Shares of Southwest Airlines (LUV) declined in trading on Tuesday after the airline major announced that Executive Chairman and former CEO Gary Kelly will retire next year, alongside a major board shake-up. The airline’s decisions come amidst increasing pressure from activist investor Elliott Investment Management. Paul Singer-led Elliott is one of the biggest activist hedge funds globally, with over $70 billion in assets under management.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

In a letter to shareholders, Kelly emphasized the need for change, stating, “Now is the time for change. It’s time to shake things up, not just stir them a bit. The wisdom comes in knowing what to change and what not to change.”

Kelly Announces Retirement after Meeting with Elliott

Kelly, who has been with Southwest for nearly forty years and has served as chairman since 2008, revealed his retirement plans shortly after a meeting with Elliott. The activist investor has been pushing for leadership changes at the airline. Elliott disclosed a nearly $2 billion stake in Southwest earlier this year. Furthermore, the investment management firm criticized the company’s “stunning underperformance” under its current leadership, including CEO Bob Jordan.

In response, Kelly assured that the board and leadership “unanimously support Bob Jordan as CEO.” He also announced that six board members will retire in November, with plans to appoint four new independent directors, potentially including up to three of Elliott’s candidates.

Adding to the pressure, Elliott recently crossed the 10% threshold required to call a special meeting.

Southwest’s Response to the Activist Investor

In response to the mounting pressure, Southwest Airlines announced a series of strategic changes in July to boost its revenue and overall performance. These changes included offering assigned seats, extra legroom, and introducing overnight flights. The company will further outline these changes at its investor day on September 26.

Is LUV a Good Buy Now?

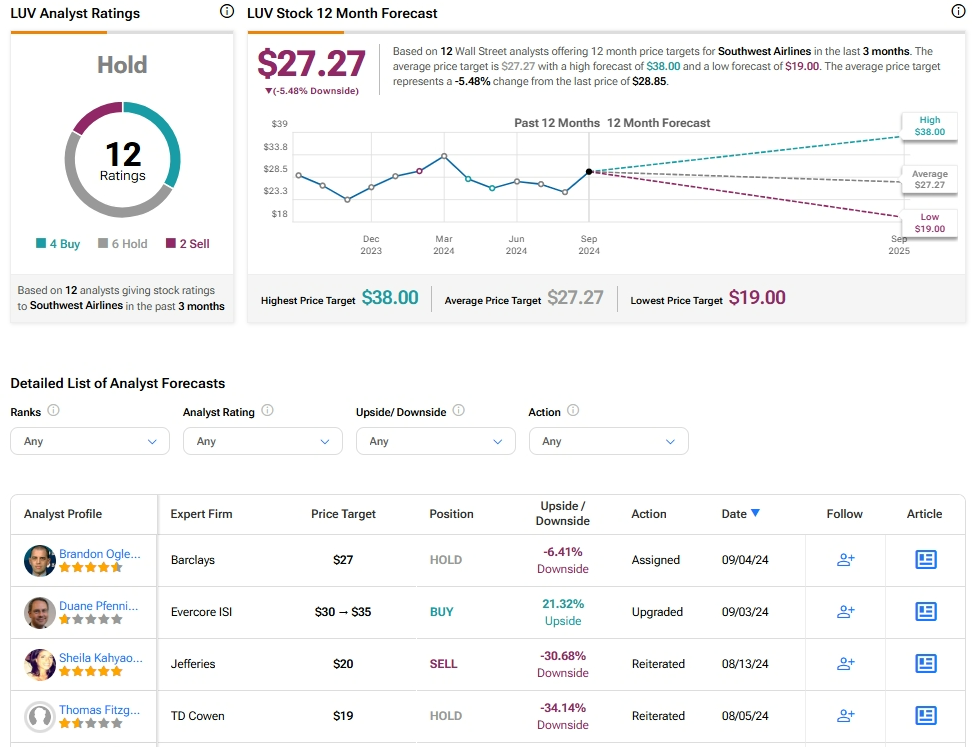

Analysts remain sidelined about Ford stock, with a Hold consensus rating based on four Buys, six Holds, and two Sells. Year-to-date, LUV has inched by 1.7%, and the average LUV price target of $27.27 implies a downside potential of 5.5% from current levels.