A shareholder of Rivian Automotive (RIVN) has filed a lawsuit against the company stating that it failed to disclose to its investors that it had underpriced its vehicles, which later led to price hikes. The higher prices were not welcomed by the clients, which forced Rivian to reinstate previous prices.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

As per an article published by Reuters, a report has been filed in U.S. District Court in San Francisco by shareholder Charles Larry Crews, who is seeking a class-action lawsuit.

On March 1, the company had raised the price of R1S (its SUV) to $84,500 from $70,000, and R1T (pickup truck) to $79,500 from $67,500.

The complainant said that the move “would tarnish Rivian’s reputation as a trustworthy and transparent company,” and risk cancellation of several pending orders dating back to 2018.

The rollback came along with an apology from CEO R.J. Scaringe. He said, “I have made a lot of mistakes since starting Rivian more than 12 years ago, but this one has been the most painful. I am truly sorry and committed to rebuilding your trust.”

Stock Rating

Mizuho Securities analyst Vijay Rakesh reiterated a Buy rating on the stock with a $145 price target, implying 243.5% upside potential to current levels.

Rakesh said, “Maintaining our Buy, though near-term it could be rocky with startup R1 and Amazon delivery vehicle ramps, We continue to see RIVN a leader and pure-play in the fast-growing EV market addressing the premium SUV/truck segment.”

Consensus among analysts is a Moderate Buy based on 8 Buys and 4 Holds. The average Rivian price target of $108.09 implies 156.1% upside potential to current levels.

Positive Sentiment

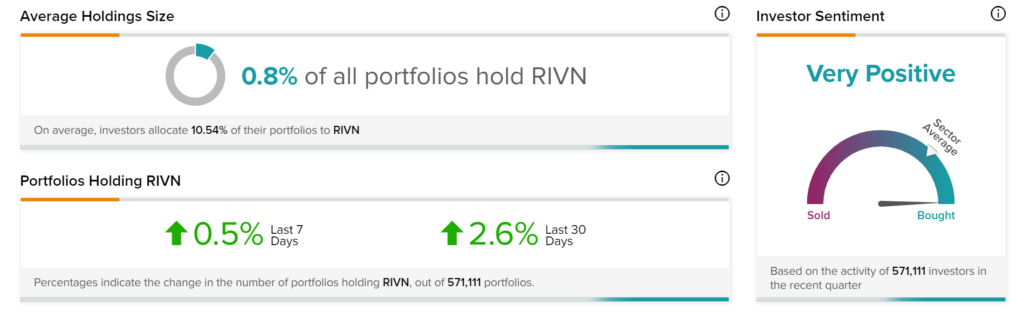

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Rivian, as 2.6% of investors increased their exposure to RIVN stock over the past 30 days.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Schlumberger Introduces Business to Lower Methane and Routine Flare Emissions

Bumble Rises 18% After-Hours Despite Weaker-Than-Expected Q4 Results

Beyond Meat’s Newly Added Risk Risk Factors