Shopify (NYSE:SHOP) shares jumped nearly 16% in the pre-market session today after the eCommerce platform delivered a robust third-quarter performance, with EPS of $0.24 handily exceeding estimates by $0.10. Moreover, revenue jumped by nearly 25% year-over-year to $1.71 billion, surpassing expectations by $40 million.

During the quarter, gross merchandise volume (GMV) increased by 22% to $56.2 billion, and gross payments volume (GPV) increased by 58% to $32.8 billion. Revenue from Merchant Solutions increased by 24%, and Subscription Solutions revenue ticked higher by 29% on the back of pricing gains and a higher number of merchants joining Shopify’s platform.

Moreover, growth across the company’s subscription plans helped its monthly recurring revenue (MRR) rise by 32% to $141 million at the end of September. Despite a difficult macroeconomic backdrop, Shopify managed to expand its gross margin to 52.6% from 48.5% and generated a positive free cash flow of $276 million. In comparison, the company had experienced a negative free cash flow of $148 million in the year-ago quarter.

For Fiscal year 2023, the company expects revenue to rise by a mid-twenties percentage. Additionally, for the upcoming quarter, gross margin is anticipated to expand by 300 to 400 basis points, compared to the year-ago period.

How High Will SHOP Stock Go?

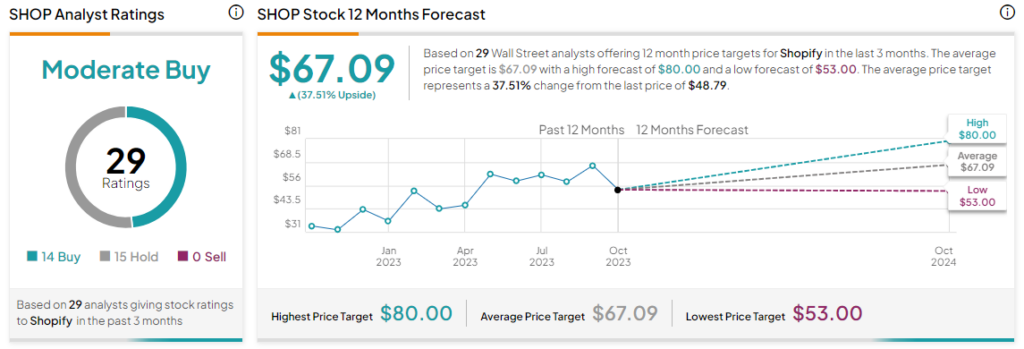

Overall, the Street has a Moderate Buy consensus rating on Shopify. The average SHOP price target of $67.09 implies a substantial 37.5% potential upside. That’s on top of a nearly 40% rise in the share price over the past year.

Read full Disclosure