Despite a 10% increase in daily active users for FY 2023, Snap’s (NYSE:SNAP) user growth has remained relatively small. It remained stagnant compared to the previous quarter and has primarily attracted younger users. In 2023, Snap’s revenue of $1.36 billion failed to meet revenue expectations of $1.38 billion. The company’s projections for the first quarter reveal a slight increase in users, exceeding expectations, but only a modest rise in revenue, falling short of anticipated growth.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Recent efforts to diversify, including new projects like Snap Spectacles and the Pixy drone, have not been very successful. Given SNAP’s modest user growth and underwhelming guidance, my stance on the stock is neutral at present.

On a brighter note, Snapchat+ has reached seven million subscribers, achieving an annualized revenue run rate of $249 million in 2023. However, Snap’s foray into AI technology remains in the early stages and faces stiff competition in the AI market.

Confidence in SNAP Weakens

Snap Inc. has faced a tough quarter. Last month, the social media giant felt compelled to make major workforce cuts. In addition, the company suffered a sharp decline in its stock price after missing its fourth-quarter earnings goal. The layoffs, which affected about 10% of its staff, incurred over 500 job losses.

The workforce reduction, part of a strategy aimed at fostering growth, is in addition to last year’s 20% staff reduction. The move is expected to result in $55 million to $75 million in pre-tax charges, mostly in severance costs.

Other efforts to diversify revenue beyond digital advertising, including the AR Enterprise Services (ARES) division, haven’t been prosperous. Although the company launched ARES last March, it was closed by September, leading to around 170 layoffs. CEO Evan Spiegel stated that the division’s closure was due to the high investment required and intense competition in generative AI.

Snap’s challenging experience with outside ventures has prompted the company to shift back to focusing on its core ad business. As mentioned earlier, hardware ventures like Snap Spectacles and the Pixy drone have had issues. The Pixy drones were eventually recalled due to fire risks, and the product line was later discontinued. The issues that surround Snap’s hardware product lines reflect its struggles in diversifying beyond social media.

These efforts reveal a company beset by operational challenges and intense market competition. It faces considerable hurdles in achieving sustainable growth and diversifying its revenue sources. The Pixy drone problem aptly illustrates Snap’s difficulties in branching out into new product areas.

Analyzing Snap’s Performance: Growth, Losses, and User Trends

Looking forward, Snap projects its first-quarter 2024 revenue to be between $1.095 billion and $1.135 billion, essentially in line with analyst estimates. However, the company anticipates adjusted EBITDA losses to range from $55 million to $95 million, which exceeds Wall Street’s expectation of a $32.7 million loss.

The timing of these losses is not helpful. Snap expects to face $55 million to $75 million in costs related to its recent layoffs. Despite these challenges, the company managed to improve its financial position in the fourth quarter. Under GAAP, it reduced its net loss by 14% year-over-year, indicating a narrowing of negative earnings. Simultaneously, on a non-GAAP basis, it outperformed expectations in terms of earnings per share (EPS), posting $0.08 EPS against a consensus estimate of $0.06.

Still, Snap is confronting a concerning trend — the disparity between its increasing daily active users and falling average revenue per user (ARPU). Although the number of daily users on Snap grew by 10% to 414 million, its ARPU decreased by 5%. The trend is not an isolated incident but a pattern that has been consistent over seven quarters. A declining ARPU suggests that merely expanding the user base may not be adequate to drive revenue growth.

Meanwhile, Snap’s user demographic is skewing younger, exacerbating concerns about public advertising to minors. If calls for regulating social media continue to gain traction, this issue could become more pronounced in the future.

Is SNAP Stock a Buy, According to Analysts?

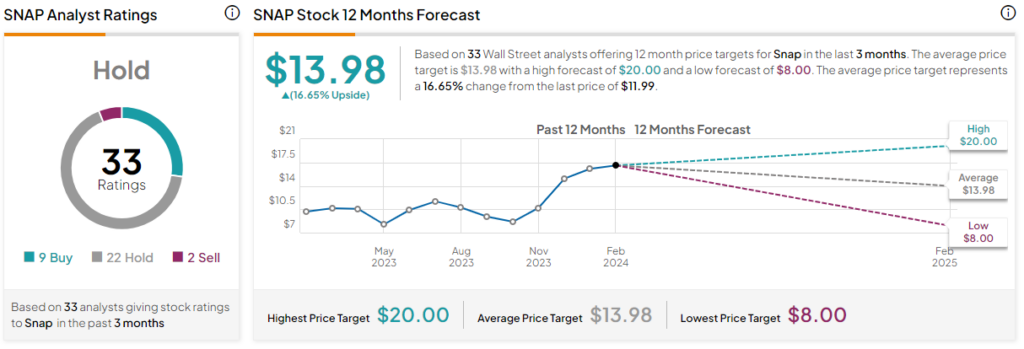

According to TipRanks, SNAP is currently rated as a Hold based on nine Buys, 22 Hold, and two Sell ratings from financial analysts over the past three months. The average price target for SNAP stock is set at $13.98, implying 16.65% upside from its last price. These analyst price targets vary, ranging from a low of $8.00 per share to a high of $20.00 per share.

Final Insight on SNAP

The recent stock price decrease reflects investors’ concerns, as SNAP’s revenue isn’t matching the pace of its expanding user base. Steadily declining quarterly net losses paint a picture of gradual recovery, yet the company struggles to increase revenue in proportion to its expanding user base. Given these mixed financial indicators, SNAP’s price outlook appears poised to remain stagnant in the near term.