SJW Group (NYSE:SJW) stock seems to be trading at its best buying point in nearly a decade. The California-based regulated water utility has seen its shares undergo a consistent decline in recent quarters, with increased interest rates pressuring equities in the industry. In the meantime, though, the company has been posting robust results, resulting in shares now looking the most attractive they have been in a while. Regardless, I believe that SJW could have further room to fall from its current levels. Thus, I am neutral on the stock.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

What Has Caused SJW Stock to Underperform Recently?

SJW stock has been on a continuous decline since early 2023. In the past year alone, the stock has fallen by 34%, deviating from the S&P 500 (SPX), which has gained by 22% over the same period. This makes for a massive performance gap, as you can see below.

However, SJW is not alone in this. This is a prevailing trend evident across all water utilities, as well as within the broader spectrum of utility sectors during this time frame. The most typical explanation is related to rising interest rates.

During periods of low interest rates, particularly when they hover near zero as they did prior to March 2022, utility stocks tend to rise as investors seek reliable income in a period of a scarcity of attractive fixed-income options. However, with the current upward trajectory of interest rates, the dynamics have shifted. Investors keep divesting from utilities, as alternative fixed-income investments now offer higher returns with reduced risk.

It’s not that there is something wrong with SJW specifically; SJW posted growing revenues and EPS in both 2022 and 2023. It’s the fact that holding shares of a mature water utility with very limited growth prospects and a thin dividend yield makes no sense when the risk-free rate in the market is on the rise. At its all-time high, SJW stock was yielding only 1.7%. With investors now able to earn 5%+ on their cash, you can see why the market keeps dumping SJW stock even now that its yield hovers close to 3.1%.

SJW Continues to Excel Operationally, Nonetheless

Despite the ongoing pressure SJW has faced from interest rate increases, the company has continued to excel operationally. This shouldn’t come as a surprise, as SJW has survived multiple unfavorable market environments, let alone a period of above-average interest rates. This is evident in its legendary dividend growth track record, comprising 56 years of consecutive annual dividend increases.

Indeed, the company continued to expand its revenues in FY2023; revenues grew by 8% to a record $670.4 million. This growth in revenues can be broken down into a $46.6 million gain from rate filings, a $5.7 million gain due to regulatory mechanism adjustments, and a $3.8 million gain from customer growth, offsetting a decline of $6.6 million related to lower customer usage. These numbers also highlight the resilient characteristics attached to water utilities, which are very organic and predictable growth catalysts.

SJW’s profitability also increased last year, even with interest rate expenses impacting its net income. With its A- credit rating ensuring favorable borrowing terms, interest expenses increased by just 14% to $66.1 million. Therefore, SJW had no issue converting its revenue growth into earnings growth. Particularly, SJW’s EPS came in at $2.68 per share, up 15% compared to the previous year.

The Cheapest Valuation in a Decade, But Downside Risk Remains

With SJW managing to maintain earnings growth against a declining share price, the stock’s valuation has plummeted to near decade-lows. Shares are currently trading at a forward P/E of 19x, which is the lowest level this multiple has fallen to in nearly a decade. Given that SJW is a high-quality company operating in a recession-proof industry and the fact that the stock is likely to rebound quickly once rates come down, I believe that its current levels present an attractive entry point.

Nevertheless, I don’t exclude the possibility of the share price continuing to experience notable pressure. Even after such a prolonged share price decline, the remaining income-oriented SJW shareholders could continue ditching the stock over higher-yielding alternatives. Therefore, a degree of downside remains.

Is SJW Stock a Buy, According to Analysts?

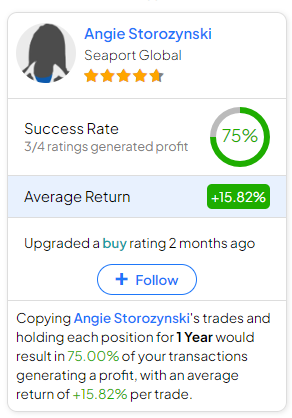

Checking Wall Street’s view on the stock, SJW has a Hold consensus rating based on one Buy and three Holds assigned in the past three months. At $61.54, the average SJW stock price target suggests 17.15% upside potential over the next 12 months.

If you’re wondering which analyst you should follow if you want to buy and sell SJW stock, the most profitable analyst covering the stock (on a one-year timeframe) is Angie Storozynski of Seaport Global, with an average return of 15.82% per rating and a 75% success rate. Click on the image below to learn more.

Final Thoughts on SJW Stock

Overall, it’s important to note that SJW’s wide underperformance recently can be linked to rising interest rates — not worsening financials. In fact, SJW has managed sustained robust revenue and EPS growth, causing the prolonged share price to send its valuation to near-decade lows. In that sense, I believe that shares could be offering an attractive entry point for those looking to hold over the long term.

At the same time, however, the persisting pressure from income-oriented investors seeking higher yields may continue to weigh on its share price. Thus, investors should maintain low expectations.