After briefly scaling back their bets on Trump Media & Technology Group (DJT) following last week’s election, short sellers are back to targeting DJT stock. Data from market analysis platform Fintel shows that short interest in the Truth Social parent company has reached its highest point since election day, prior to Trump’s victory over Vice President Kamala Harris. As DJT stock has trended downward since its election day surge, bears have clearly sensed an opportunity.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

What’s Happening with DJT Stock Today?

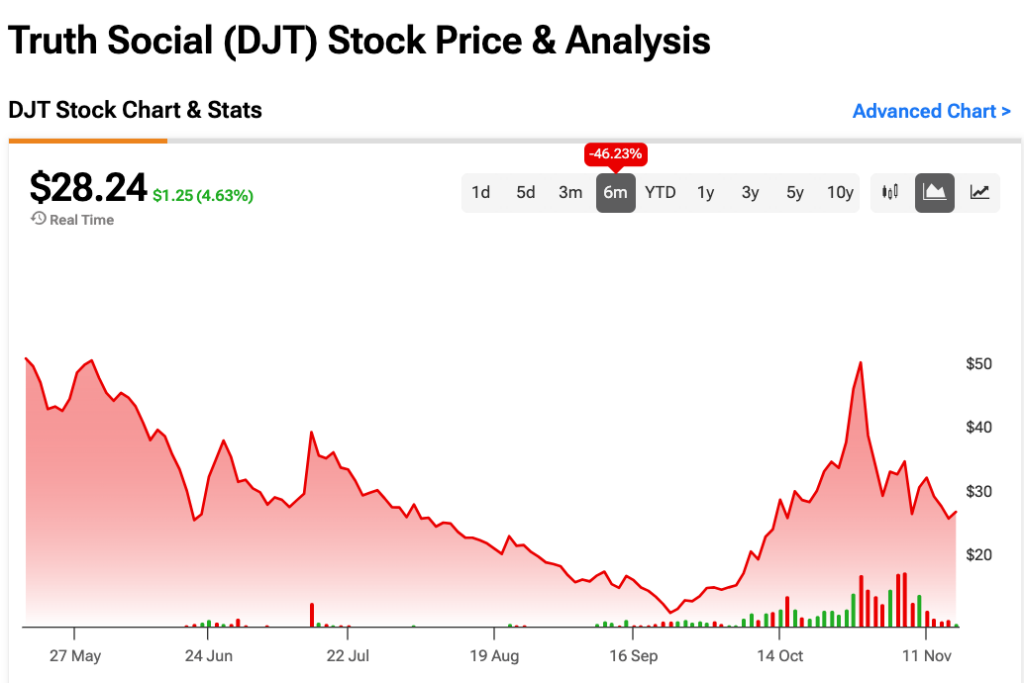

After a week of losing momentum, DJT stock has finally started rising again today. This is likely due to a shift in market momentum, as the company hasn’t reported any specific catalysts. As of this writing, DJT is up 4% for the day after declining this morning, though trading has been volatile. That said, this stock is no stranger to market turbulence, as its declines over the past six-month period show.

Despite today’s pop, Fintel’s data shows that short sellers are back to ramping up their bets against DJT. Short interest currently accounts for 20% of the stock’s float. Both yesterday and today, the amount of shares available to short has fallen to zero. Currently, short sellers would need less than one day to cover their positions. All this indicates that short interest in the troubled stock is back to rising.

DJT stock isn’t the only company linked to Trump that short sellers are targeting. Short interest in video-sharing platform Rumble (RUM) and Trump campaign software partner Phunware (PHUN) has been rising recently and remains high. But DJT still boasts the highest short interest, suggesting that investor confidence in conservative media stocks is low, even as Trump prepares to return to the White House.

Is It Time to Sell DJT Stock?

Although Trump is still in full focus following his recent victory, DJT stock remains a highly speculative investment, as evidenced by the consistent interest from short sellers. Since no analysts currently follow the stock, it is hard to properly assess which rating it deserves based on expert opinions. That said, the TipRanks technical analysis tool suggests a Sell signal on the one-day timeframe based on overall bullish sentiment.