Gold and copper are having a moment, having hit historic highs. For Seabridge Gold (NYSE:SA) and its vast gold and copper resources, this represents significant potential for growth. However, the company must make progress in tapping those resources to unlock that pent-up value, making its stock a sound investment rather than a gamble like it is now.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Analysts predict a continued bullish trend in gold and copper prices fueled by demand from central banks, Chinese stimulus, and a wealth of energy transition projects. That being said, investors in the stock are gambling that management can execute its strategic objectives.

Seabridge Stakes a Claim, or Two

Seabridge Gold specializes in acquiring and developing gold properties and owns several North American gold projects. These include the KSM and Iskut projects located in Canada’s ”Golden Triangle,” the Courageous Lake project in Canada’s Northwest Territories, the Snowstorm project in Northern Nevada’s Getchell Gold Belt, and the 3 Aces project in the Yukon Territory.

The company’s business strategy focuses more on expanding its mineral resources via exploration than on producing independently. Seabridge often opts to sell projects or form joint ventures with large mining companies to enter production.

According to management, compared with other publicly traded mining and exploration companies in North America, the United Kingdom, Australia, New Zealand, and Singapore, Seabridge Gold possesses the most metal value per share, boasts the highest gold per share, and has the most copper per share among exploration and mining companies.

Analysis of Recent Financial Results & Outlook for Seabridge

The company did not report any revenue for the first quarter of 2024. The net loss was $8.2 million, a slight improvement from the same period in 2023 when it stood at $10.8 million. Earnings per share (EPS) of -$0.07 missed the analyst estimate of -$0.03.

Also, Seabridge invested $39.3 million in mineral interests project spending, which is low compared to $48.6 million in Q1 of 2023. As of the end of Q1, the net working capital was $43.2 million, a decrease from $54.5 million at the end of December 2023.

Seabridge Gold’s strategic objectives for 2024 are focused on key partnerships, funding, and resource expansion. The Company is exploring various alternatives for raising the necessary funds to operate and meet its objectives, including selling shares or debt issued by the company, share sales through its ATM program, and sales of royalty or streaming interest in the KSM Project. Some of these options could dilute current shareholders.

Is SA Stock a Buy?

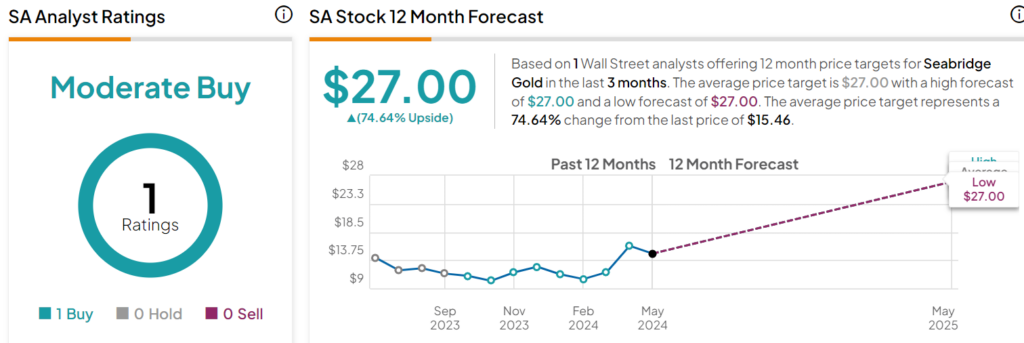

Wall Street follows the stock thinly. Based on the recommendation of RBC Capital analyst Michael Siperco, Seabridge Gold is rated a Moderate Buy. The price target on SA stock is $27, representing an upside of 74.64% from current levels.

Shares have been trending upward, climbing over 26% year-to-date. The stock sits at the upper end of its 52-week price range of $9.31-$16.71 and continues to show positive price momentum, trading above its 20-day (15.08) and 50-day (14.55) moving averages.

With a P/B Value of 2.54x, the shares appear relatively overvalued compared to the Basic Materials sector P/B average of 1.7x and the Gold industry average of 1.78x.

Seabridge in Summary

Seabridge has assets in the ground but needs to show progress in monetizing those assets. The current price of the shares suggests investors have some faith that management can do so. Significant progress on any of its locations would catalyze shares to higher levels. However, the company may have to dilute shareholders to get there.

Investors interested in current gold and copper trends may want to explore other options with active mining operations and revisit this when management has shown progress in unlocking the long-term value of the company’s assets.