Humacyte (HUMA), a biotech firm specializing in creating bioengineered human tissues, is awaiting FDA approval for its potentially groundbreaking treatment, the Acellular Tissue Engineered Vessel (ATEV). In recognition of its significance, the FDA had previously awarded Humacyte with a regenerative medicine advanced therapy (RMAT) designation for three indications, including vascular trauma repair, arteriovenous access for hemodialysis, and peripheral arterial disease.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

However, the FDA just announced that it will need additional time for the Biologics License Application (BLA) review for ATEV, and the company’s stock has fallen 25% in the aftermath. Yet, Humacyte remains optimistic about the treatment’s ultimate approval based on its ongoing communication with the FDA. The sell-off may be overdone, as this may prove to be a minor delay in bringing a game-changing treatment to market, presenting investors with a buy-on-the-dip opportunity.

Humacyte’s Promising Lead Treatment Candidate

Humacyte is a biotechnology firm developing novel acellular human tissue and organ technologies. Among its clinical-stage pipeline of potential treatments are human acellular vessels (HAVs), which are currently in late-stage clinical trials for various vascular applications. The HAVs were the first product to receive the FDA’s RMAT expedited review and received priority designation from the Secretary of Defense for vascular trauma treatment.

Recently, the FDA extended the review time for the BLV for the ATEV’s use in vascular trauma treatment. Yet, positive preliminary results were reported from a Phase 3 clinical trial for the ATEV regarding its application in arteriovenous (AV) access for hemodialysis patients. Additionally, the FDA awarded a third RMAT designation to the ATEV for use with advanced peripheral artery disease (PAD) patients.

HUMA’s management has reiterated confidence in ATEV’s broad applicability across multiple indications and expects FDA approval. The company is gearing up for a planned U.S. launch, having established a multidisciplinary program to achieve launch readiness. This includes procuring four new ICD-10 codes from the Centers for Medicare and Medicaid Services and appointing Morgan Rankin, a former VP of Sales at Teleflex Medical, to lead the commercial launch efforts.

Analysis of Humacyte’s Recent Financial Results

The company recently reported financial results for Q2 2024 and recorded zero revenue for this quarter, the same as Q2 2023. Research and development expenses rose to $23.8 million, up from $20.5 million in Q2 2023, due to increased materials and personnel costs to bolster research, development initiatives, and clinical trials.

More so, net expense of $27.2 million increased from the $4 million recorded in Q2 2023. The net loss also increased significantly to $56.7 million from $22.7 million in Q2 2023, while earnings per share (EPS) of -$0.48 fell below the analysts’ forecast of -$0.24.

As of the quarter’s end, the company reported cash and cash equivalents of $93.6 million. It also reported a net cash inflow of $13.1 million for H1 2024, in contrast to a net cash outflow of $35.2 million during H1 2023, mainly due to the receipt of $43 million from a public offering of common stock and $20 million from an additional draw under the funding arrangement with Oberland Capital Management.

What Is the Price Target for HUMA Stock?

Despite the recent inflection in price, the stock has been on an upward trajectory, climbing 111% year-to-date. It trades near the middle of its 52-week price range of $1.96 – $9.97 while demonstrating negative price momentum by trading below its 20-day (7.73) and 50-day (7.05) moving averages.

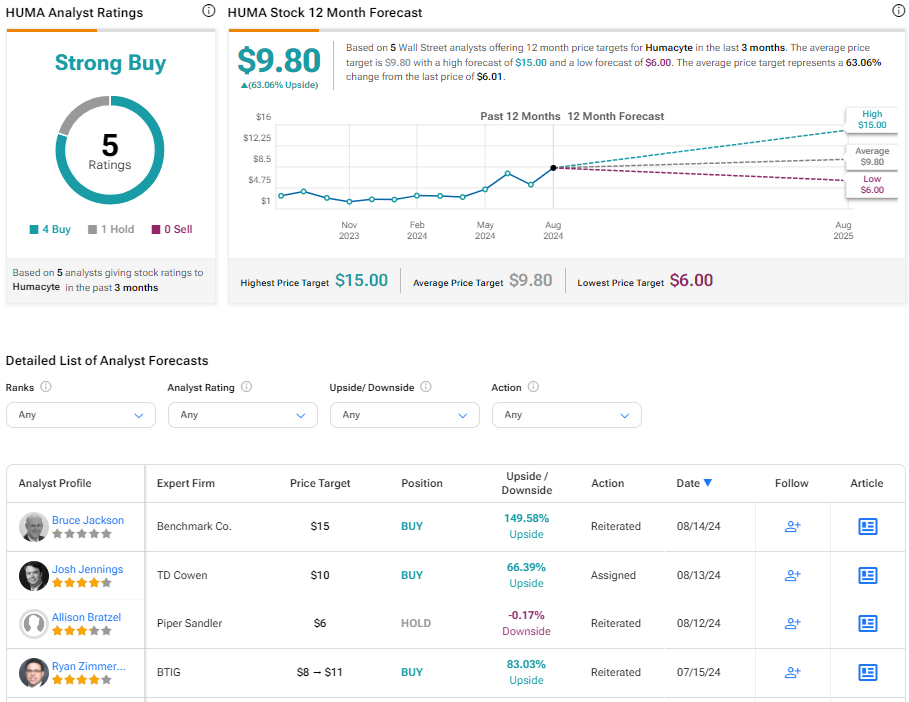

Analysts covering the company remain bullish on the stock, with Benchmark Co. and TD Cowen analysts maintaining Buy ratings on the shares post-FDA announcement. Based on five analysts’ aggregate recommendations and price targets, Humacyte is rated a Strong Buy overall, with an average price target on HUMA stock of $9.80, representing a potential 63.06% upside from current levels.

Final Analysis of HUMA

Humacyte’s potential game-changing treatment in the pipeline makes it a small-cap stock worth investors’ attention. Despite recent setbacks with FDA approval, promising preliminary results from clinical trials, and ongoing communication with regulatory bodies, the company is confident this is nothing more than a minor delay. If so, the stock’s recent decline could provide savvy investors with a buy-on-the-dip opportunity in a promising biotech.