Bank of America (BAC) is bullish on silver for the year ahead.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Analysts at the U.S. bank say that despite some near-term headwinds, they expect the price of silver to continue rising as global consumption outpaces supply. A stronger U.S. dollar and weak industrial activity have placed pressure on the price of silver in recent months.

Silver’s price has been around $30 an ounce over the last nine months. Silver’s price could experience further downside as president-elect Donald Trump imposes import tariffs on Canada and Mexico, two of the world’s biggest suppliers of the metal that is used for industrial applications and jewelry.

Production Shortfall

Despite the risks, Bank of America analyst Michael Widmer remains positive on the outlook for silver, saying that he expects the price to rise this year as demand outstrips supply. Widmer notes that global consumption of silver has outpaced production of the precious metal every year since 2022.

Bank of America estimates that 37,083 tonnes of silver will be consumed this year, down only about 0.4% from 2024 levels. At the same time, silver output is seen rising 3.5% to 33,021 tonnes. Despite the production growth, the silver market is expected to remain in deficit, underpinning prices.

“Silver won’t lose its luster long-term,” wrote Widmer in his report.

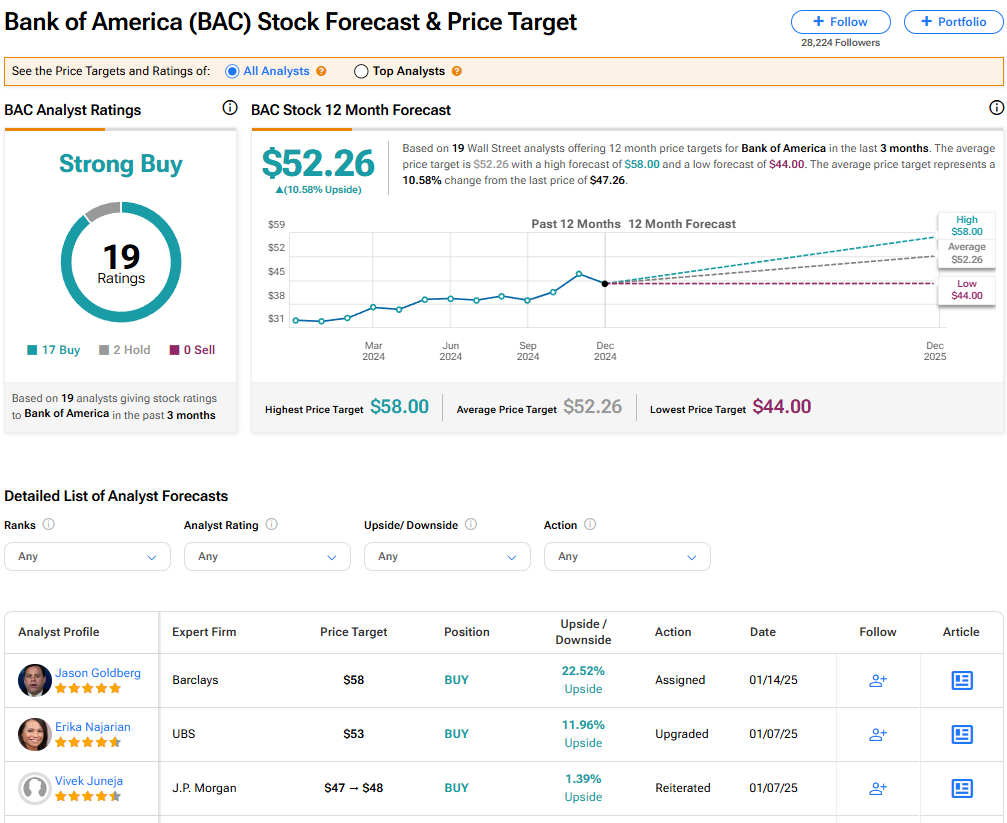

Is BAC Stock a Buy?

The stock of Bank of America has a consensus Strong Buy rating among 19 Wall Street analysts. That rating is based on 17 Buy and Two Hold recommendations assigned in the last three months. The average BAC price target of $52.26 implies 10.58% upside from current levels.