Shares of Snap (NYSE:SNAP) tanked in after-hours trading after the social media giant reported a second-quarter adjusted profit of $0.02 per share on revenue of $1.24 billion. This was in line with analysts’ EPS expectations but missed revenue estimates of $1.25 billion.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

These results are an improvement from the same quarter of last year, which can be attributed to growing advertising sales and an expanding user base on its Snapchat platform.

Furthermore, Snap’s advertising platform saw the number of active advertisers more than double year-over-year, while daily active users (DAUs) reached 432 million, up 9% from last year. The company has also been successful in diversifying its income streams, as its Snapchat+ subscription service has grown to over 11 million members.

Looking ahead to the third quarter, Snap anticipates revenue to come in between $1,335 million and $1,375 million. This represents a 12% to 16% growth year-over-year and misses the consensus estimate of $1.361 billion at the midpoint of the guidance range ($1,355 million). The company also projects an adjusted EBITDA of between $70 million and $100 million.

Is SNAP a Buy or Hold?

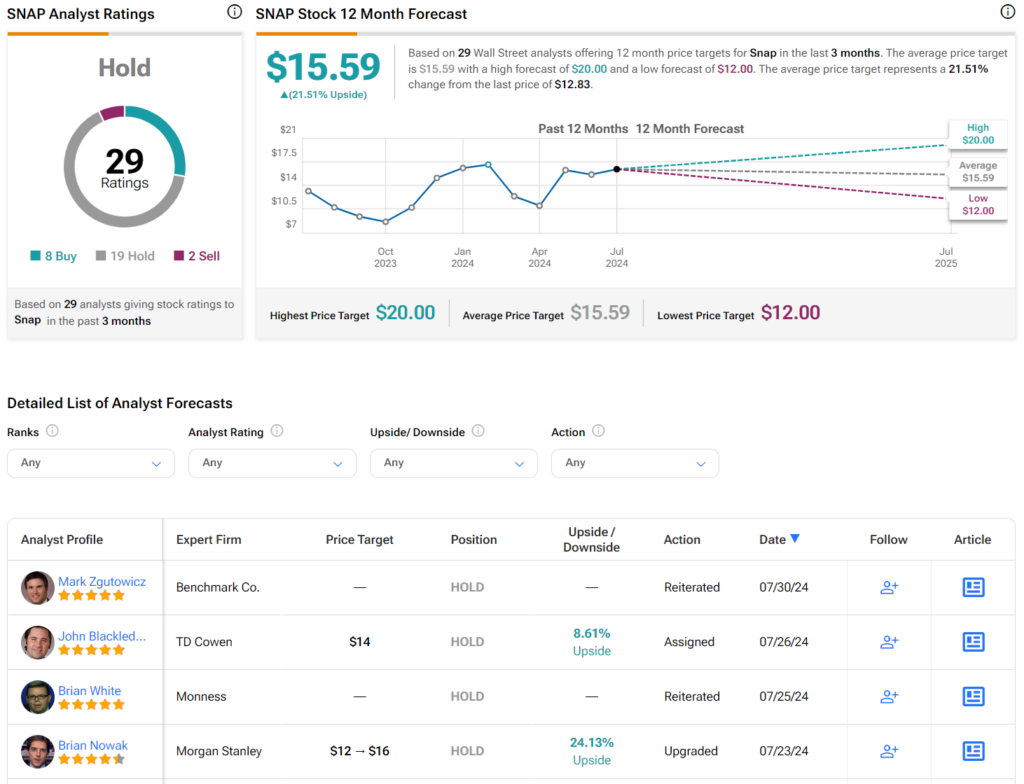

Turning to Wall Street, analysts have a Hold consensus rating on SNAP stock based on eight Buys, 19 Holds, and two Sells assigned in the past three months, as indicated by the graphic below. After a 17% rally in its share price over the past year, the average SNAP price target of $15.59 per share implies 21.51% upside potential. However, it’s worth noting that estimates will change following today’s earnings report.