Global renewable energy company SPI Energy Co., Ltd. (NASDAQ: SPI) recently announced plans to upgrade its manufacturing facility in Sacramento, CA. The company’s solar manufacturing division will carry out the work.

TipRanks Cyber Monday Sale

- Claim 60% off TipRanks Premium for data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

Following the news, shares of the company declined 1.5% to close at $3.33 on Friday.

The definitive agreement signed by the company’s solar manufacturing division entails upgrading the California facility with the latest technology and increasing the existing solar module manufacturing capacity to 1.1 GW by the second half of 2022.

CEO’s Comments

The CEO of SPI Energy, Xiaofeng Denton Peng, said, “The state-of-the-art solar module manufacturing facility, which combines California’s highly skilled workers with machine-to-machine connectivity, will feature a high degree of precision automation and continuous improvement for manufacturing PV modules.”

Price Target

The stock has a Moderate Buy consensus rating based on 1 Buy. Three months ago, Maxim Group analyst Tate Sullivan reiterated a Buy rating on the stock with a price target of $12 (260.4% upside potential). Shares of the company have declined 64.3% over the past year.

Negative Sentiment

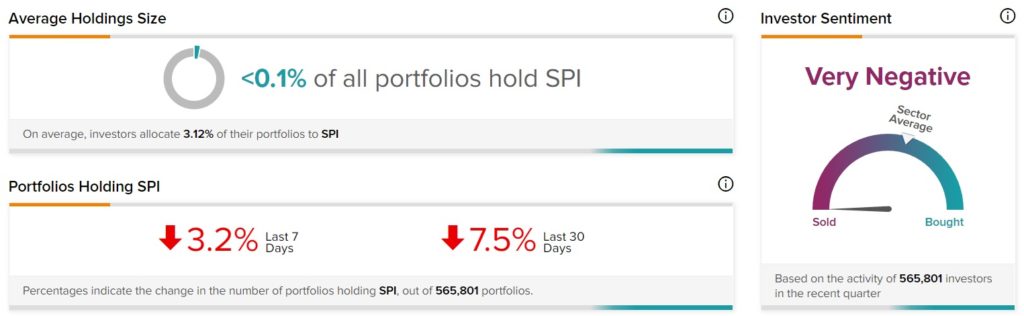

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on SPI, as 7.5% of portfolios tracked by TipRanks decreased their exposure to SPI stock over the past 30 days.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Yamana’s Q4 Earnings Exceed Estimates on Higher Gold Production

Amazon and Reliance Fight for Indian Cricket League Media Rights – Report

Aon Raises Share Buyback Authority to $9.2B, Hikes Dividend