Shares of the UK-based Melrose Industries PLC (GB:MRO) gained nearly 9% as of writing after the company reported strong revenue growth in its latest trading update. Revenues of the GKN Aerospace owner grew 7% between July 1 and October 31, compared to the same period a year ago. The top line grew despite persistent supply chain challenges across the industry.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Melrose is a manufacturing company and operates through two divisions, Engines and Structures. In 2023, it spun off its automotive division to focus exclusively on the aerospace sector.

Melrose’s Revenue Climbs on Robust Aftermarket Services

Among Melrose’s segments, the Engines division demonstrated robust revenue growth of 17%. The growth was driven by a 32% year-over-year increase in its aftermarket business, with the defence sector playing a significant role. The ongoing production delays at aerospace manufacturers have forced airlines to extend the use of older planes. This has resulted in increased demand for aftermarket services and parts, which has been favourable for Melrose.

Meanwhile, revenue of the Structures division grew 1%, reflecting challenges from reductions in original equipment (OE) volumes and customer destocking.

Melrose Confirms Outlook

Despite the supply chain challenges, Melrose maintained its full-year adjusted operating profit forecast of £550 million to £570 million. In 2025, it projects reaching an adjusted operating profit of £700 million. Additionally, the company’s restructuring programs are expected to lead to a substantial decrease in related cash expenditures in 2025.

Moving forward, the company remains focused on close collaboration with key customers to effectively meet production schedules while continuing its internal business improvement initiatives.

Is Melrose a Good Stock to Buy?

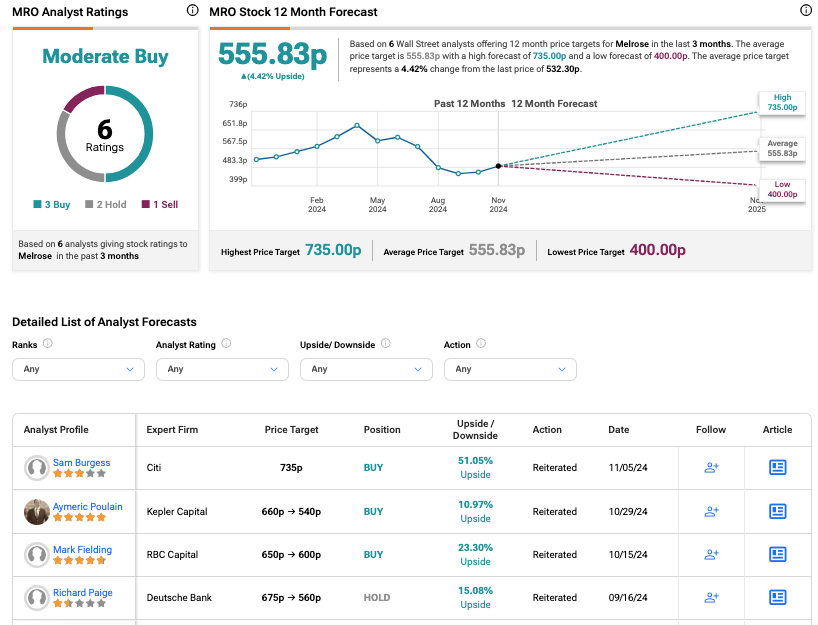

According to TipRanks’ consensus, MRO stock has received a Moderate Buy rating based on six recommendations from analysts. The Melrose share price target is 555.83p, which implies an upside potential of 4.42%.