Audio product manufacturer Sonos (NASDAQ:SONO) has made sweet music with its innovative wireless, portable home theater speakers and accessories. Nevertheless, like many direct-to-consumer technology companies, it has experienced challenging times and a significant slowdown in its revenue growth, influenced by factors such as higher interest rates, overcapacity in the consumer tech market, and a drop in discretionary spending.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The stock has fallen close to 15% so far this year. Yet, the company holds a solid position in a substantial market, and its brand possesses a robust foundation for future growth. Investors may want to wait and revisit this one when consumer discretionary spending recovers.

Sonos Branches Out

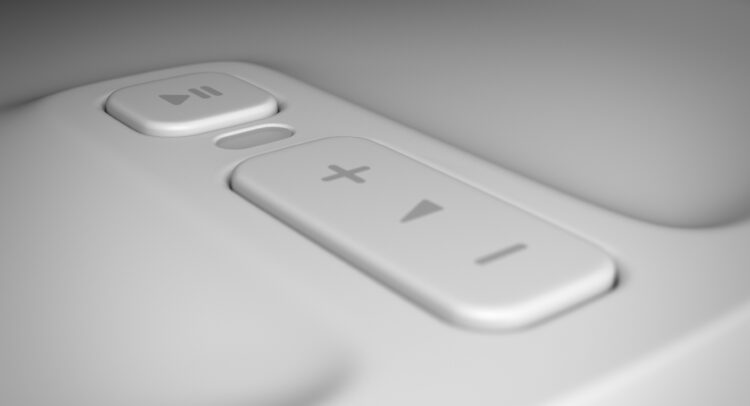

Sonos and its subsidiaries design, develop, manufacture, and sell audio products and services. The company delivers its products worldwide, spanning the Americas, Europe, the Middle East, Africa, and the Asia Pacific, utilizing various distribution methods. These include around 10,000 third-party retail locations, home audio system custom installers, e-commerce retailers, and its own website.

The company experienced strong sales during COVID-19 but has since seen a period of stagnation. In response, it has branched into new product categories, notably wireless over-ear headphones. The launch was delayed a few months due to technical difficulties. Still, the new initiative is predicted to stimulate growth despite competition from established brands like Apple (AAPL), Sony Group (SONY), and Bose.

Sonos’ Financial Results and Outlook

Sonos recently released its Q2 2024 financial performance. The company reported revenue of $252.66 million, exceeding analysts’ expectations of $247.41. Gross margin was 44.3%, while the non-GAAP net loss was $42.1 million. The non-GAAP diluted EPS was -$0.34, surpassing consensus estimates of -$0.46.

Management has issued guidance for 2024. Projected revenue is between $1.6 billion to $1.7 billion, marking a potential year-over-year change from -3% to 3%. Gross margin estimates range from 45% to 46%, while non-GAAP margins, after adjustments, are expected to be slightly higher, ranging from 45.4% to 46.4%. Adjusted EBITDA is projected at $150 million to $180 million.

What Is the Price Target for SONO Stock?

The stock has been volatile over the past year and is down 14%. It trades near the middle of its 52-week price range of $9.78 – $19.76 and shows ongoing negative price momentum, trading below its 20-day (14.90) and 50-day (15.72) moving averages. The shares appear undervalued based on their P/S ratio of 1.2x, which sits well below the Consumer Electronics industry average of 4.9x.

Analysts following the company have been bullish on the stock. Based on their recommendations and price targets, Sonos is rated a Moderate Buy. The average price target for SONO stock is $25.00, representing a potential upside of 72.89% from current levels.

Sonos in Summary

Despite the recent challenging environment, Sonos’s robust brand position and wide-ranging product and service offerings, including its venture into wireless over-ear headphones, lay a solid foundation for future expansion. The stock trades at a discount, offering an enticing prospect for investors searching for undervalued opportunities in the consumer electronics space. However, waiting for a turn in the macroenvironment might be a wise move.