Server maker Super Micro Computer’s (SMCI) stock has been under attack in recent months ever since notorious short seller Hindenburg Research published a negative report on the company. Days after the critical report alleging accounting malfeasance, Super Micro Computer said that it was delaying its latest 10-K regulatory filing as it reviews its accounting practices, adding fuel to the fire set by Hindenburg Research. While I understand the concerns investors have, and why SMCI stock has fallen 45% in the last three months, I remain optimistic about the company’s long-term prospects.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

SMCI’s 10-K Issue Might Be a Headwind

I partly remain bullish on Super Micro Computer because the current issue with the company’s 10-K filing is likely a temporary headwind. A 10-K is a comprehensive report filed annually by publicly traded companies about their financial performance. While SMCI’s 10-K report has been delayed, the server technology company has stated that the delay is temporary. It needs additional time to assess the effectiveness of its internal financial controls. This review could end up leaving the company stronger and with more robust accounting practices.

To be sure, the Hindenburg report was damaging. The short seller says that during an investigation lasting three months, it uncovered “glaring accounting red flags” and evidence of undisclosed related party transactions. The short-seller also accused Super Micro of rehiring executives involved in a previous accounting scandal that led to the company’s temporary delisting from the Nasdaq exchange in 2018.

While the Hindenburg report had an immediate impact on SMCI stock, some analysts have criticized its claims. JPMorgan Chase (JPM) has questioned the substance of Hindenburg’s accusations, stating that the report lacks specific details of alleged wrongdoings that would impact Super Micro’s outlook. It’s also important to remember that, as a short-seller, Hindenburg is betting against SMCI stock and benefits when the share price falls.

Super Micro Computer’s Challenges

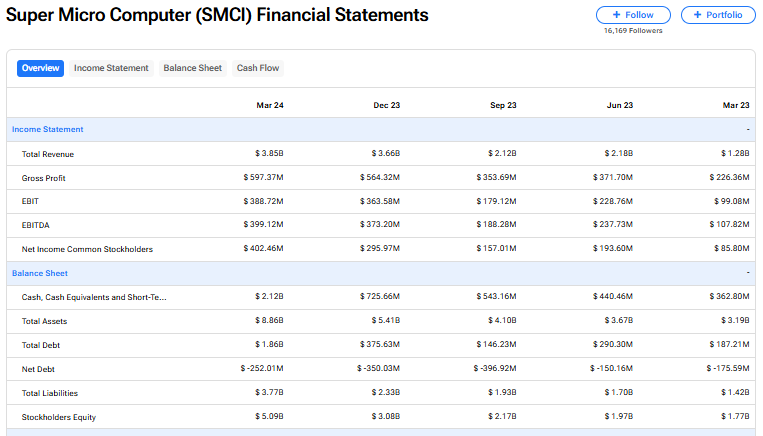

I remain bullish on Super Micro Computer’s stock despite evidence of new challenges facing the company. These include a decrease in gross margins from 15% to 11% and negative free cash flow in the last three quarters. Management blames the margin squeeze on the introduction of liquid cooling systems, which are more expensive to produce but offer long-term benefits to clients. Management expects this pressure to ease by the end of Fiscal 2025.

There’s also evidence that Super Micro’s pricing power may be under threat. Tesla (TSLA) is among the customers that used to work exclusively with Super Micro Computer and bought its servers that run AI applications and models. But Tesla and other companies have recently started working with Dell (DELL) as well.

While the company has room to increase leverage with a 28.4% debt-to-capital ratio, this could increase risk and impact the stock price over the near-term. Raising equity could lead to shareholder dilution, although this might not be possible given the recent pressure on the stock and concerns about accounting practices.

Tailwinds for Super Micro Computer

Despite these challenges, I continue to remain positive on the long-term outlook for Super Micro Computer. The company’s AI server business has been growing at an incredible pace, even faster than Dell. And forecasts for the future of the data center industry point to a decade of tailwinds ahead.

The global data center market is projected to expand significantly, with estimates suggesting it could reach $775.73 billion by 2034, up from $256.05 billion in 2024. This represents a compound annual growth rate (CAGR) in the double digits.

The AI server segment is expected to be a key driver of this growth, as demand for high-performance computing capabilities continues to surge. Bank of America (BAC) projects that Super Micro’s share of this market will grow from 10% to 17% over the next three years. So, despite near-term challenges, the data points towards a potentially lucrative future.

Is SMCI Stock a Buy or Sell?

On TipRanks, SMCI stock has a consensus Hold rating among 13 Wall Street analysts. This is based on two Buy, 10 Hold, and one Sell recommendation assigned by analysts in the past three months. The average price target on Super Micro Computer’s stock of $613.92 implies 34.26% upside potential from current levels.

Read more analyst ratings on SMCI stock

Conclusion

On paper, Super Micro Computer’s stock looks like excellent value. The data points to a company with strong future growth potential. However, investors should rightly be concerned by the delay of the 10-K regulatory filing and the immediate uncertainties surrounding the company. While I might not double down on the stock today, I remain bullish on its long-term prospects.