Tesla (TSLA) reported third-quarter earnings that exceeded analysts’ expectations, with an adjusted earnings per share of 0.72 cents, beating analysts’ estimates of 0.58 cents. Despite revenue falling slightly short of projections at $25.18 billion compared to the expected $25.37 billion, the company’s stock surged by roughly 20% on Thursday. Although the stock is premium priced, the company has eased concerns about its profitability through its third-quarter financials and estimations of 20%-30% growth in car sales next year, prompting a renewed belief in TSLA stock and placing my bullish stance on TSLA stock along the way.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Tesla’s Q3 Performance

As mentioned above, one of the main reasons for my bullish sentiment on TSLA stock is its last earnings report, which showcased its strong position in the EV market. The electric vehicle maker’s revenue increased 8% from the $23.35 billion reported in the same quarter the previous year. Net income also rose from $1.85 billion, or 0.53 cents per share, to about $2.17 billion, or 0.62 cents per share.

Tesla’s profit margins benefited from $739 million in automotive regulatory credit revenue, which comes from selling excess credits to other automakers that don’t meet regulatory targets. A margin beat is likely one of the key drivers of why Tesla stock enjoyed a massive post-earnings rally.

“This is clearly an indication that Tesla Chief Executive Elon Musk and company are continuing to focus on its profitability side while balancing its plans for the future,” analysts at Wedbush claimed in their note to clients.

Tesla’s third-quarter vehicle deliveries totaled 462,890, a 6% increase from last year but below analysts’ expectations. The company produced 469,796 electric vehicles as of September 30. Despite previous quarters showing year-over-year declines, Tesla is optimistic about a slight growth in vehicle deliveries in 2024 and plans to launch more affordable models in the first half of 2025.

Bullish Comments From Elon

Another reason Tesla shares rallied is that CEO Elon Musk provided insights on the earnings call about the company’s outlook, predicting vehicle growth of 20% to 30% next year, driven by lower-cost vehicles and autonomous advancements.

This forecast surpasses the 15% increase and 2.04 million deliveries expected by analysts. Musk also highlighted that Tesla aims to introduce driverless ride-hailing services as early as 2025 in Texas and potentially California and mentioned the use of a ride-hailing app by employees in the Bay Area.

Also, Tesla’s Cybertruck has become the third-best-selling fully electric vehicle in the U.S. despite not having sales figures broken down by model. The company achieved a positive gross margin on the Cybertruck for the first time and sold over 16,000 units in the third quarter.

What Analysts Are Saying

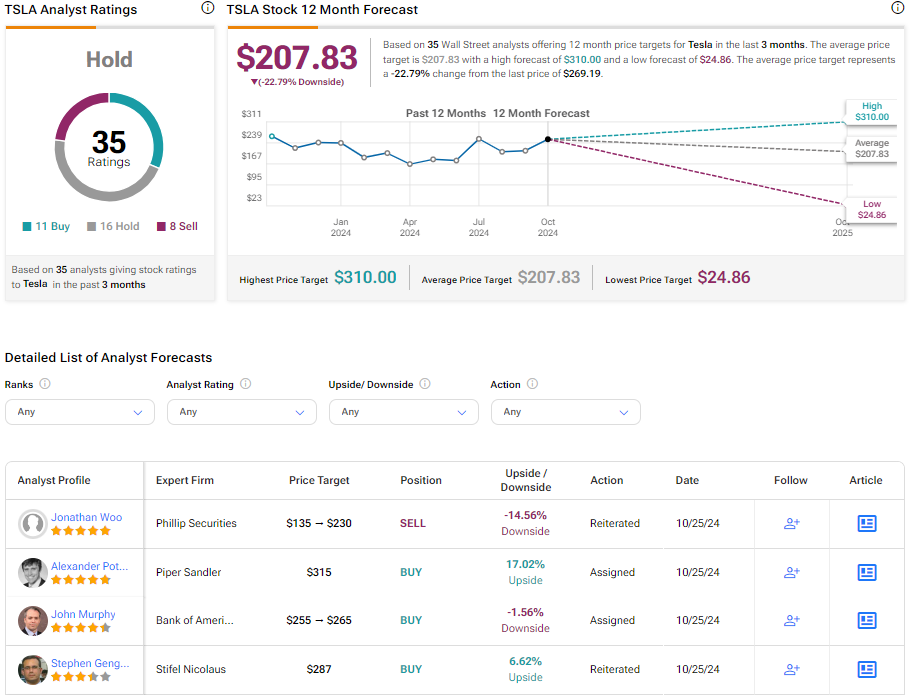

According to TipRanks’ collection of analysts’ ratings and price targets, Tesla stock has a strong ‘Hold’ rating. The 12-month forecast implies a nearly 20% downside from current levels. The highest price target on Wall Street is $310 per share, the lowest is $24.86, and the average price target is $207.83.

Since Tesla is one of the most popular stocks on the Street, several sell-side analysts have offered their analysis of the most recent earnings report and management commentary. “It’s hard to be anything but optimistic following today’s call,” noted Piper Sandler’s analyst Alexander Potter, a five-star analyst according to Tipranks’ ratings.

Piper Sandler reiterated its Overweight rating on Tesla while maintaining a $310.00 price target on shares of the electric vehicle manufacturer. Potter was especially particularly curious about the significant quarter-over-quarter increase in gross margin.

Similarly, Deutsche Bank analysts also maintained their Buy rating and $295.00 stock price target on the EV stock. Analysts noted that the offered guidance is likely to ease concerns about the company’s growth trajectory for 2025.

Should You Buy TSLA at a Premium?

After the commentary on the call, I believe there are many reasons to stay positive on Tesla stock. Tesla reaffirmed its commitment to delivering a vehicle priced under $30,000 in early 2025. Elon Musk, the CEO, has described every vehicle the company produces as a “robotaxi.” This futuristic/FSD vision is a key factor in the premium currently placed on Tesla’s market valuation, which trades at 95 times the projected earnings per share (EPS) for 2025.

On the other hand, skepticism is also on the up following the recent “We, Robot Day” event. There is doubt that Tesla’s promise for robotaxi service will materialize until after 2030. The lack of detailed information provided about the project has led to caution among stakeholders. Analysts have pointed out that the ambitious robotaxi initiative will likely face a lengthy and uncertain regulatory approval process. This could potentially delay the project’s realization well beyond Tesla’s initial early 2025 target.

Furthermore, reports from the event have indicated that the showcased robots were operated via teleoperation rather than being fully autonomous. This adds to the concerns about the feasibility of Tesla’s robotaxi service in the near term and raises questions about the current state of the technology. Many investors see Tesla as a tech/AI/ML company rather than just a car business; hence, they are ready to pay a premium to own a futuristic stock.

Conclusion

Tesla’s Q3 earnings easily exceeded expectations and ultimately facilitated a 20% rally in this EV stock. Vehicle deliveries rose 6% year-over-year, while gross margins topped analysts’ expectations. More importantly, Elon Musk forecasted 20% -30 % vehicle growth in 2025, driven by lower-cost models and advancements in autonomy. Most analysts remain optimistic, although concerns over Tesla’s ambitious robotaxi timeline linger. In my opinion, Tesla stock is likely to stay supported in the near term amid easing concerns about the company’s growth outlook for the next year.