Costco’s (COST) gold bars are flying off the shelves this year, according to an exclusive Bloomberg report. Gold (GLD) prices have surged by more than 25% year-to-date as the macroeconomic uncertainty has made the precious metal more attractive to buyers. This is because the yellow metal is considered a safe haven and a hedge against inflation.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

How Is COST Selling Gold?

Costco is making gold accessible to its customers by offering prices that are below the ones offered by traditional precious metal dealers, along with extra rewards for its most loyal customers. Let us look at how Costco does this in more detail.

Costco members can receive 2% cash rewards for using an affiliated Citi credit card and another 2% with an executive membership, which costs $130 annually. According to the report, on September 28, Costco was offering one-ounce bullion bars at a 1.6% premium over the spot price of gold. This was lower than what most precious metals retailers charge. Furthermore, with the added potential of 4% in rewards to be earned by COST members, this was a better deal, increasing the appeal of buying bullion through the warehouse retailer.

Costco first started selling gold in June 2023 in its U.S. stores and on its website and has now added platinum bars to its precious metal line-up, which also includes silver coins.

How Much Gold is COST Selling?

According to Bloomberg, around 77% of the Costco stores carrying gold bars surveyed were sold out within the first week of October. Furthermore, Bloomberg‘s calls to 101 locations across 46 states confirmed that each store had recently received fresh stock of gold products, but the demand remained overwhelming.

Is COST Stock a Buy?

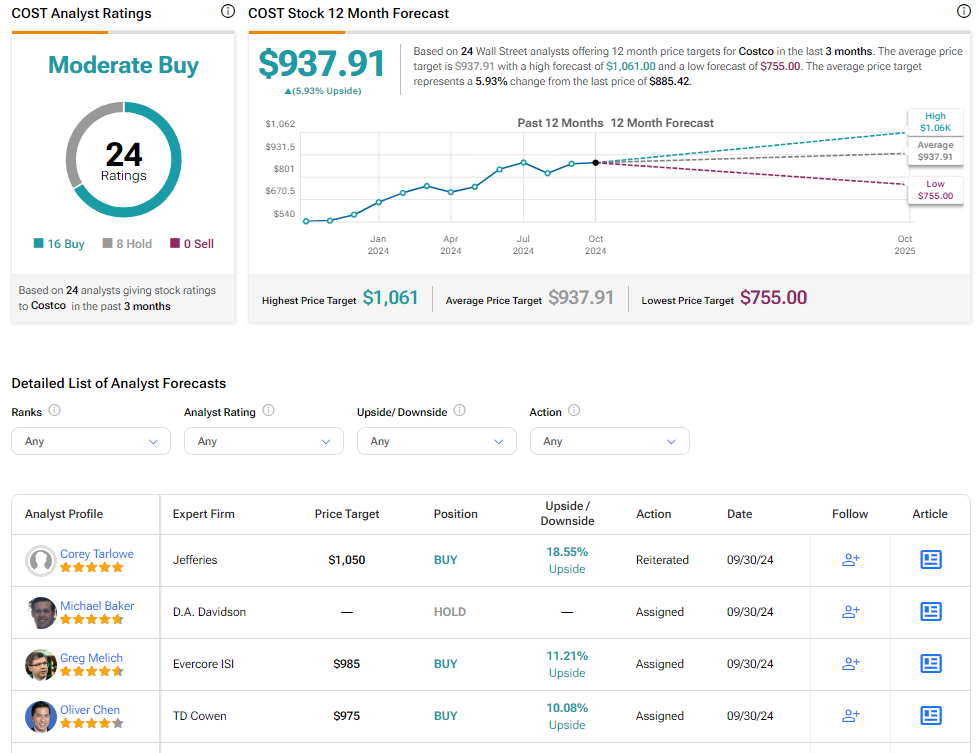

Analysts remain cautiously optimistic about COST stock, with a Moderate Buy consensus rating based on 16 Buys and eight Holds. Over the past year, COST has surged by more than 60%, and the average COST price target of $937.91 implies an upside potential of 5.9% from current levels.