Audio products maker Sonos (NASDAQ:SONO) launched its first-ever headphones, Sonos Ace, to accelerate growth. This marks the company’s entry into the personal listening category, which is much larger than the wireless audio speaker market.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

It’s worth noting that the company’s highly anticipated headphones are debuting at a time when the audio market is struggling with lower demand and sales.

New Products to Support Growth

While the broader audio products market is under pressure, Sonos focuses on launching multiple products to capture a higher market share. The launch of new products and an eventual recovery in the consumer electronics market will likely accelerate its growth rate and support margin expansion.

It’s worth highlighting that Sonos currently has just 2% of the $100 billion global audio market, presenting a significant opportunity for growth. However, its foray into the headphones market now puts it against large competitors like Apple (NASDAQ:AAPL) and Sony (NYSE:SONY).

Sonos delivered revenue of $866 million in the first half of the current fiscal year, reflecting a decline of 11% year-over-year. However, the company’s management remains upbeat and expects its full-year sales to stay roughly flat, implying an acceleration in its growth rate in the second half of the year. Management’s optimism stems from the rollout of new products, which will drive significant growth.

Is Sonos a Good Stock to Buy?

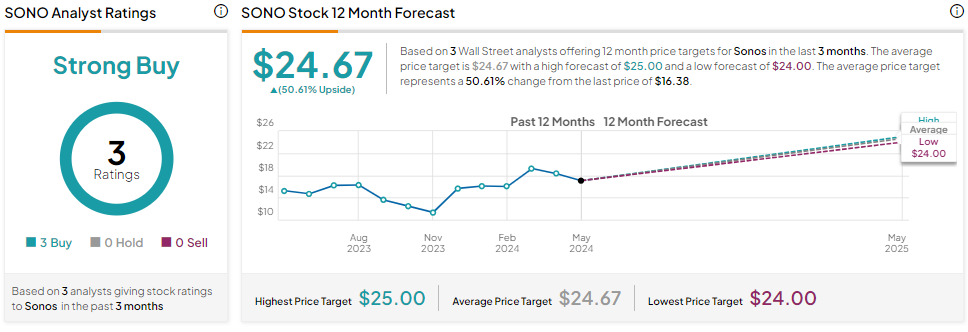

Sonos stock is down about 4.4% year-to-date. Nonetheless, Wall Street analysts are upbeat about its prospects.

Sonos stock has three unanimous Buy recommendations for a Strong Buy consensus rating. Analysts’ average price target on SONO stock is $24.67, implying 50.61% upside potential from current levels.