Snap’s (SNAP) CEO, Evan Spiegel, strives to grow the social media company’s advertising business in a bid to revive the stock, which has collapsed nearly 48% so far this year. In a letter to employees yesterday, Speigel addressed the need to grow the company’s advertising revenues as it continues to lag rivals. Snap competes with social media giants such as Meta Platforms’ (META) Instagram and TikTok, which have relatively larger advertising businesses.

Spiegel is also shifting focus toward developing augmented reality (AR) and smart glasses to boost revenues. SNAP shares fell 5.1% yesterday as part of the broader tech sell-off.

Spiegel Aims to Boost Snap’s Ad Business

Spiegel believes that SNAP stock has underperformed due to the company’s lagging advertising business. He stated that Snap will test two types of ad placements, called Sponsored Snaps and Promoted Places. These ad experiments will be powered by machine learning and automation.

Sponsored Snaps will appear directly within the chat inbox as a new Snap and users will have the option to open or ignore it. This will enable advertisers to effectively target prospective customers and initiate conversations with an in-message call-to-action. Meanwhile, Promoted Places will place the ad on the user’s Snap Map to drive higher reach.

Spiegel is also launching the next generation of Snap’s AR-powered smart glasses, Spectacles. This product was was earlier launched in 2016 but found no success. This time around, Spiegel is confident that the glasses will find a larger customer base.

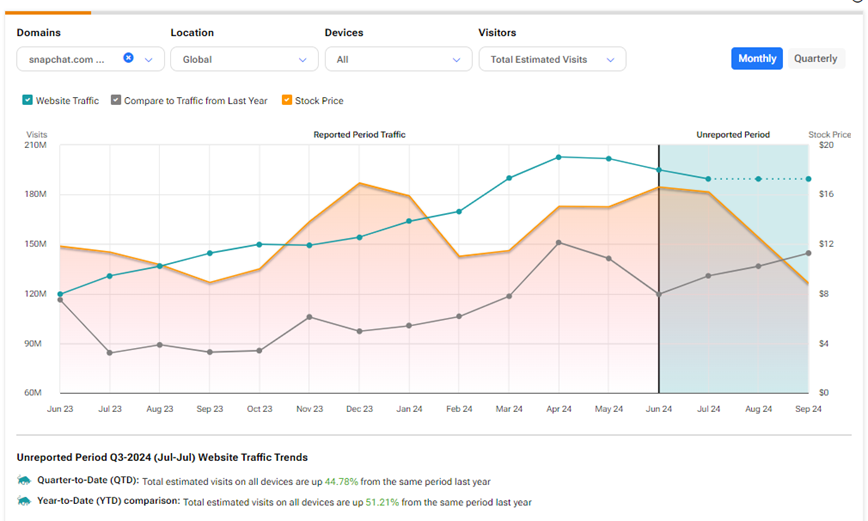

Website Traffic Hints at Snap’s Growing Business

Despite Snap’s dismal financial performance, its website traffic trend hints at a growing business. According to TipRanks’ Website Traffic tool, the total estimated visits to all of Snap’s apps and websites worldwide increased by an impressive 51.21% in the year-to-date period compared to last year.

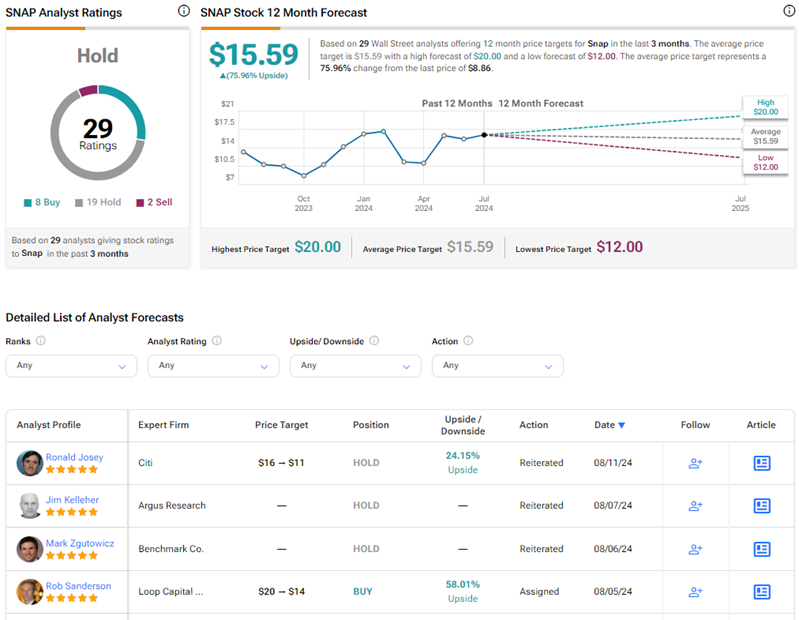

Is SNAP a Good Stock to Buy?

Wall Street remains unimpressed by Snap’s performance and prefers to be on the sidelines. On TipRanks, SNAP stock has a Hold consensus rating based on eight Buys, 19 Holds, and two Sell ratings. Also, the average Snap price target of $15.59 implies a nearly 76% upside potential from current levels.