quarter-over-quarter growth rates of 2%. The company expects total revenue to reach €4 billion, a 19.2% year-over-year growth rate, similar to the 19.8% growth in Q2. Spotify’s net income growth has consistently outpaced revenue growth, with a 7.2% net profit margin in Q2.

What Is the Price Target for SPOT?

Analysts say Spotify is a Strong Buy, with 13 Buys, One Hold, and Zero Sells. The average price target for SPOT stock is $431, reflecting 12.09% upside.

The Final Word on SPOT

Spotify is the biggest music streaming company for monthly paid subscribers, beating Apple Music, YouTube Music, and everyone else. The company keeps growing and increasing its margins, but its overblown valuation is still a worry and could pose a problem going forward. However, expectations are high for the coming earnings call, with investors eager to see if Spotify can continue its impressive growth while addressing concerns about its high valuation.