Semtech’s (SMTC) stock price surged over 8% at the time of writing after UBS initiated coverage with a Buy rating. This rating was largely due to Semtech’s key product win in Nvidia’s (NVDA) Blackwell platform. The win involves Semtech’s CopperEdge product, which will be used in Nvidia’s data center networking. According to UBS, led by five-star analyst Timothy Arcuri, Semtech’s CopperEdge product offers a cost-effective solution for reducing noise in AI data center networking.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The product is initially being used in Active Copper Cables but is expected to be integrated into Nvidia’s devices in the future. UBS has set a price target of $85 for Semtech’s stock due to the company’s growing potential in the AI data center market. Indeed, Semtech’s stock has already seen significant growth after rising over 300% in the past year. It’s worth noting that, so far, Arcuri has enjoyed a 72% success rate on his stock ratings, with an average return of 33.7% per rating.

In addition, Semtech’s CEO, Hong Hou, highlighted the growing importance of his company’s products in cloud and data center technology. Semtech’s chips enable high-bandwidth, low-latency network connectivity, which is crucial for data centers. Hou noted that Semtech’s unique offering lies in its ability to enhance network connectivity while minimizing power consumption and delay.

Is SMTC a Strong Buy?

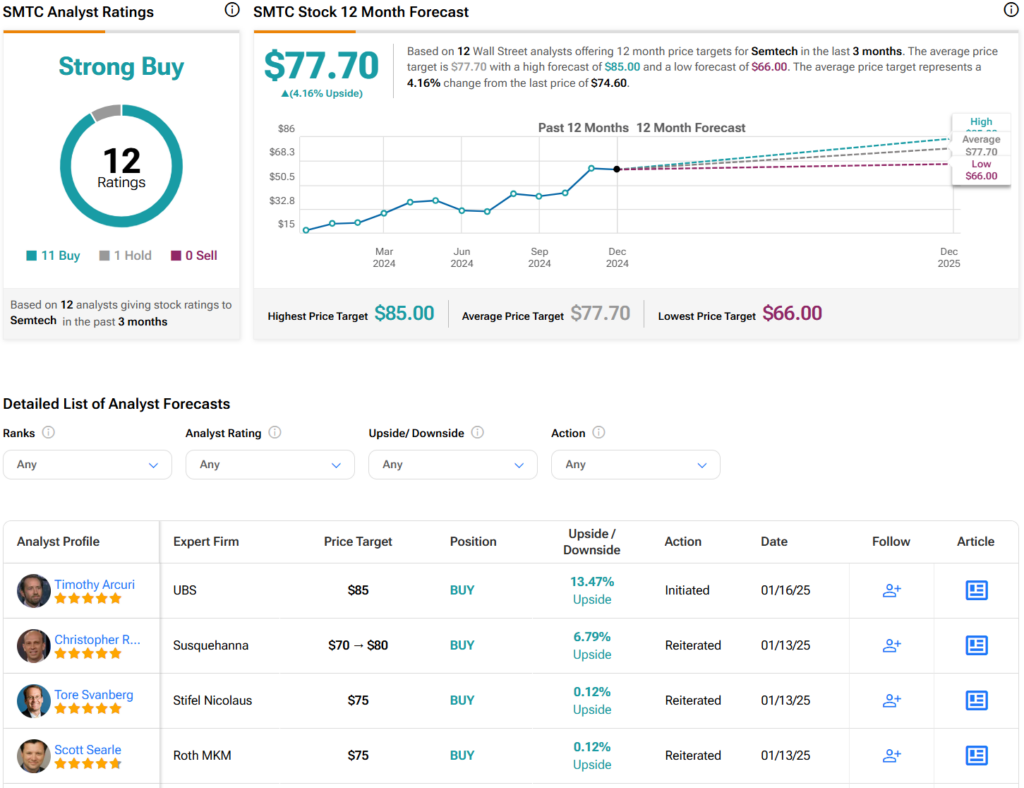

Turning to Wall Street, analysts have a Strong Buy consensus rating on SMTC stock based on 11 Buys, one Hold, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average SMTC price target of $77.70 per share implies 4.2% upside potential.