JetBlue Airways (JBLU) seems caught in an “air pocket” but demonstrates great resilience to get back into smooth aviation. Despite setbacks from an unsuccessful merger with Spirit Airlines (SAVE) and fluctuations in domestic fares, JetBlue is poised for an ambitious transformation. The company aims at an incremental EBIT uplift of $800 to $900 million by 2027.

However, the airline’s future also seems dependent on inconsistent elements such as domestic airline demand and the unpredictable fortunes of shareholder activism, embodied by the brief interlude with billionaire investor Carl Icahn earlier in the year.

Shares are down over 14% since the company announced top-and-bottom-line beats for Q2, with management’s projections for decreasing revenue in the near future. JetBlue’s strategic initiatives could be pivotal on its journey to profitability, but investors may want to see more progress before considering taking a position.

JetBlue’s JetForward Strategy

JetBlue Airways is a leading low-cost airline with key hubs in Boston and JFK. The company operates a diverse fleet of Airbus and Embraer aircraft and serves a hundred destinations across the U.S., the Caribbean, Latin America, Canada, and Europe. Each year, it serves more than 30 million customers.

The company has announced its “JetForward” strategy to enhance its financial performance. It has outlined four strategic initiatives, which it hopes will collectively yield an incremental EBIT of $800M —$900M between 2025 and 2027.

The first initiative revolves around improving on-time performance and delivering superior customer service through investments in advanced tools and technology. Secondly, JetBlue is reorienting its network to concentrate on leisure flying, with recent additions like Manchester and New Hampshire indicating this shift. The third strategy is to enhance its product offerings and loyalty benefits to attract customers seeking high-quality, premium experiences.

Finally, the company intends to secure its financial future by sustaining its cost advantage through a transformation program, re-balancing its balance sheet through capital discipline, and conceiving an incremental aircraft deferral of about $3 billion of planned capital expenditures.

Taking initial steps in executing the strategy, the company has refocused its operations on profitable routes, primarily in New York, New England, Florida, and Puerto Rico, while withdrawing from less financially successful routes and destinations.

JetBlue’s Recent Financial Results & Outlook

The company’s second-quarter financial performance of 2024 surpassed analysts’ expectations. Revenue of $2.43 billion exceeded consensus projections of $2.40 billion. The company’s operating income of $2.4 billion decreased 6.9% year-over-year, and the operating expense per available seat mile (CASM) increased 2.6% year-over-year. The average fuel price during the quarter was $2.87 per gallon. The company reported earnings per share of $0.08, defying the analysts’ prediction of -$0.11.

Management has offered guidance for Q3 and FY 2024. This is supported by $300 million in revenue initiatives and core geographies’ ongoing normalization of competitive capacity. Estimates for the third quarter and full year of 2024 show a decrease in ‘Available Seat Miles’ (ASMs) and revenue compared to the previous year, but an increase in CASM Ex-Fuel. The fuel price per gallon is expected to be between $2.82 and $2.97 for 3Q 2024 and $2.80 to $3.00 for FY 2024. Capital expenditures are estimated at around $365 million in 3Q 2024 and approximately $1.6 billion for FY 2024.

What Is the Price Target for JBLU Stock?

The stock has been volatile, with a beta of 1.31, as it has traveled a downward trajectory, shedding over 63% in the past three years. It trades near the middle of its 52-week price range of $3.42 – $7.58 and shows negative price momentum, trading below the 20-day (6.01) and 50-day (5.96) moving averages. The stock appears slightly undervalued, with a P/S ratio of 0.2x compared to the Airline industry average of 0.4x.

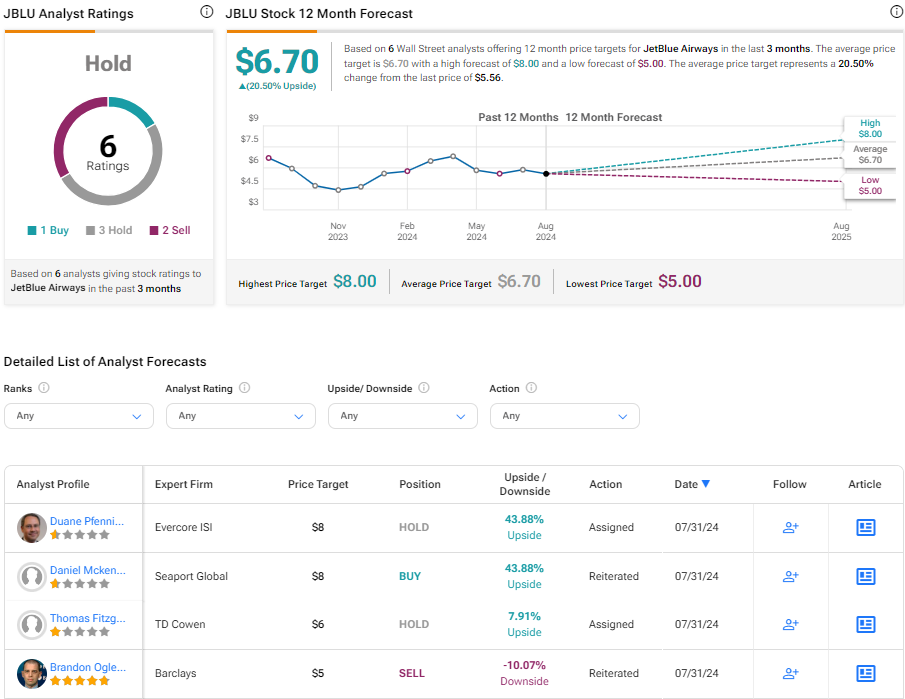

Analysts following the company have mostly taken a cautious stance on the stock. For instance, TD Cowen analyst Thomas Fitzgerald recently raised the price target on the shares from $4 to $6 while maintaining a Hold rating, noting the firm’s JetForward strategic plan.

JetBlue Airways is rated a Hold overall, based on the six analysts’ recommendations and price targets. The average price target for JBLU stock is $6.70, representing a potential 20.50% upside from current levels.

Bottom Line on JetBlue

Despite recent setbacks and market fluctuations, JetBlue is transforming its operations. Despite a drop in shares following the Q2 financial revelations, steps taken towards rebalancing the balance sheet, concentrating on leisure traveling, and enhancing customer experiences look promising for the airline’s future. However, these proactive initiatives are set against uncertain domestic demand. Investors may want to track JetBlue’s transformation as a journey worth considering.