Normally, the time to discuss toy sales was a month or two ago during the holiday shopping season. However, a huge new toy purchase arrived only recently, and for Canadian toy giant Spin Master (TSE:TOY), it was the kind of toy buy that left shareholders concerned. Concerned enough, in fact, to send shares down nearly 2% in Wednesday afternoon’s trading.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The buy in question, valued at US$950 million, featured Spin Master picking up early childhood toy brand Melissa & Doug. Melissa & Doug, based on its website’s offerings, focuses on imaginative play, though not particularly branded. Items like the Fresh Mart Grocery Store and the 100-Piece Wood Blocks Set make it clear that Melissa & Doug toys aren’t the loudest, flashiest toys based on the latest kids’ movie blockbuster. Still, this gives Spin Master an exciting new component in the children’s market and offers new and significant potential for future profit, as toys are still a big seller, even if not as big as they were in the past.

A Dark Market for Toys Right Now

So, here’s the thing: this is not a great toy market right now. We just came off of prime time for toy season: the holiday shopping season that featured Christmas, Hanukkah, and Kwanzaa all under one roof. In fact, the fourth quarter typically accounts for 70% of all toy sales, and right now, the market is looking for a late-season boost, complete with new discounts and marketing. But with toy sales already down 9% going into the holiday shopping season, it’s not looking good, especially as toy buyers work to keep food on the table amid soaring inflation.

Thus, Spin Master dropping nearly a billion bucks on toys may not seem like a great investment. At least, not right now. Spin Master did get a bit of a discount—Melissa & Doug agreed to drop some contingent earnout pay—but under the circumstances, perhaps not enough of one.

Is Spin Master a Good Stock to Buy?

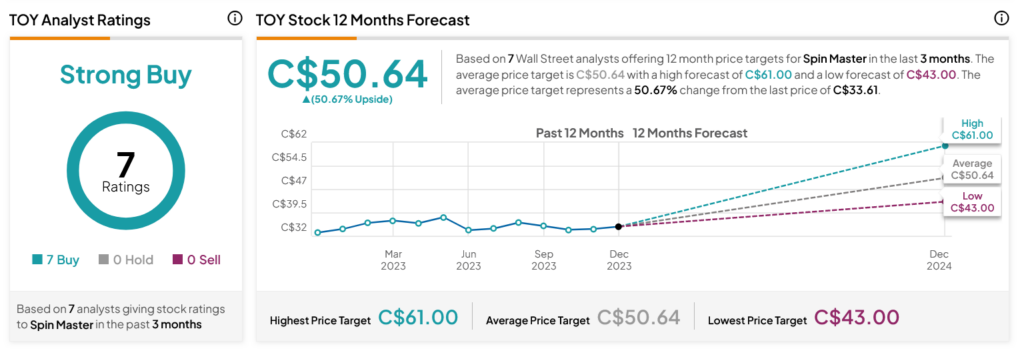

Turning to Wall Street, analysts have a Strong Buy consensus rating on TOY stock based on seven Buys assigned in the past three months, as indicated by the graphic below. After seeing little change in its share price over the past year, the average TOY price target of C$50.64 per share implies 50.67% upside potential.