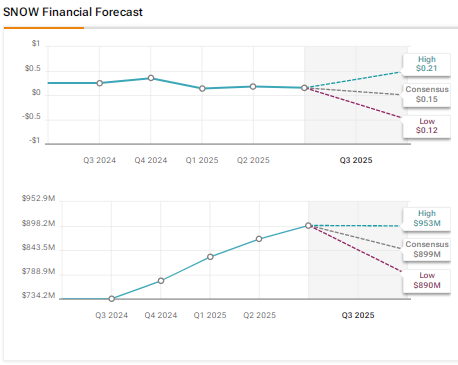

Cloud-based data warehousing and analytics company Snowflake (SNOW) is scheduled to announce its results for the third quarter of Fiscal 2025 after the market closes on November 20. Shares are down 36% year-to-date amid concerns over profitability, decelerating product revenue growth, and intense competition from private player Databricks. Analysts expect SNOW’s Q3 FY25 revenue to grow by more than 22% year-over-year to $899.3 million, but adjusted EPS (earnings per share) to decline by about 40% to $0.15 per share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

While Snowflake’s Q3 revenue is projected to gain from the demand for the company’s innovative offerings and artificial intelligence (AI)-capabilities, the bottom line is expected to be impacted by higher costs and growth investments.

Analysts’ Views Ahead of Snowflake’s Q3 FY25 Results

Ahead of the Q3 FY25 results, Citigroup analyst Tyler Radke lowered his price target for SNOW stock to $183 from $200 to reflect slightly lower estimates for Fiscal 2026. That said, Radke maintained a Buy rating on the stock. He expects the company to deliver “solid” Q3 results and surpass product revenue estimates by 2% to 3%.

Moreover, Radka expects Snowflake to raise its implied Q4 guidance, thanks to continued hyperscaler stabilization commentary and fewer headwinds for the company’s Iceberg storage offering. He added that the intra-quarter checks revealed mixed aspects, with positives like larger customer ramps and higher uptake of generative AI products, such as Cortex, offset by negatives like growing competition and worsening win rates.

To conclude, while the near-term catalyst path for SNOW stock looks mixed, Radke thinks that current levels offer a good entry point ahead of stabilizing growth and a generative AI product cycle under the leadership of CEO Sridhar Ramaswamy.

Meanwhile, Goldman Sachs analyst Kash Rangan reaffirmed a “Conviction Buy” rating on SNOW stock with a price target of $220. Rangan thinks that the Q3 results could be a potential positive catalyst for the stock if Snowflake delivers a 3% to 4% product revenue beat and issues 21% to 22% growth guidance for Fiscal Q4 product revenue.

Options Traders Anticipate a Major Move

TipRanks’ Options tool offers a quick way to gauge what options traders anticipate from the stock following its earnings report. The expected earnings move is calculated using the at-the-money straddle of the options set to expire closest to the announcement. While this may sound complex, the tool handles the calculations for you.

Currently, it indicates that options traders are predicting about an 11.4% swing in either direction in SNOW stock.

Is Snowflake a Good Stock a Buy?

Overall, Wall Street is cautiously optimistic on Snowflake stock due to near-term pressures. The stock earns a Moderate Buy consensus rating based on 24 Buys and 10 Holds. The average SNOW stock price target of $166.24 implies 30.5% upside potential from current levels.