Move over, Skynet – there is a new robot overlord in town. Serve Robotics (SERV), a former Uber (UBER) spin-off, has developed AI-powered, low-emission delivery robots that cruise the sidewalks, making deliveries easier and more sustainable. With tech giant Nvidia (NVDA) and Uber being significant shareholders and robust contracts with companies like Uber Eats and 7-Eleven, Serve is already a seasoned player in the delivery field.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Its latest Gen3 robot, with Nvidia’s Jetson Orin technology on board, offers faster speeds, a longer range, and extended operating times, leading to an impressive 50% reduction in operating costs. Serve’s promising growth includes a plan to deploy 2,000 new robots by the end of 2025, expanding its services to more regions while reducing Uber’s reliance on human delivery drivers.

Investors have taken notice, driving the stock up over 63% in the past week. However, investors should approach with caution, given the company’s lack of revenue and earnings. It is an exciting time for robot enthusiasts, but investors may want to let the story play out a bit and let revenue catch up with the stock’s heady valuation.

Domo Arigato, Mr. Roboto

Serve Robotics is an advanced AI-powered robotic delivery company that was spun off from Uber in 2021 and has since completed tens of thousands of deliveries for partners such as Uber Eats and 7-Eleven. The company’s robots, which use level 4 autonomy (akin to self-driving cars), have notched up a reliability rate of up to 99.94%, making them more reliable than human drivers (as long as they obey Isaac Asimov’s “Three Laws of Robotics”).

With an agreement to deploy 2,000 new robots on the Uber Eats platform by the end of 2025, the company plans to expand into other areas of California as well as Dallas and Fort Worth in Texas. This expansion will potentially save Uber significantly by reducing its dependence on human delivery drivers.

Alongside geographic expansion plans for LA and Dallas, Serve also announced an agreement to acquire Vebu, a trailblazer in full-stack automation and robotics solutions for restaurants – such as the guacamole-making Autocado. The all-stock deal is expected to strengthen Serve’s strategic position by providing its restaurant partners with automation solutions and expanding its offering into back-of-house automation.

Daily Active Robots Roughly Double

Serve’s Q2 2024 financials showed total revenue of $221k, a 254.1% increase year over year. This includes $40k in software service revenue from the company’s agreement with Magna. Additionally, the company averaged 465 daily supply hours during the third quarter, a 108% year-over-year increase driven by a 97% increase in daily active robots.

The total operating expenses totaled $8.2 million, resulting in a loss of $8.4 million from operations. Other costs, including interest and changes in the fair value of simple agreements for future equity, resulted in a total other income loss of $448,854. Consequently, Serve Robotics reported a net loss of $7.9 million for the quarter and a GAAP EPS of—$0.20.

As of the quarter’s end, the company had $50.9 million in cash and cash equivalents and no outstanding debt.

Skeptics Remain

The stock is up over 343% in the past six months, and it demonstrates ongoing positive price momentum as it trades above all major moving averages.

Yet, in a recently published report, Bonitas Research says it is short for Serve Robotics, based on the company’s announcement that it would acquire Vebu, an automation incubator founded by Serve’s director, James Buckley Jordan. Bonitas claims Vebu has a history of launching failed prototypes, and the company is using the Vebu acquisition to enrich insiders at the expense of SERV shareholders.

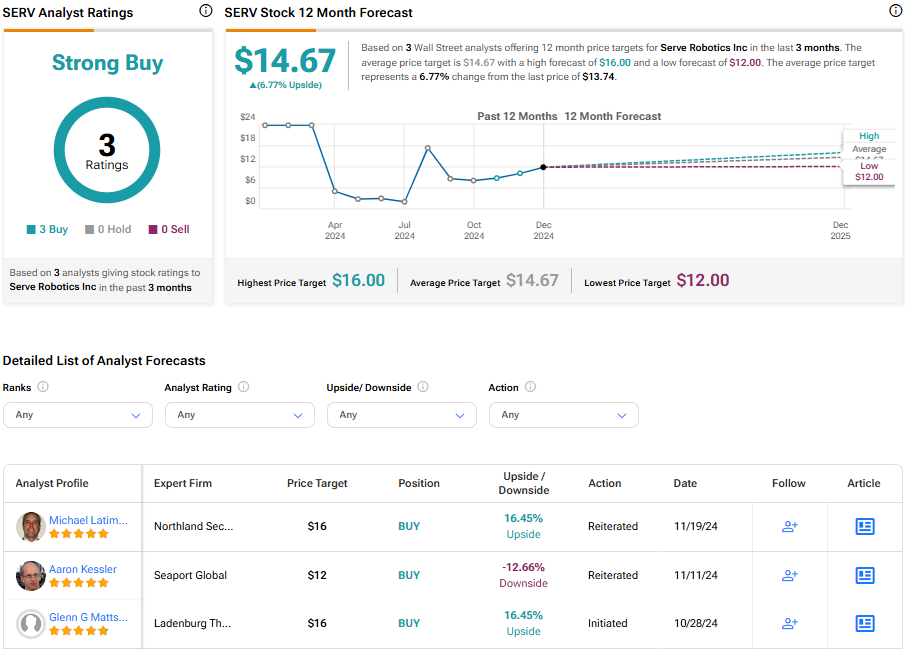

In contrast, analysts following the company remain bullish on SERV stock. Based on three analysts’ recent recommendations, shares of SERV are rated a Strong Buy overall. The average price target over the next 12 months for SERV is $14.67, which represents a potential upside of 6.77% from current levels.

SERV in Summary

With its AI-powered, low-emission delivery robots, serve Robotics is at the forefront of the robotic delivery revolution. Despite naysayers questioning its upside potential, the company boasts a bullish analyst outlook, having Nvidia and Uber as significant shareholders and close partnerships with Uber Eats and 7-Eleven. While investors are warned to watch the unfolding development before jumping in, it’s undeniable that the future of delivery is steering towards robotics – as is evident in Serve’s remarkable progress and expansion plans. It’s a thrilling era for robot enthusiasts but a time of calculated moves for savvy investors.