Jim Cramer recently discussed why he doesn’t think investors should be worried about the recent Nvidia (NVDA) Blackwell chip news. Earlier this week, a report from The Information revealed that Nvidia’s new AI chips are overheating in servers, leading to speculation that the company may be in trouble. However, NVDA stock is back in the green today after initially falling on the news. And as Jim Cramer noted on his show Mad Money recently, this may end up being an opportunity for investors to acquire Nvidia shares at a discounted price before they surge again.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Why Is Nvidia Stock Rising Today?

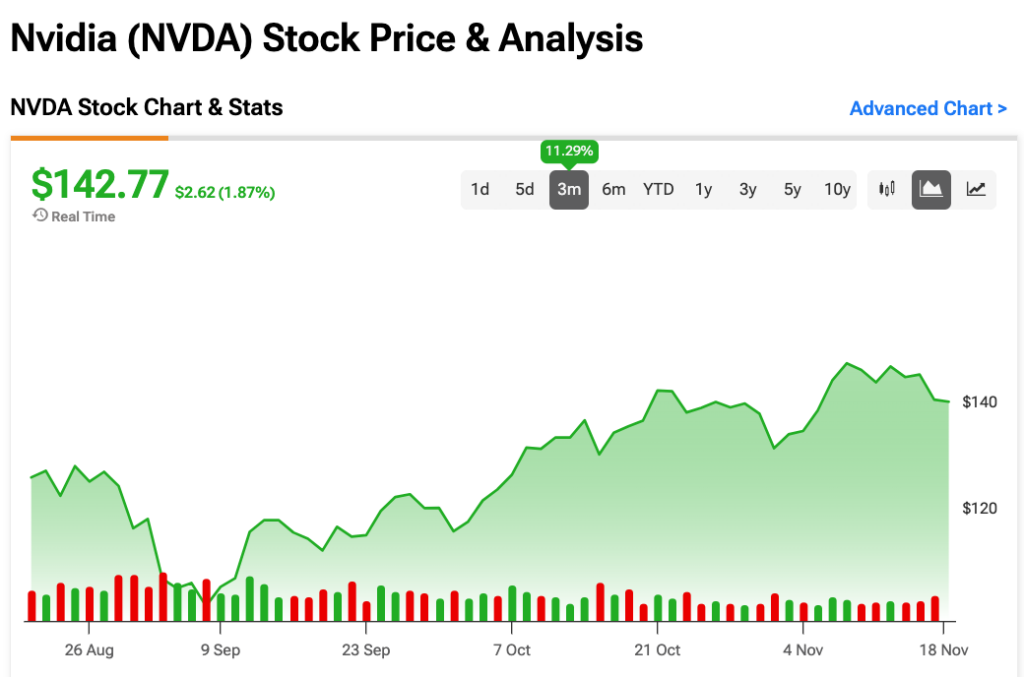

Despite some initial panic after the overheating story broke, Nvidia stock is already bouncing back from its fall, likely because the market isn’t concerned about problems stemming from it. Shares are up 2% for the day, and while trading has been volatile, the stock appears to be on course for further gains. NVDA remains in the red for the week but it has still performed well over the past quarter with gains of 11%.

Cramer weighed in on the Blackwell chip concerns recently, laying out why he doesn’t see it as a reason for investors to panic. The show host highlighted Nvidia’s position in the fast-growing AI market, reminding viewers that customers have “nowhere else to go for this kind of chip” as demand for AI graphics processing units (GPUs) like Blackwell continues to rise.

As Cramer also highlighted, Nvidia reports earnings tomorrow and all eyes will be on the company as this key date approaches. But he stressed that he sees the recent Blackwell decline as a key buying opportunity, bringing up the trend of investors quickly selling stocks based on information that doesn’t end up being meaningful. “Minutiae can shake you out of tremendous investments every time,” Cramer stated.

Wall Street Remains Highly Bullish on Nvidia Stock

So far, the Blackwell story hasn’t impacted Wall Street sentiment towards Nvidia. Analysts have a Strong Buy consensus rating on NVDA stock based on 39 Buys and three Holds assigned in the past three months, as indicated by the graphic below. After a 185% rally in its share price over the past year, the average NVDA price target of $164.29 per share implies 14% upside potential.